Safe & secure Spark wallet

Take control of your Spark assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your Spark with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Spark

Sync your Trezor with wallet apps

Manage your Spark with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Spark Network

- Ethereum

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

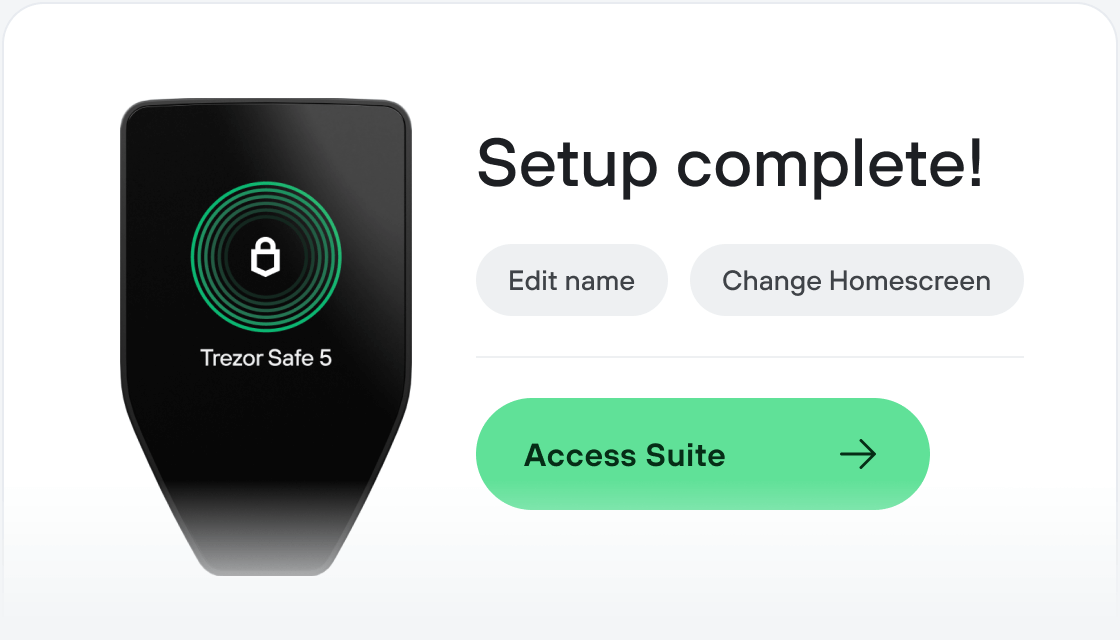

How to SPK on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your SPK

Make the most of your SPK

Trezor keeps your SPK secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

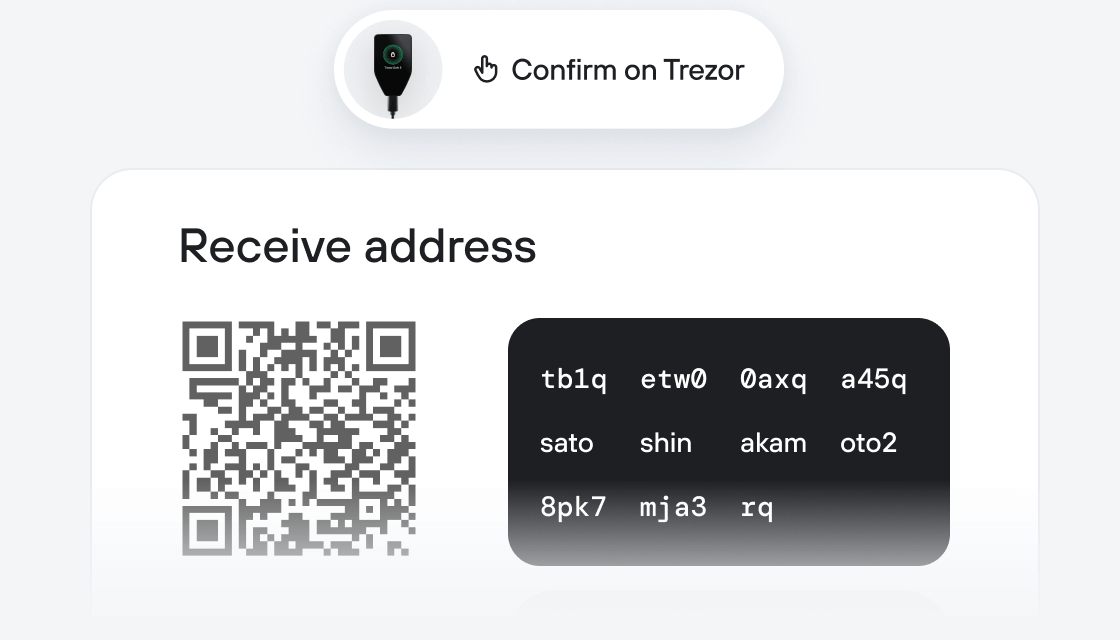

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Spark is an onchain capital allocator, with $3.86B deployed across DeFi, CeFi, and RWA. It unlocks capital efficiency at scale, auto-balancing allocations based on market conditions while maintaining a conservative risk profile. Spark was created to solve DeFi’s core inefficiencies: fragmented liquidity, unstable yields, and idle stablecoin capital. It acts as a two-sided capital allocator—borrowing from Sky’s $6.5B+ reserves and deploying across DeFi, CeFi, and RWAs to provide deep, consistent liquidity. This yield is packaged into products like sUSDS and sUSDC, offering users programmable, fee-free income. Rather than competing with protocols, Spark powers them as the liquidity and yield infrastructure for onchain finance.

Access to Deep, Scalable Liquidity: Spark taps into Sky’s $6.5B+ stablecoin reserves, enabling large-scale capital deployment across DeFi, CeFi, and RWAs. User-Friendly Yield Products: Yield is delivered through stablecoins like sUSDS and sUSDC—fully composable, fee-free, and available across chains.

