Safe & secure Real Estate Crypto Crowfunding wallet

Take control of your Real Estate Crypto Crowfunding assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

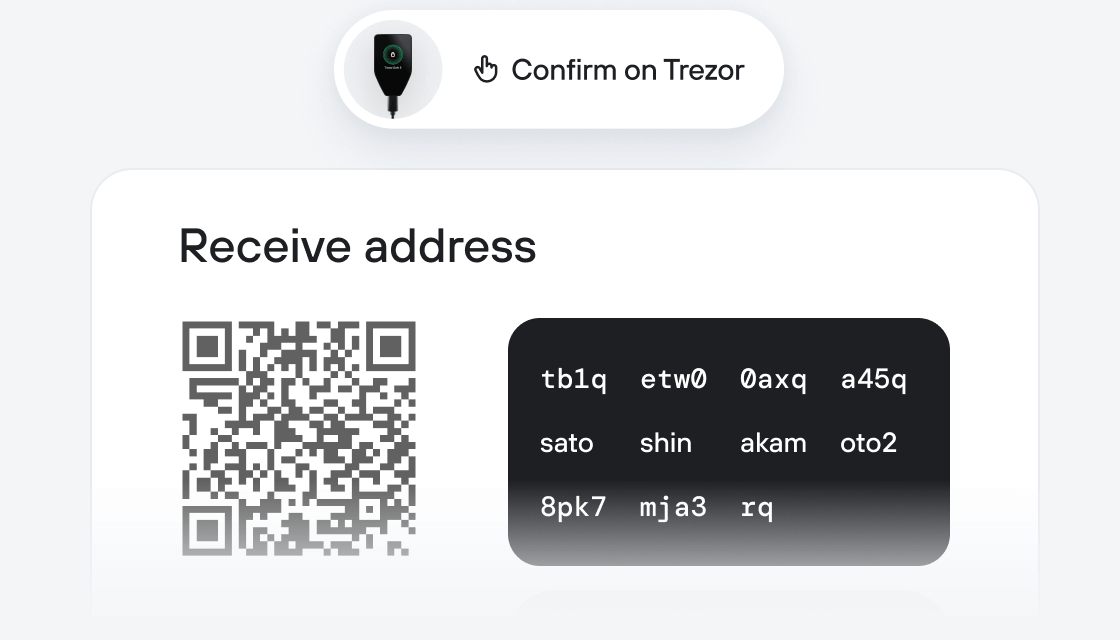

Send & receive your Real Estate Crypto Crowfunding with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Real Estate Crypto Crowfunding

Sync your Trezor with wallet apps

Manage your Real Estate Crypto Crowfunding with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

Backpack

NuFi

Supported Real Estate Crypto Crowfunding Network

- Solana

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

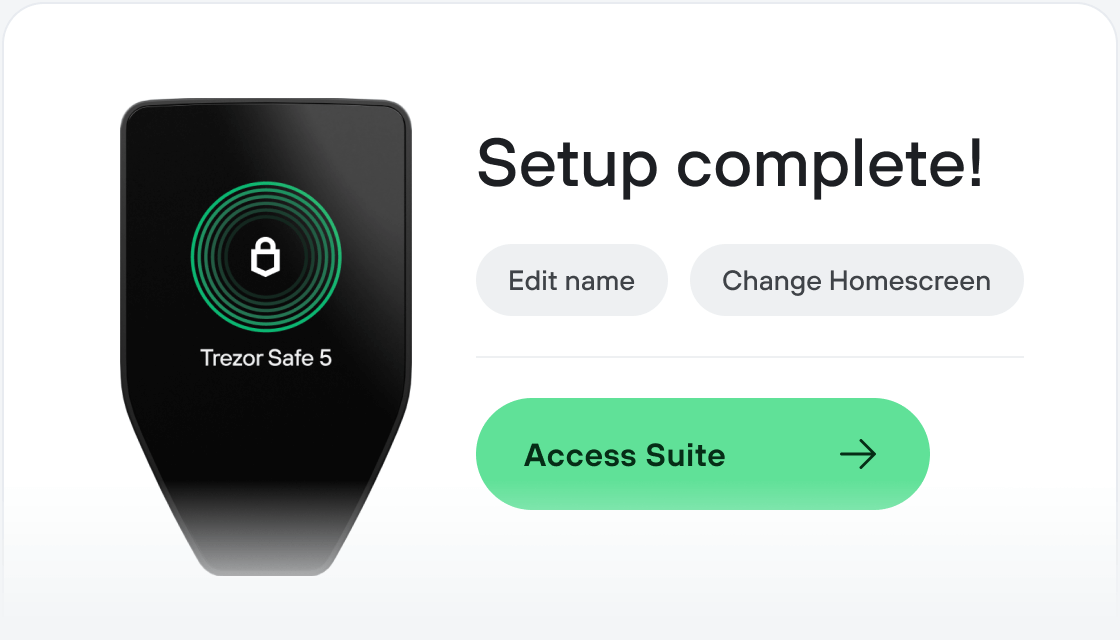

How to RECC on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your RECC

Make the most of your RECC

Trezor keeps your RECC secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

RECC is a Solana-native protocol that tokenises real-world real-estate financing and lets investors lend stablecoins to vetted development projects. Acting as a crowdfunding intermediary, it matches KYB-verified property developers (“sellers”) with crypto or fiat investors (“buyers”) who seek predictable yield . When a project is approved, a smart contract opens a dedicated project pool, accepts the pledged USDC/USDT and mints an LP token that represents each investor’s share; once the funding goal is met, the capital is lent to the developer, and upon repayment investors burn the LP token to reclaim principal plus interest . Initial opportunities advertise estimated annual returns between 6 % and 18 %, reflecting the risk-adjusted cash-flows of each underlying asset . Road-mapped utilities include multi-chain and fiat on-ramp support, a secondary trading venue for LP tokens, a referral and insurance programme, and optional auto-roll of proceeds into new pools, widening access and liquidity for real-world-asset yield on Solana .