Safe & secure Dopex wallet

Take control of your Dopex assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your Dopex with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Dopex

Sync your Trezor with wallet apps

Manage your Dopex with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Dopex Networks

- Ethereum

- Arbitrum One

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to DPX on Trezor

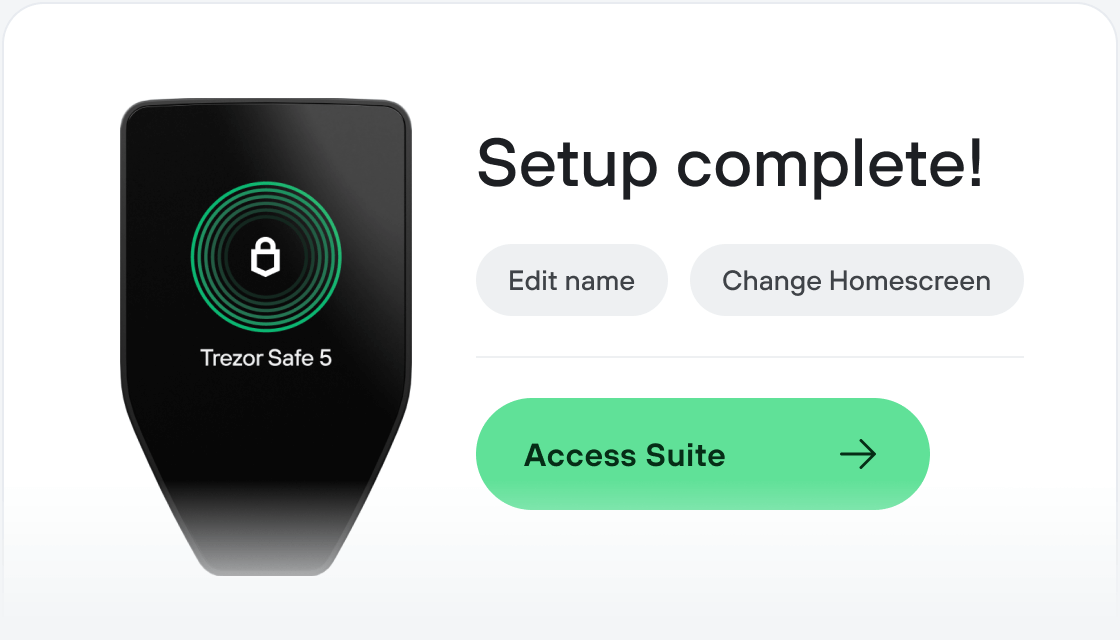

Connect your Trezor

Install Trezor Suite app

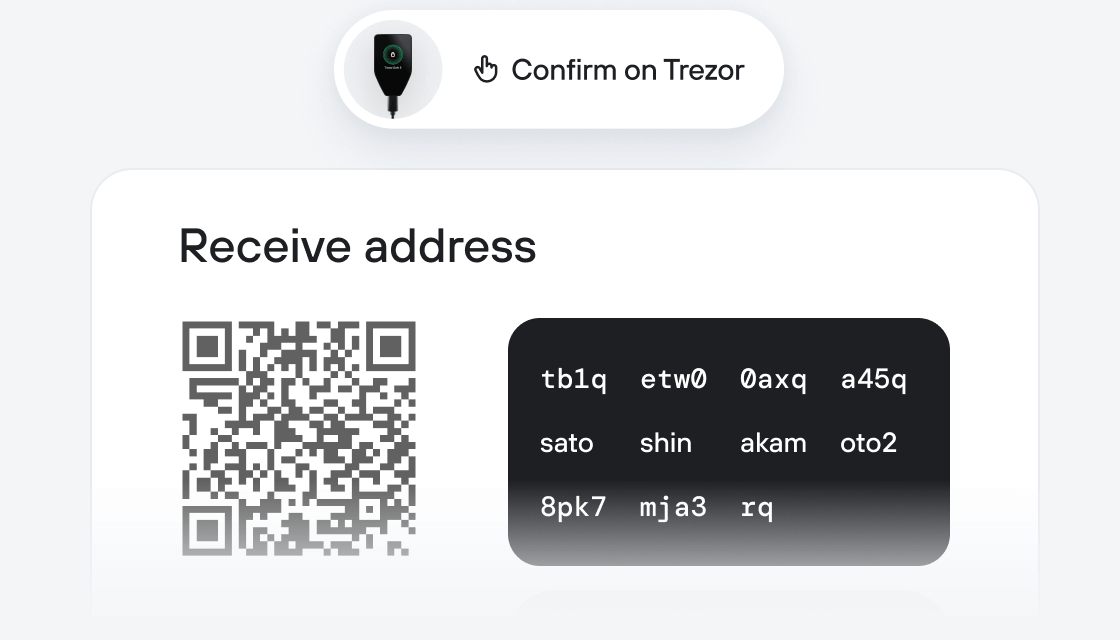

Transfer your DPX

Make the most of your DPX

Trezor keeps your DPX secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Dopex (Decentralized Options Exchange) is a decentralized options protocol that aims to maximize liquidity and minimize losses for option writers while maximizing gains for option buyers. This is done in a passive manner for liquidity-contributing participants.

DPX is the limited supply governance token for the Dopex protocol and is used to vote on protocol and app level proposals. Apart from being a vanilla governance token, DPX also accrues fees and revenue from pools, vaults and wrappers built over the Dopex protocol after every global epoch.

Dopex makes use of unique option pricing model that is calculated on-chain based on the Black-Scholes formula — using implied volatility and asset prices retrieved via Chainlink adapters — and passed through a function to determine volatility smiles based on the realized volatility of the asset. This model ensures pricing that is fair and efficient platform flow. Dopex provides solutions to low liquidity, unfair pricing, lack of composability, lack of user adoption, and unfair arbitrage opportunities during times of high volatility — all without compromising the buyer and seller experience.