Safe & secure PRIME wallet

Take control of your PRIME assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

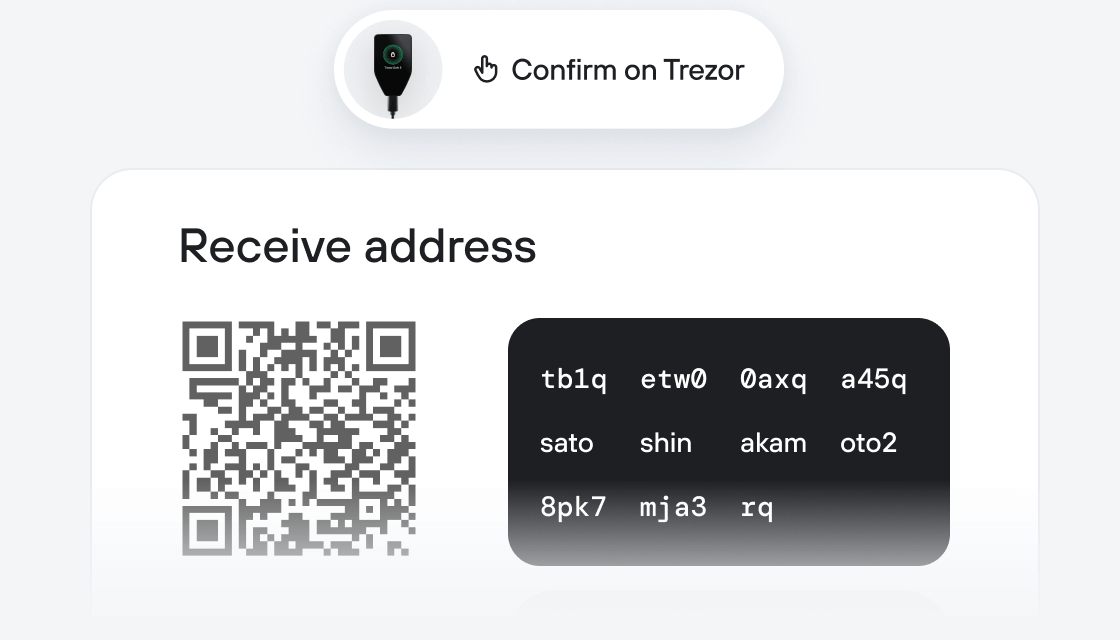

Send & receive your PRIME with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support PRIME

Sync your Trezor with wallet apps

Manage your PRIME with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

Backpack

NuFi

Supported PRIME Network

- Solana

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to PRIME on Trezor

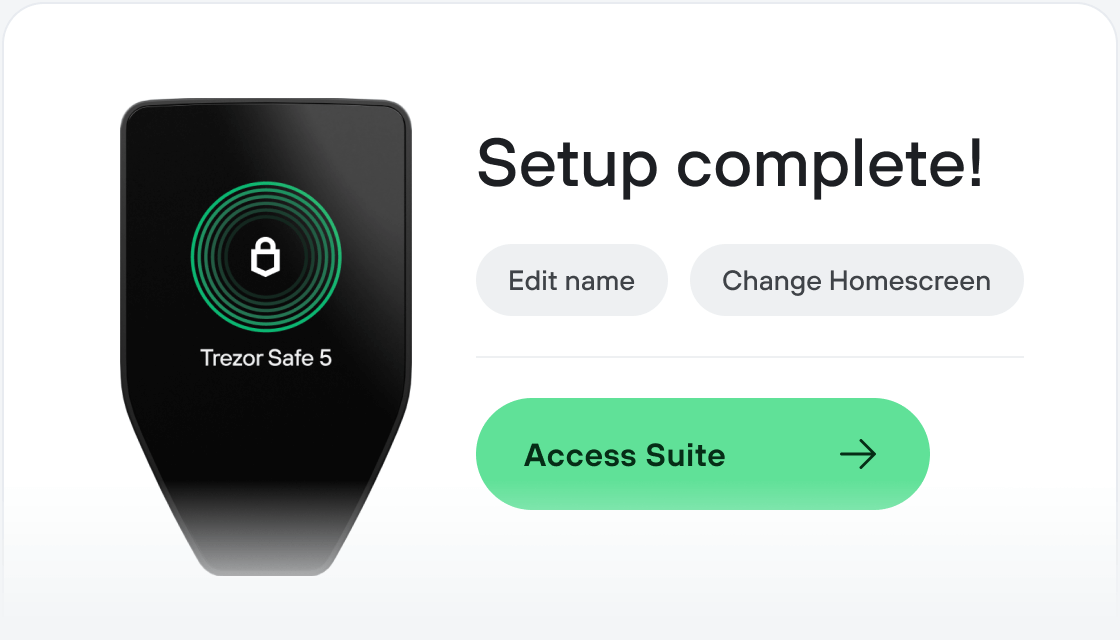

Connect your Trezor

Install Trezor Suite app

Transfer your PRIME

Make the most of your PRIME

Trezor keeps your PRIME secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Hastra is a decentralized protocol on Solana that bridges institutional-grade real-world assets (RWAs) with DeFi. The protocol tokenizes access to Figure's loan portfolio—a publicly-traded, SEC-regulated financial services company with over $17 billion in loan originations—enabling users to earn sustainable yields backed by real consumer lending operations. The Hastra ecosystem features two primary yield-bearing tokens: wYLDS, a wrapped version of Figure's SEC-registered stablecoin backed by treasury securities, and PRIME, a liquid staking token that earns yield from Figure's Democratized Prime HELOC lending pools. Both tokens are fully composable across Solana DeFi protocols like Kamino, Raydium, and Jupiter. Unlike traditional DeFi yield that relies on token emissions or speculative trading, Hastra delivers real yields from audited, real-world lending operations with transparent underlying collateral and regulatory compliance.