Safe & secure Beta Finance wallet

Take control of your Beta Finance assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

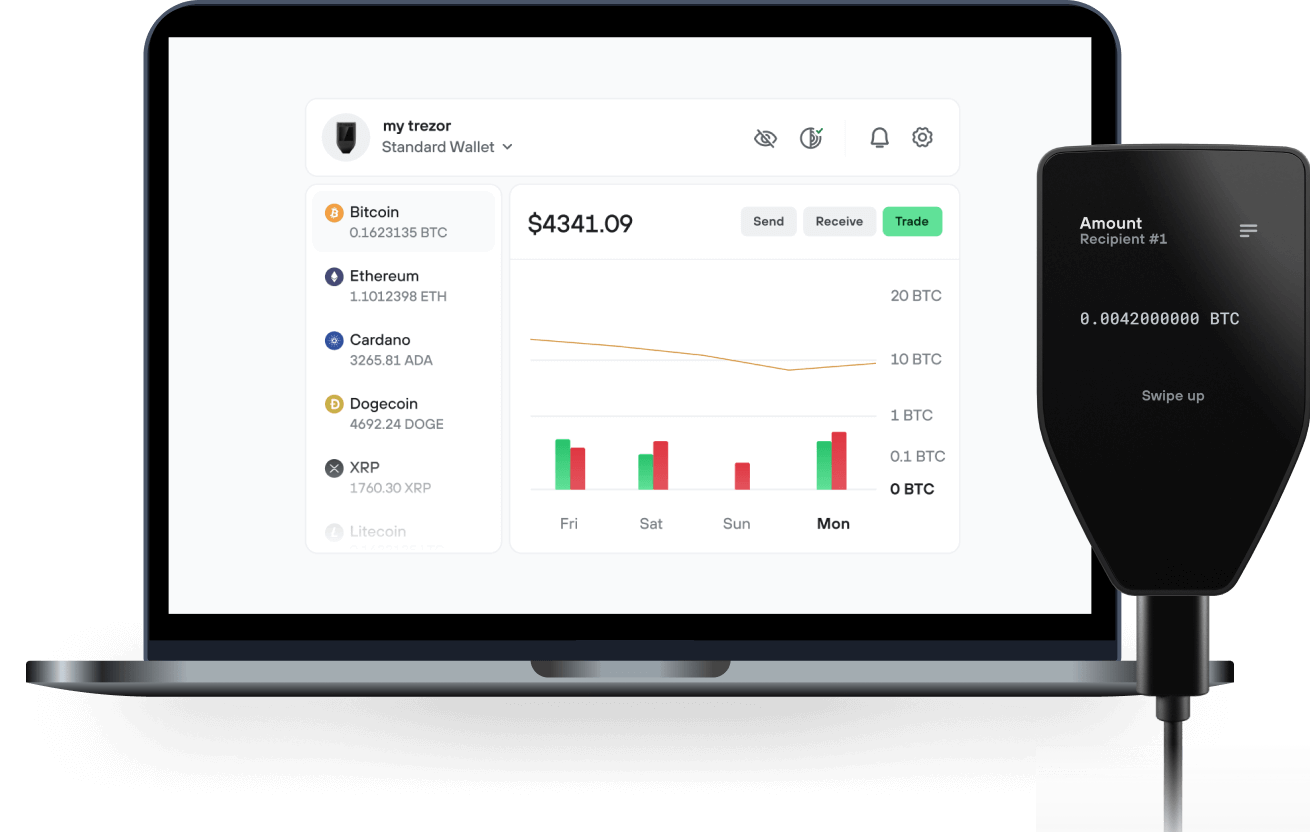

Send & receive your Beta Finance with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Beta Finance

Sync your Trezor with wallet apps

Manage your Beta Finance with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Beta Finance Networks

