Safe & secure Mir Token wallet

Take control of your Mir Token assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

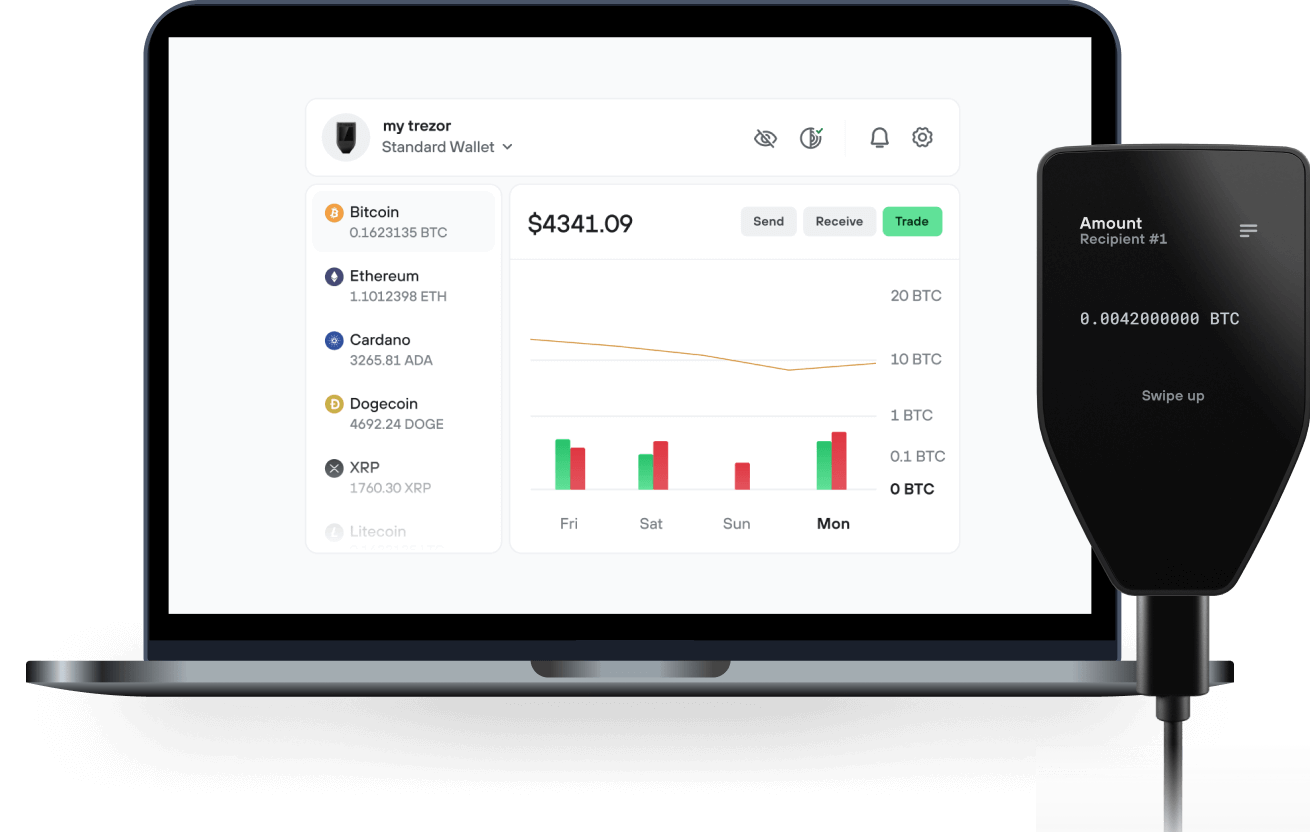

Send & receive your Mir Token with the Trezor Suite app

Send & receive

Trezor hardware wallets that support Mir Token

Sync your Trezor with wallet apps

Manage your Mir Token with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Mir Token Network

- BNB Smart Chain

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to MIR on Trezor

Connect your Trezor

Open a third-party wallet app

Manage your assets

Make the most of your MIR

Trezor keeps your MIR secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Today, as in the past, financial transactions in the banking system face enormous difficulties, including systemic segmentation and isolation, high transfer fees, and the unavailability of liquidity in certain amounts and among banks. Even more so now, since Covid-19, it has become increasingly common to use digital transaction methods. Thus, the most digitalized banks are more and more solicited and efficient with three details: Transactions from one bank to another take a lot of time, they are costly and sometimes when they drag on, it is almost impossible to track the level of evolution of the transaction, both for the Sender and the Reciever. All this is even worse when it comes to Africa.

One of the main difficulties, which central banks will face when they finally decide to start using it, is the progressive weighting of Blockchain over time. Indeed, it turns out that the more Blockchains are solicited, the heavier they become over time. This is the case of the Bitcoin blockchain, whose speed of issuance has been considerably reduced over the past ten years. Not to mention its mining costs, which have become increasingly insignificant, for increasingly complex algorithms. Also other Blockchain models have emerged, offering a total mining, but suffering quite quickly the same problem of weighting in the medium term. All this does not serve the banking sector any more at the moment when it decides to tackle it.

MIR is a Token to fund the future of Blockchain, an optimization model of two types: Blockchains that will be able to carry billions of transactions per day without the constraint of reduced performance, thanks to new types of servers already in development.

Algorithms that reverse the weighting of Blockchain, thanks to new types of encodings and language of micro compression of information on Blockchain.