Safe & secure sGYD wallet

Take control of your sGYD assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your sGYD with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support sGYD

Sync your Trezor with wallet apps

Manage your sGYD with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported sGYD Networks

- Polygon POS

- Ethereum

- Arbitrum One

- Avalanche

- Optimism

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to SGYD on Trezor

Connect your Trezor

Install Trezor Suite

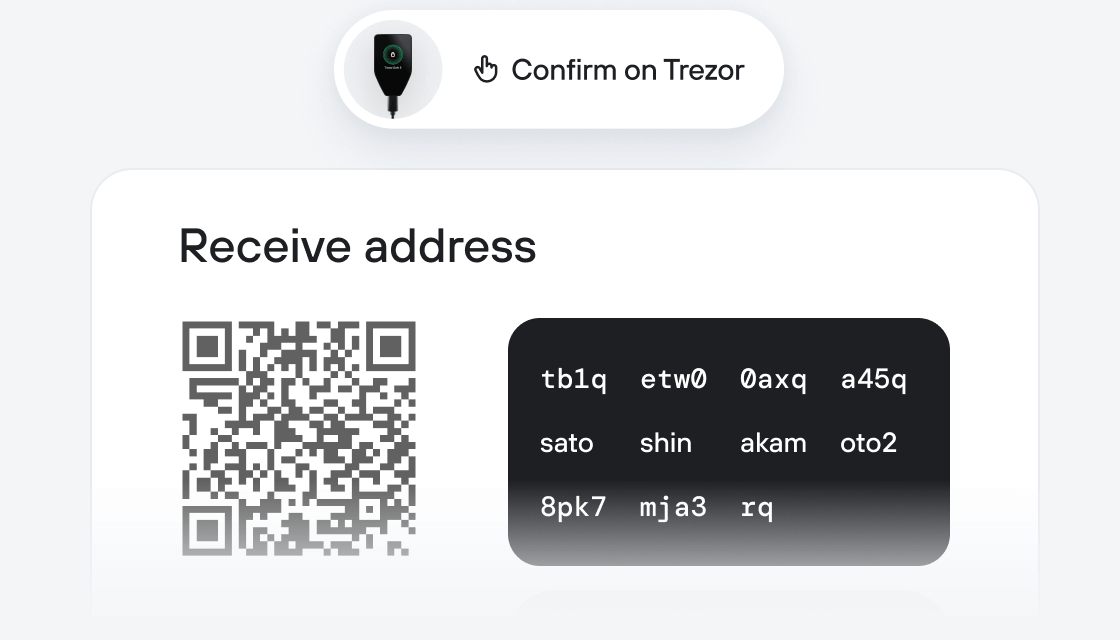

Transfer your SGYD

Make the most of your SGYD

Trezor keeps your SGYD secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Gyroscope sets out to create stablecoin superliquidity.

Gyroscope does so via its dual-offering of concentrated liquidity AMMs and a meta-stablecoin. Both products are designed to absorb complexity:

-

GYD is a meta-stablecoin that allows its holders to get one-stop-access to a diversified basket of stablecoins and advanced onchain risk controls. Yield earned by deploying GYD reserve assets is distributed to GYD stakers, via the sGYD ERC-4626 implementation. Reserve asset yield can also be streamed to GYD pools.

-

E-CLPs are CL AMMs - built on Balancer - that concentrate liquidity. As E-CLP price-bounds are defined on a per-pool level, LPs effectively subscribe to a portfolio-strategy, but take on no operational burden. E-CLPs are highly customizable and support yield-bearing assets and Aave deposit-receipt tokens. By using rate providers that factor out yield from asset prices it is possible to avoid drifting out of range. E-CLPs thus yield high capital efficiency, control over desired liquidity shapes, and a seamless LP experience. E-CLPs are also integrated into all major order routers.