Safe & secure Solayer Staked SOL wallet

Take control of your Solayer Staked SOL assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

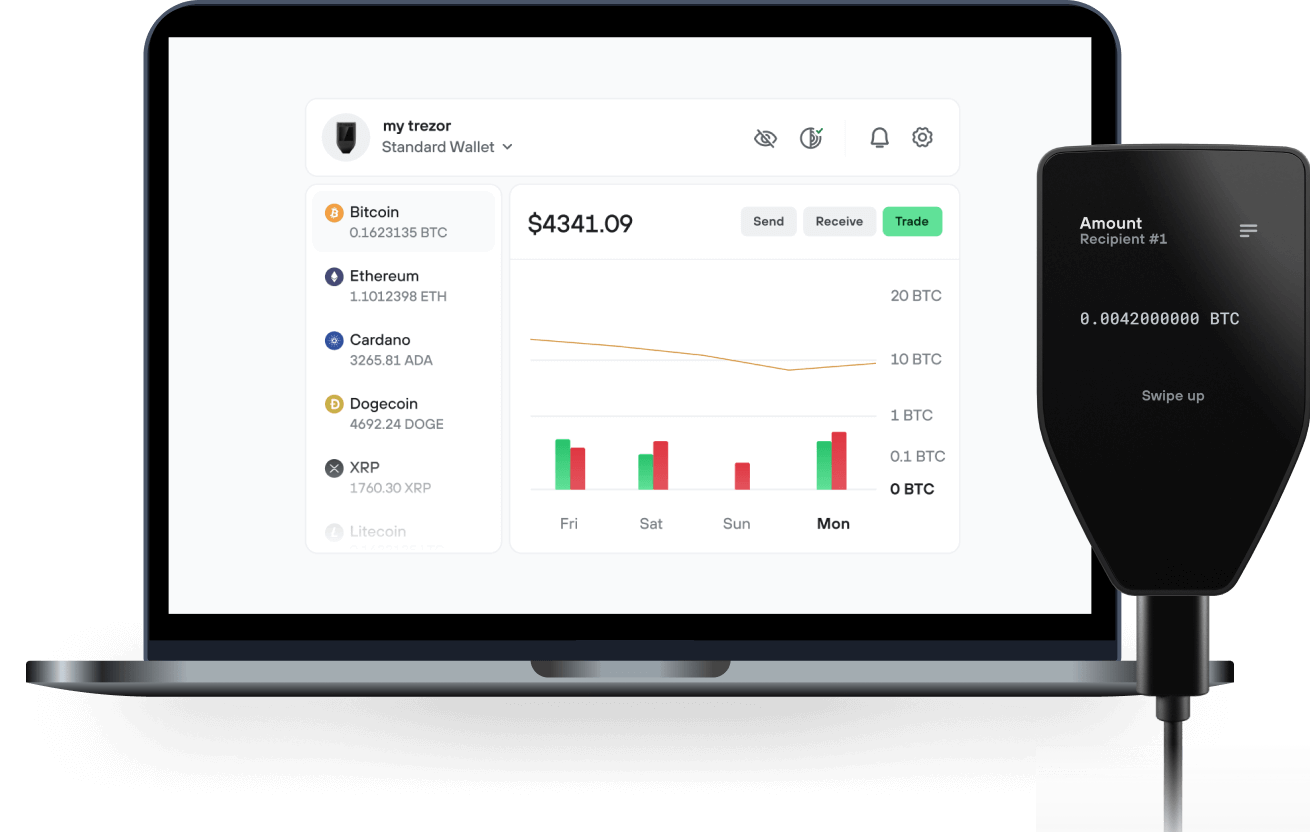

Send & receive your Solayer Staked SOL with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Solayer Staked SOL

Sync your Trezor with wallet apps

Manage your Solayer Staked SOL with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

