Safe & secure Impossible Finance wallet

Take control of your Impossible Finance assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

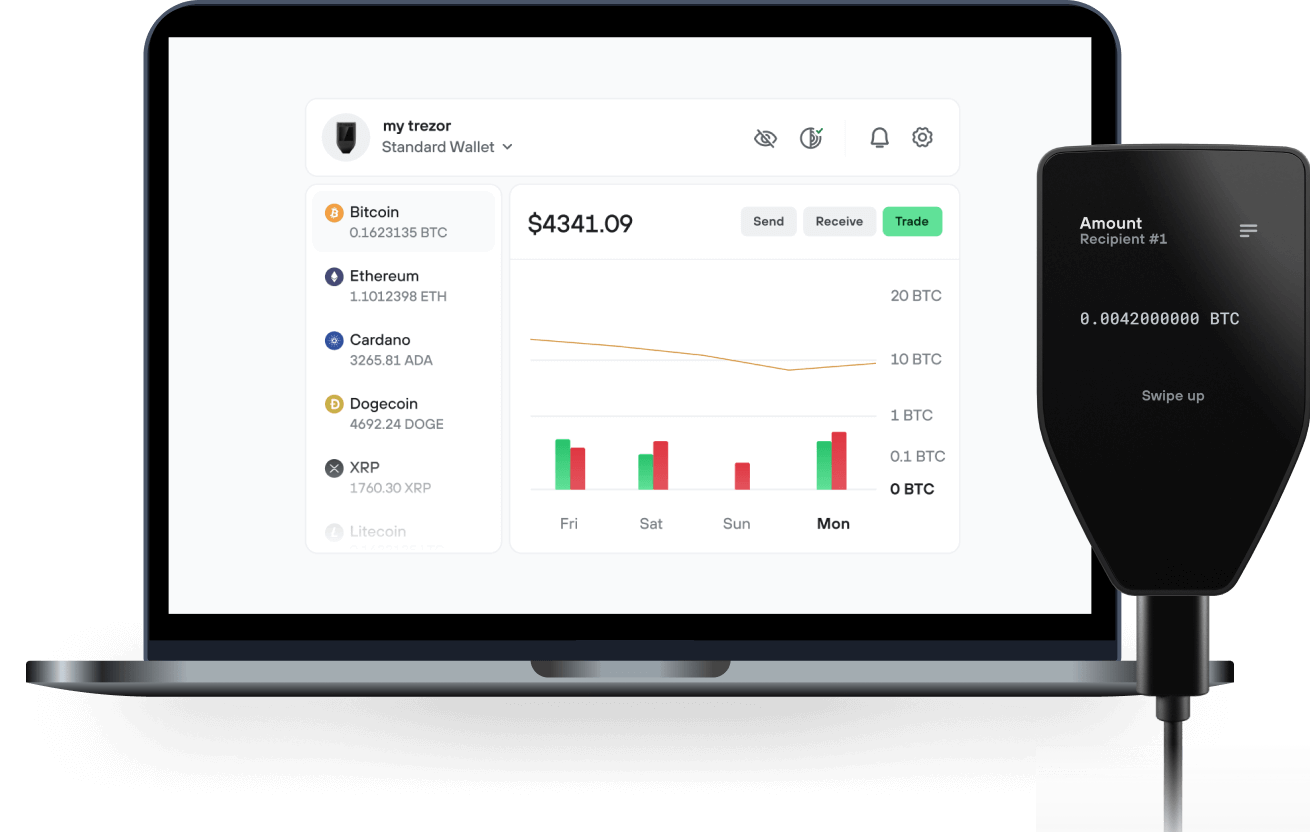

Send & receive your Impossible Finance with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Impossible Finance

Sync your Trezor with wallet apps

Manage your Impossible Finance with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Impossible Finance Network

