Safe & secure Curve DAO wallet

Take control of your Curve DAO assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

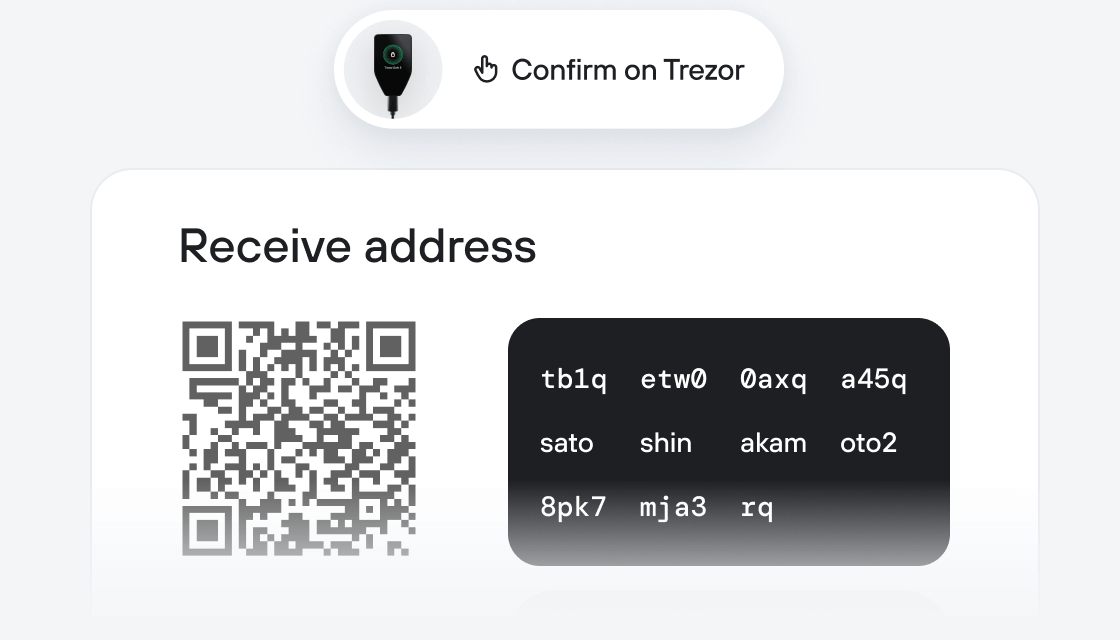

Send & receive your Curve DAO with the Trezor Suite app

Send & receive

Buy & swap

Trezor hardware wallets that support Curve DAO

Sync your Trezor with wallet apps

Manage your Curve DAO with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Curve DAO Networks

- Polygon POS

- Base

- Ethereum

- Fantom

- Arbitrum One

- Optimism

- Energi

- Etherlink

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to CRV on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your CRV

Make the most of your CRV

Trezor keeps your CRV secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Similar to Uniswap, Curve Finance is an Automated Market Maker (AMM) based Decentralised Exchange (DEX). Unlike Uniswap, its main focus is only to swap between assets that are supposed to have the same value. This is useful in the DeFi ecosystem as there are plenty of wrapped tokens and synthetic tokens that aim to mimic the price of the real underlying asset.

For example, one of the biggest pools is 3CRV, which is a stablecoin pool consisting of DAI, USDT, and USDC. Their ratio in the pool will be based on the supply and demand of the market. Depositing a coin with a lesser ratio will yield the user a higher percentage of the pool. As such when the ratio is heavily tilted to one of the coins, it may serve as a good chance to arbitrage.

Curve Finance also supports yield-bearing tokens. For example, it collaborated with Yearn Finance to release yUSD pools that consisted of yDAI, yUSDT, yUSDC and yTUSD. Users that participated in this pool will not only have yield from the underlying yield-bearing tokens, but also the swap fees generated by the Curve pool. Including the yield farming rewards in terms of CRV tokens, liquidity providers of the pool actually have three sources of yield.