Safe & secure WETH wallet

Take control of your WETH assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

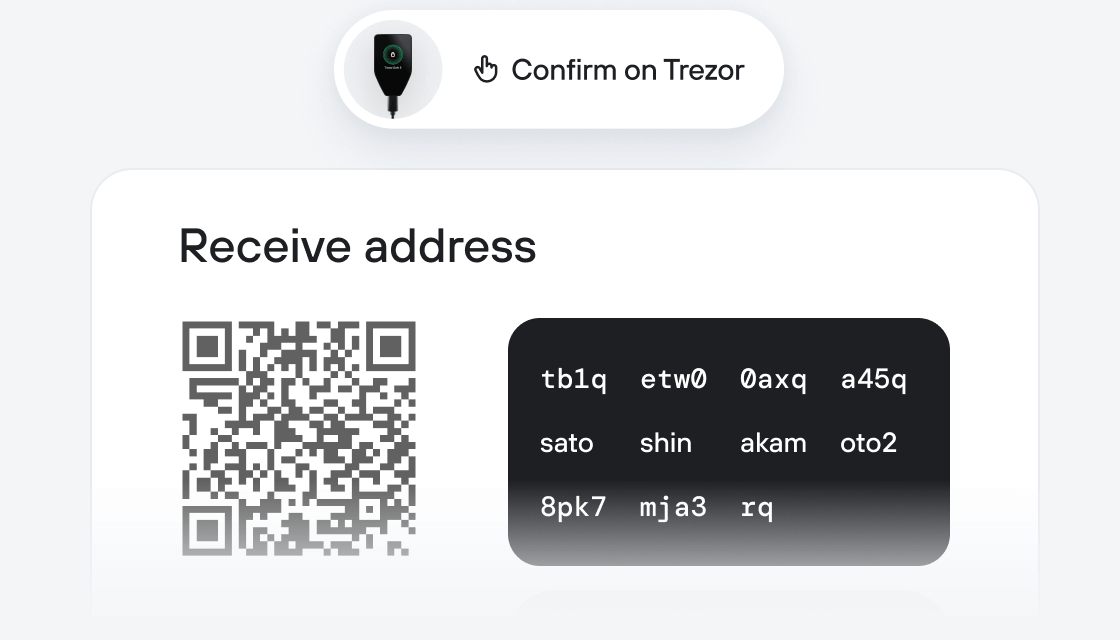

Send & receive your WETH with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support WETH

Sync your Trezor with wallet apps

Manage your WETH with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported WETH Networks

- Ethereum

- Scroll

- Manta Pacific

- Astar zkEVM

- Re.al

- Zora

- Kroma

- Ancient8

- Zircuit

- AlienX

- Rari

- Cyber

- Ham

- Mint

- Redstone

- Morph L2

- Hemi

- Katana

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

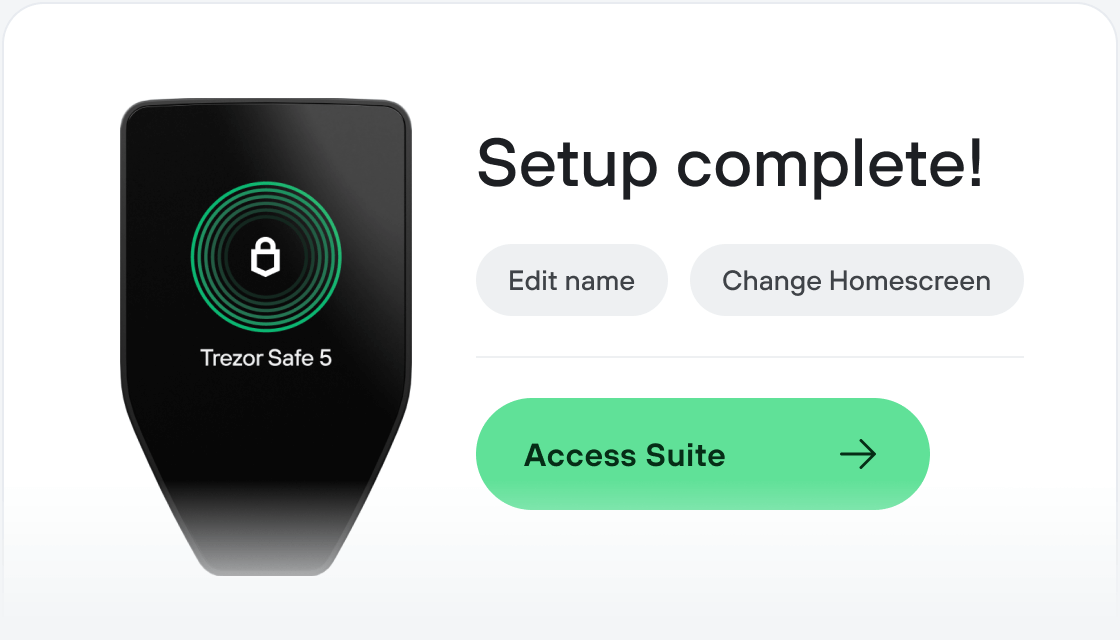

How to WETH on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your WETH

Make the most of your WETH

Trezor keeps your WETH secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

What is WETH (Wrapped ETH)? WETH is the tokenized/packaged form of ETH that you use to pay for items when you interact with Ethereum dApps. WETH follows the ERC-20 token standards, enabling it to achieve interoperability with other ERC-20 tokens.

This offers more utility to holders as they can use it across networks and dApps. You can stake, yield farm, lend, and provide liquidity to various liquidity pools with WETH.

Also, unlike ETH, which doesn’t conform to its own ERC-20 standard and thus has lower interoperability as it can’t be used on other chains besides Ethereum, WETH can be used on cheaper and high throughput alternatives like Binance, Polygon, Solana, and Cardano.

The price of WETH will always be the same as ETH because it maintains a 1:1 wrapping ratio.

How to Wrap ETH? Custodians wrap and unwrap ETH. To wrap ETH, you send ETH to a custodian. This can be a multi-sig wallet, a Decentralized Autonomous Organization (DAO), or a smart contract. After connecting your web3 wallet to a DeFi exchange, you enter the amount of ETH you wish to wrap and click the swap function. Once the transaction is confirmed, you will receive WETH tokens equivalent to the ETH that you’ve swapped.

On a centralized exchange, the exchange burns the deposited ETH and mints a wrapped form for you. And when you want to unwrap it, the exchange will burn the wrapped version and mint the ETH on your behalf.

What’s Next for WETH? According to the developers, hopefully there will be no future for WETH. According to the website, steps are being taken to update ETH to make it compliant with its own ERC-20 standards.