Safe & secure Superstate Short Duration U.S. Government Securities Fund (USTB) wallet

Take control of your Superstate Short Duration U.S. Government Securities Fund (USTB) assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your Superstate Short Duration U.S. Government Securities Fund (USTB) with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Superstate Short Duration U.S. Government Securities Fund (USTB)

Sync your Trezor with wallet apps

Manage your Superstate Short Duration U.S. Government Securities Fund (USTB) with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Superstate Short Duration U.S. Government Securities Fund (USTB) Networks

- Ethereum

- Plume Network

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to USTB on Trezor

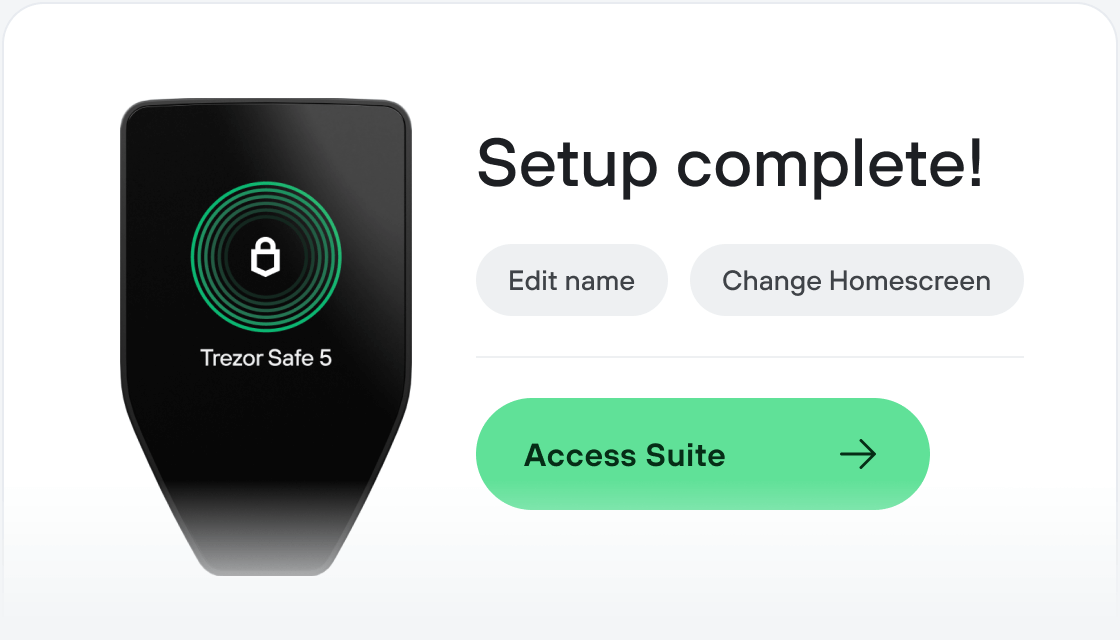

Connect your Trezor

Install Trezor Suite app

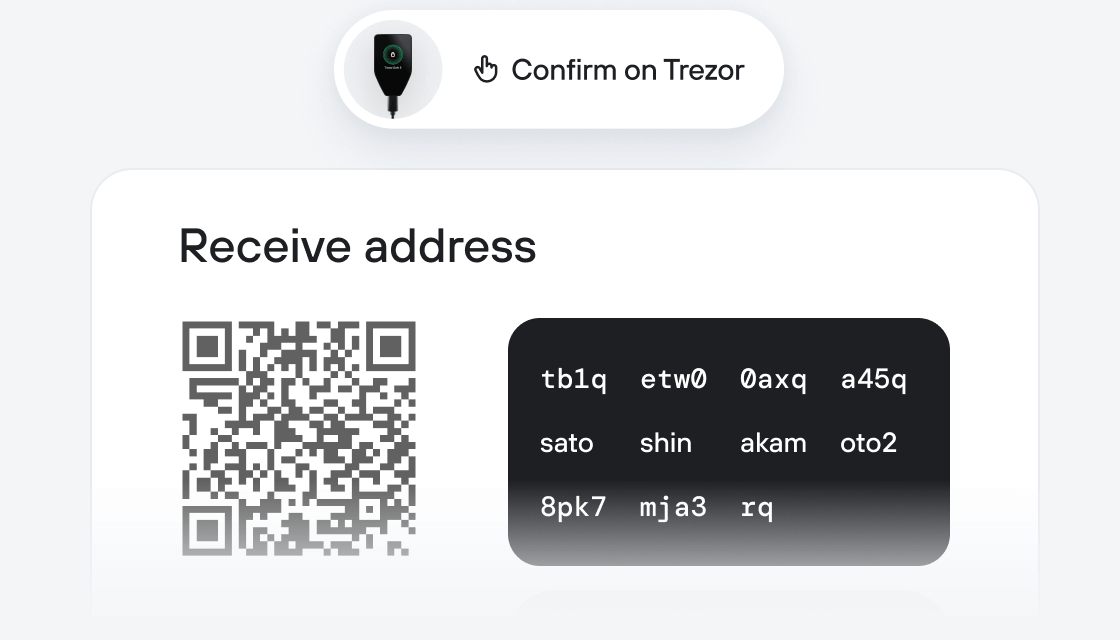

Transfer your USTB

Make the most of your USTB

Trezor keeps your USTB secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

USTB’s innovative structure and partnership with established service providers breaks new ground in the private funds space.

The fund invests in short duration U.S. Treasury and U.S. Agency securities, targeting the federal funds rate, with a 0.15% management fee.

Accepted U.S. Qualified Purchasers are able to subscribe to and redeem from the Fund using USDC2 at a daily NAV which is calculated by NAV Consulting. USTB’s Ethereum-based Allowlist enables on-chain ownership, transfer, and compliance. Additionally in the future, it is likely that peer-to-peer transactions will be possible, subject to applicable restrictions.

The Fund’s flexibility carries through to custody; investors can self-custody USTB in the on-chain addresses of their choice, such as an EOA, multi-sig, or MPC wallet. Additionally, investors can choose to utilize Anchorage Digital Bank National Association, a custodian and federally chartered bank, or BitGo, a qualified custodian and New York state chartered trust.

Superstate, an Exempt Reporting Adviser, serves as the Fund’s investment manager, with Federated Hermes serving as the Fund’s sub-advisor. USTB is a series of a Delaware Trust, which is legally separate from Superstate. For more Fund details, please consult the USTB information page.

USTB marks the start of our mission to tokenize the world’s assets. We’re committed to developing regulated, modern investing products that enhance investment opportunities for institutions, and, ultimately, all investors.