Backpack

NuFi

Supported Solayer Staked SOL Network

- Solana

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to SSOL on Trezor

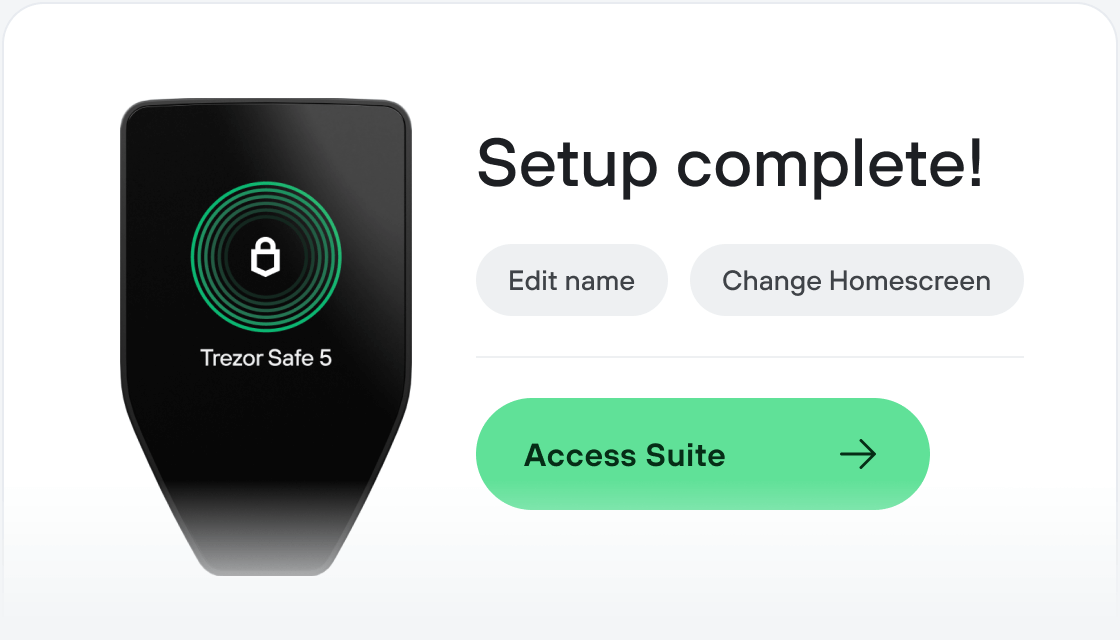

Connect your Trezor

Install Trezor Suite app

Transfer your SSOL

Make the most of your SSOL

Trezor keeps your SSOL secure

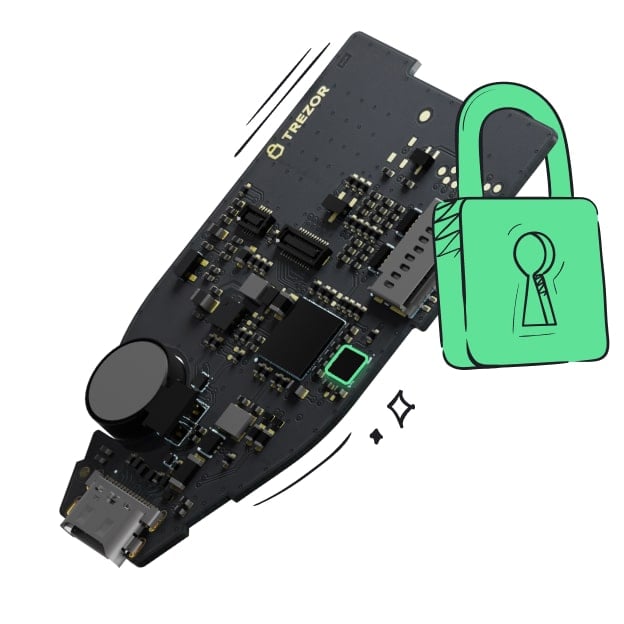

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

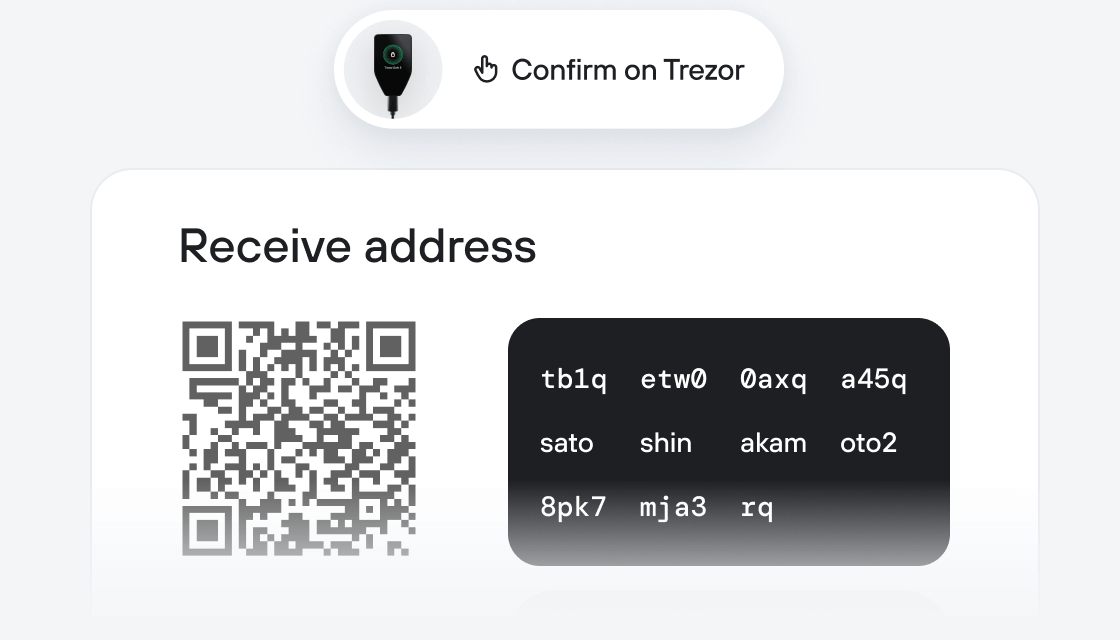

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Solayer is the dominant restaking marketplace on Solana..

We aim to empower on-chain decentralized applications (dApps) with improved network bandwidth while securing the L1 at the same time.

Our goal is to provide dApps on Solana with a greater likelihood of securing block space and prioritizing transaction inclusion.

sSOL is the universal liquidity layer for delegates [dApps] and LRTs on Solayer. Every unit of SOL can be perceived as a unit of blockspace lent towards dApps, securing network bandwidth and TPS.

The stake delegated towards dApps, which derives an AVS SPL token, is built on top of sSOL-SOL liquidity. Similarly, LRTs are built on top of sSOL liquidity interface to generate vault strategies.

There are various ways of utilizing sSOL and earning maximum yield as an sSOL holder. You can delegate to dApps to bootstrap network bandwidth or participate in DeFi strategies to earn additional APY, starting with our launch partners.

There are various ways of utilizing sSOL and earning maximum yield as an sSOL Holder. You can delegate to dApps to bootstrap network bandwidth or participate in DeFi strategies to earn additional APY, starting with our launch partners.

Now we will go through a couple of examples on how you can put your sSOL to work in AMMs, lending protocols, perpetual exchanges, and more.

Liquidity Vaults on Kamino Kamino’s liquidity vaults are an automated liquidity solution that allows users to earn yield on their crypto assets by providing liquidity to concentrated liquidity market makers (CLMMs).