SparkLend: A stablecoin lending market. Unlike other lending protocols where rates fluctuate based on utilization or loan size, SparkLend offers governance-defined rates that do not vary based on those factors. This is made possible by Spark’s Liquidity Layer (SLL), which supplies consistent stablecoin liquidity to the protocol.

Spark Savings: A product for earning yield on stablecoins like USDC, and USDS (and soon, USDT) by converting them into yield-bearing sUSDS or sUSDC. These yield tokens are composable with other DeFi protocols, making it easy to put capital to work while maintaining exposure to onchain yield at a competitive risk-adjusted rate.

Spark Liquidity Layer (SLL): A backend capital allocator that routes liquidity to other protocols like Aave, Morpho, and even RWAs (e.g., BlackRock’s BUIDL). One of the most important SLL deployments on Base is the Spark USDC Morpho Vault, which currently supplies $95M USDC, making it the largest liquidity provider to the Coinbase app integration on Base. This vault plays a key role in mitigating rate volatility for borrowers and demonstrates how SLL enhances liquidity conditions across DeFi.

Existing Products: Spark's total TVL is currently $7.9B, split between SparkLend and the Spark Liquidity Layer (SLL). You can find real-time details and breakdowns here: https://defillama.com/protocol/spark#information

Spark in DeFiLlama, https://defillama.com/protocol/spark#information

SparkLend is one of the largest lending protocols in DeFi. It offers deep liquidity and governance-defined rates, providing borrowers with transparent conditions.

Spark Savings is live on Ethereum mainnet, Base, Optimism, Arbitrum, Unichain, and Gnosis, offering vaults for both USDS and USDC.

The Spark Liquidity Layer actively deploys capital across protocols on multiple chains, including Ethereum mainnet, Base, and Arbitrum.

SLL allocations in real-time, https://data.spark.fi/spark-liquidity-layer