- BNB Smart Chain

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to IF on Trezor

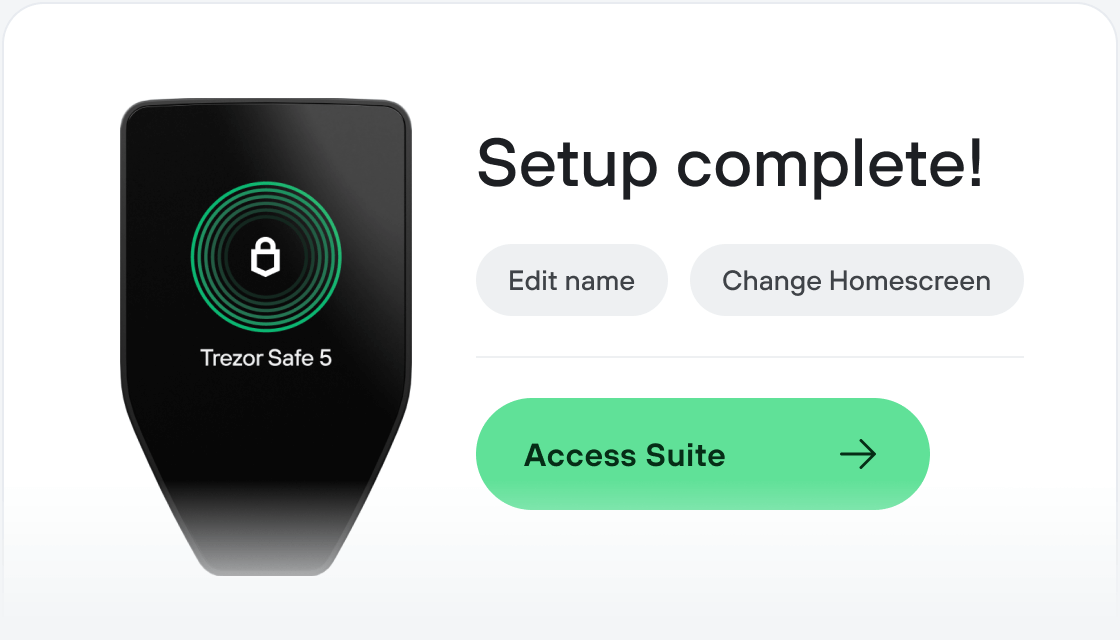

Connect your Trezor

Install Trezor Suite

Transfer your IF

Make the most of your IF

Trezor keeps your IF secure

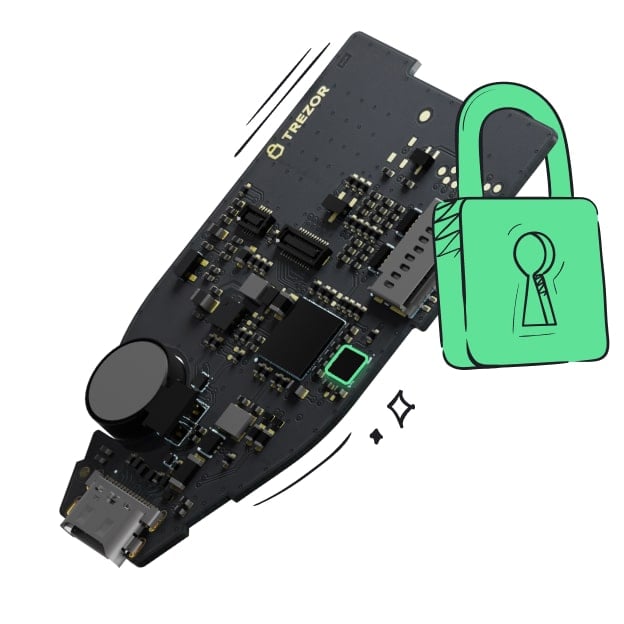

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

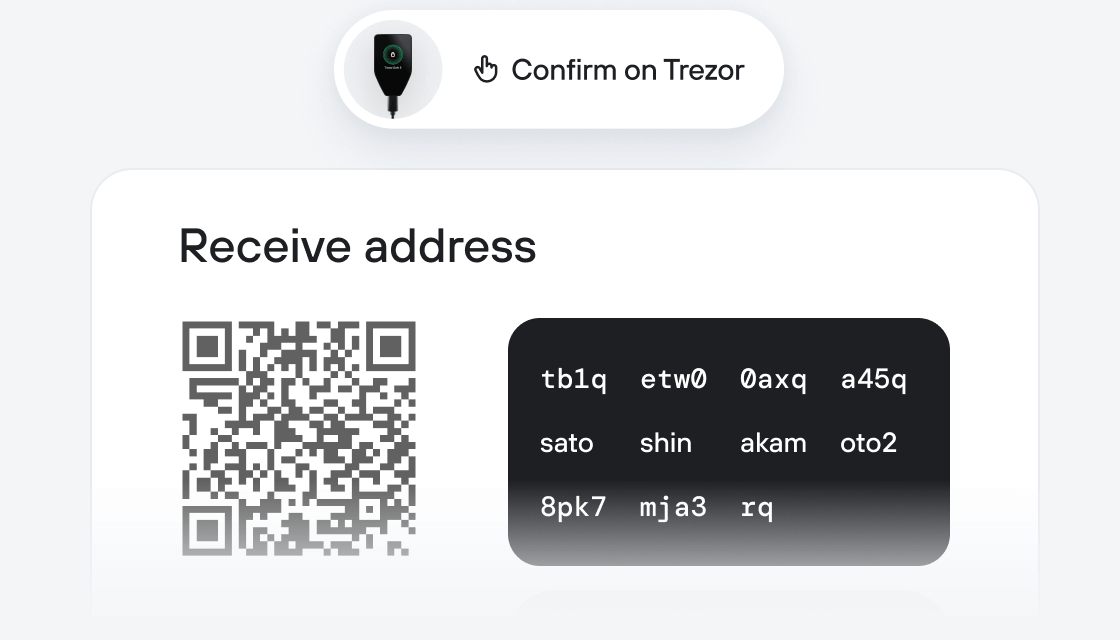

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

The first two Impossible Finance products revolve around yield & autonomous community creation. Versus TradFi’s low yields, defi yield protocols have been a killer app, but impermanent loss still looms large. Instead, focusing on low-IL asset pools such as EUR and JPY stablecoins, where central banks have negative interest rates, or non-dividend yielding synthetics (hint: high growth stocks don’t have dividends) like synthetic TSLA, we propose the first wave of “Impossible Yield” products powered by our stablecoin swap, StableXswap. Taking a page out of Aave & Synthetix’ playbook, this also encourages us to integrate many synthetic assets, lending protocols, and cross-chain solutions to aggregate liquidity. This yield generated from stable EUR, JPY, or TSLA pools is unbeatable by TradFi, at least until the ECB changes policies, the Japanese population pyramid inverts, or Elon Musk changes his website’s FAQ.