A vault deploys liquidity into an underlying DEX pool, consisting of 2 tokens. When you deposit into a vault, you earn fees from trading volume.

In other words, if you deposit into a pool with sSOL and SOL, any token swaps that utilize that pool will incur a small cost to the swapper. As a Kamino depositor, you earn from that swap fee.

Vault Capital Deposit Example

Situation: You have 100 sSOL worth $10,000 USD. You want to earn yield on your assets without active management.

Use Case: Deposit your sSOL into a Kamino vault. Your sSOL will provide liquidity to a DEX, earning fees from trading volume. Kamino automates rebalancing and compounding, maximizing your yield.

Benefit: Earn yield passively while maintaining exposure to sSOL.

Liquidity Provision on Orca Orca utilizes a Concentrated Liquidity Automated Market Maker (CLAMM) to enhance capital efficiency and yield for liquidity providers. By providing liquidity to Orca’s pools, users can earn yield on their crypto assets through trading fees.

When you provide liquidity to an Orca pool, such as the sSOL-SOL pair, you earn fees from each token swap within that pool. This means if you deposit sSOL and SOL into the pool, any trades that occur between these tokens will generate fees, which are distributed to you as a liquidity provider. Orca automates this process, ensuring optimal capital efficiency and low slippage.

LP Example

Situation: You have 100 sSOL worth $10,000 USD. You want to earn yield on your assets without active management.

Use Case: Deposit your sSOL and an equivalent amount of SOL into an Orca CLAMM pool. Your sSOL and SOL will provide liquidity to the DEX, earning fees from trading volume. Orca’s advanced CLAMM technology will ensure that your assets are utilized efficiently, maximizing your returns.

Benefit: Earn yield passively from trading fees while maintaining exposure to both sSOL and SOL.