- Ethereum

- Avalanche

- BNB Smart Chain

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

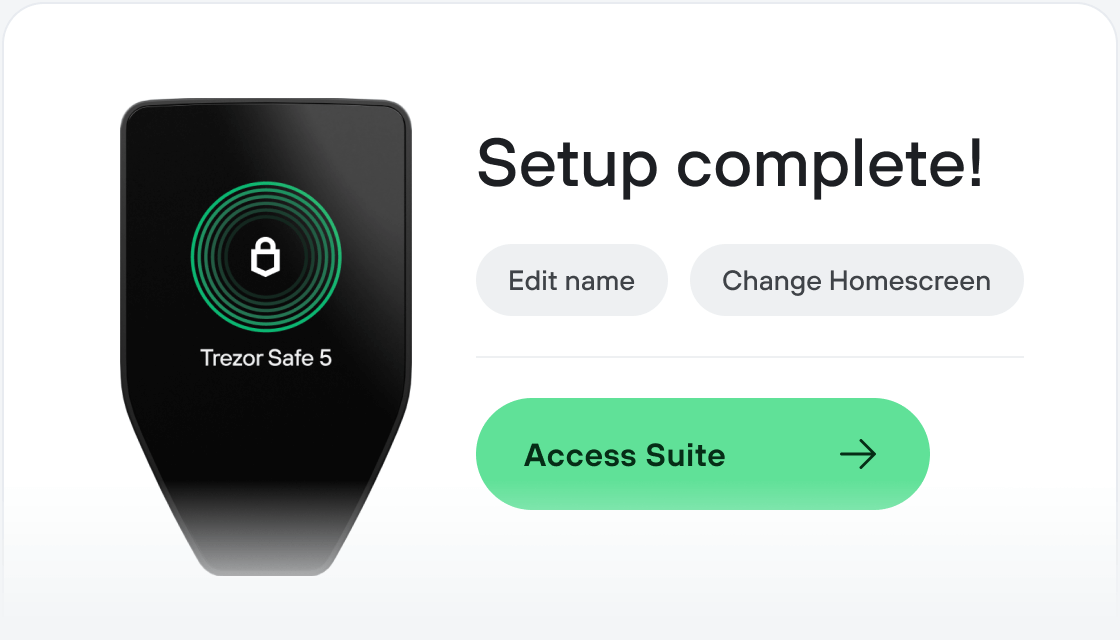

How to BETA on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your BETA

Make the most of your BETA

Trezor keeps your BETA secure

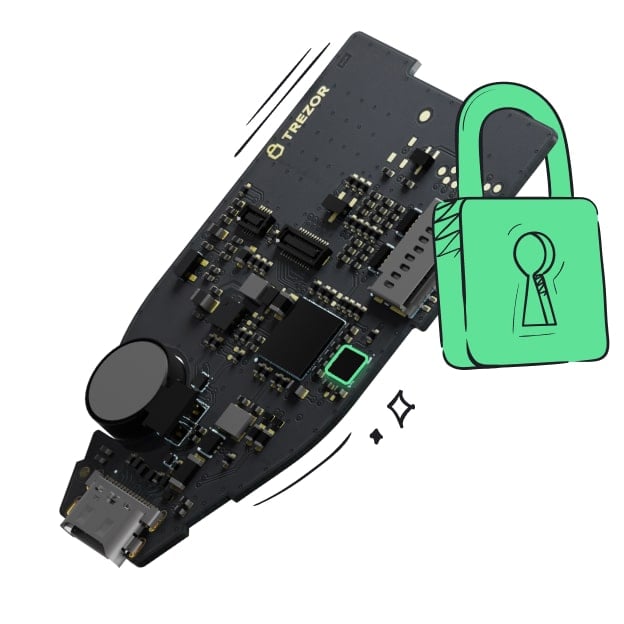

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

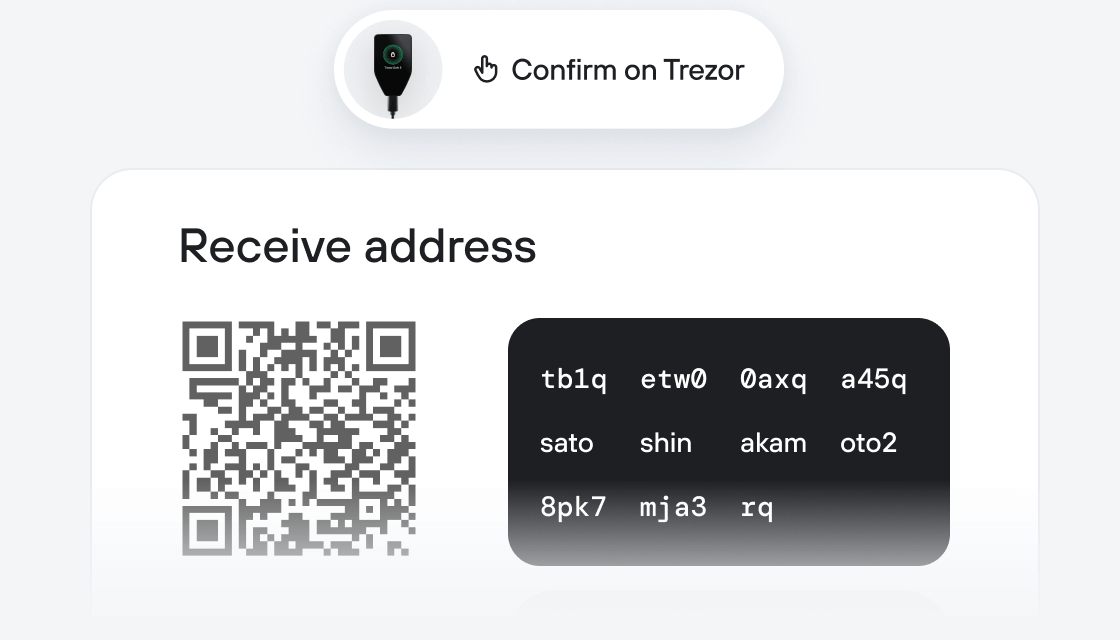

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Beta Finance is the permissionless money market for borrowing, lending, and shorting crypto assets. This means that anyone at anytime is able to create a money market for any crypto asset.

Lenders are able to now earn risk-free yield (as high as 1000+%) on not only popular assets, but also the long tail of crypto assets, including yield farmed tokens, that exist today! Easily deposit your tokens on Beta into the token's money market, or create it yourself if it's not there yet.

Borrowers are able to borrow crypto assets by supplying ETH and/or Stablecoin as collateral. This gives users flexibility when interacting with other protocols that requires using assets they currently do not have without losing their current positions.

Traders are able to short sell any crypto asset by using their ETH and/or Stablecoin as collateral. Beta provides an integrated "1-Click" Short that makes initiating and managing short positions simple.

Liquidators are able to earn a premium bounty reward for monitoring and liquidating under-collateralized positions.