In early 2021, we saw Wall Street Bets clash with Robinhood & hedge funds, putting emphasis on addressing retail users’ needs without sacrificing user autonomy. Beyond avoiding business models that actively harm users (i.e. selling flow to frontrunners, or hiding spreads to mask fees), why would you ever accept dividendless holdings when defi can give you yield? That’s Impossible Finance: we’re hellbent on providing better financial instruments for the world.

The second release of Impossible Finance products tackle crypto’s best killer app: fundraising. In the wake of 2017 ICO scams, Vitalik posited DAICOs, (DAO + ICOs), where project teams could raise smart- contract vested funds, provided they achieve certain milestones. Governors determined whether the team was still building, or else refund investors. However, 2018 lacked robust governance and voting portals (i.e.snapshot.page), let alone real products to invest in. Today, we propose the launch of self-sustaining- initial-dex-offerings, or SSIDOs. With the power of yield from our AMMs and partner protocols, a team that raises $10M with a $2M burn rate can be self-sustaining with just 20% APY, creating a new raise once, build forever model. The Andre’s of the world can find capital & liquidity and no longer need to rely on cexes and rent-seeking private investment funds to pay the bills. Meanwhile, vesting stable LP tokens from the fundraise stay within our AMM, which creates sticky TVL. Teams that raise via this system get automatically transparent banking, while traders get access to steady liquidity, anti-rugpull peace of mind. Our mission at Impossible Finance will be to continue finding win-wins for traders, investors, projects, and protocols alike.