Safe & secure yearn.finance wallet

Take control of your yearn.finance assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Buy, sell & manage your yearn.finance with the Trezor Suite app

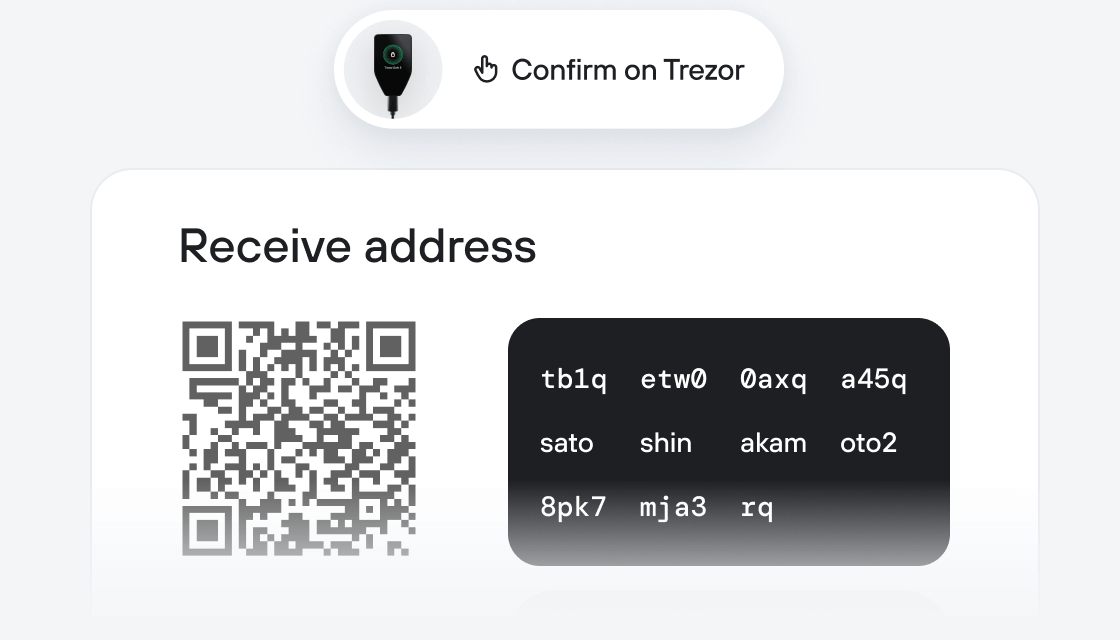

Send & receive

Buy, sell & swap

Trezor hardware wallets that support yearn.finance

Sync your Trezor with wallet apps

Manage your yearn.finance with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported yearn.finance Networks

- Polygon POS

- Base

- Ethereum

- Fantom

- Harmony Shard 0

- Arbitrum One

- Avalanche

- Optimism

- Gnosis Chain

- Energi

- Huobi ECO Chain Mainnet

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to YFI on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your YFI

Make the most of your YFI

Trezor keeps your YFI secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Yearn Finance is a suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain. The protocol is maintained by various independent developers and is governed by YFI holders.

It started out as a passion project by Andre Cronje to automate the process of switching capital between lending platforms in search of the best yield offered, as the lending yield is a floating rate rather than fixed rate. Funds are shifted between dYdX, AAVE, and Compound automatically as interest rates change between these protocols.

The service offered includes major USD tokens such as DAI, USDT, USDC, and TUSD. For example, if a user deposits DAI into yearn.finance, the user will receive yDAI token in return, which is a yield-bearing DAI token.

Later on, it collaborated with Curve Finance to release a yield-bearing USD tokens pool that includes four y-tokens: yDAI, yUSDT, yUSDC and yTUSD, it is named as yUSD.

Yearn Finance debuted the vault feature after its token launch, igniting a frenzy on automated yield farming and is considered the initiator of the category of yield farming aggregator. Basically, the vault will help users to claim yield farming rewards and sell it for the underlying assets.

Vaults benefit users by socializing gas costs, automating the yield generation and rebalancing process, and automatically shifting capital as opportunities arise. End users also do not need to have proficient knowledge of the underlying protocols involved or DeFi, thus the Vaults represent a passive-investing strategy. It is akin to a crypto hedge fund where the aim is to increase the amount of assets that users deposited.