Safe & secure VirtuSwap wallet

Take control of your VirtuSwap assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

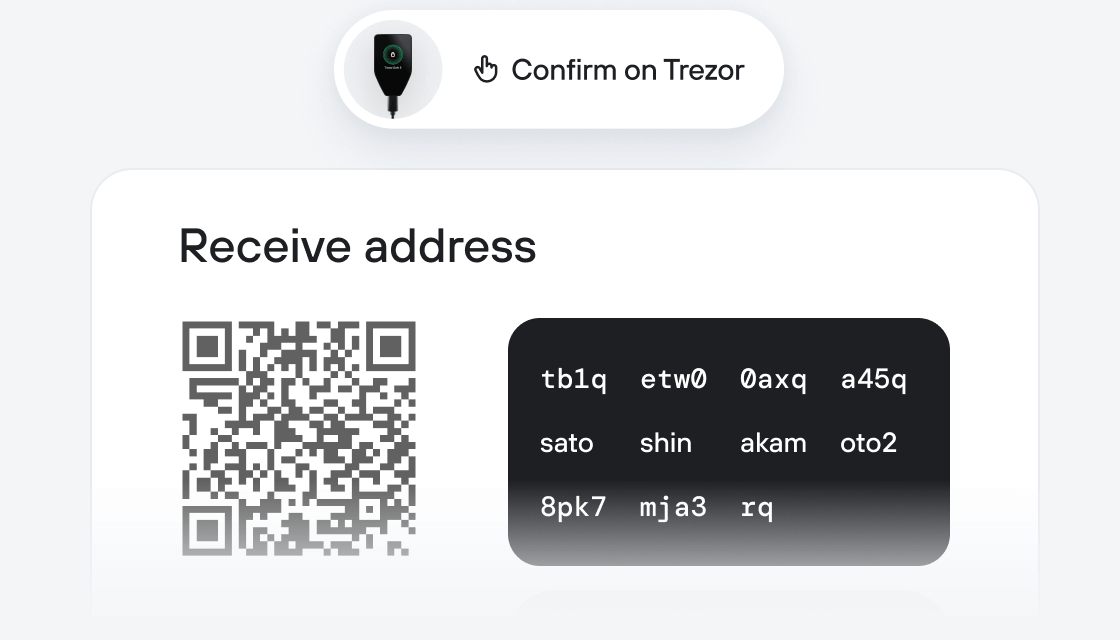

Send & receive your VirtuSwap with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support VirtuSwap

Sync your Trezor with wallet apps

Manage your VirtuSwap with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported VirtuSwap Networks

- Polygon POS

- Ethereum

- Arbitrum One

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to VRSW on Trezor

Connect your Trezor

Install Trezor Suite

Transfer your VRSW

Make the most of your VRSW

Trezor keeps your VRSW secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

VirtuSwap goal is to make DEX trading as efficient as CEX trading. VirtuSwap innovation is centered on two main aspects. Firstly, the VirtuSwap AMM based DEX implement a new backend architecture that uses “Virtual Reserves”, which enable to significantly increase liquidity efficiency while solving the problem of indirect trades that 99% of crypto-assets suffers from. VirtuSwap DEX achieves that by enabling Liquidity Pools to hold, for a limited scope, making all pools work as an orchestra to direct liquidity to the trade, thus eliminating the need for costly indirect trade when trading assets with insufficient direct liquidity. Secondly, VirtuSwap developed the “Minerva Engine”, an AI-based optimizer that analyzes real trading activity to suggest the optimal allocation of economic incentives to Liquidity Providers, thus making VRSW emission allocation derive from informed real data basis. In the future VirtuSwap will also incorporate a hedging model that will enable small to medium cap project who suffers the most from insufficient direct liquidity, to support trading with multiple assets by opening a single pool. VRSW token is VirtuSwap governance token, and can be used for Staking or Locking to receive increased economic incentives, as well as voting on the governance of the protocol using vote-escrowed VRSW, noted as gVRSW.