Safe & secure Re7 USDT Morpho Vault wallet

Take control of your Re7 USDT Morpho Vault assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

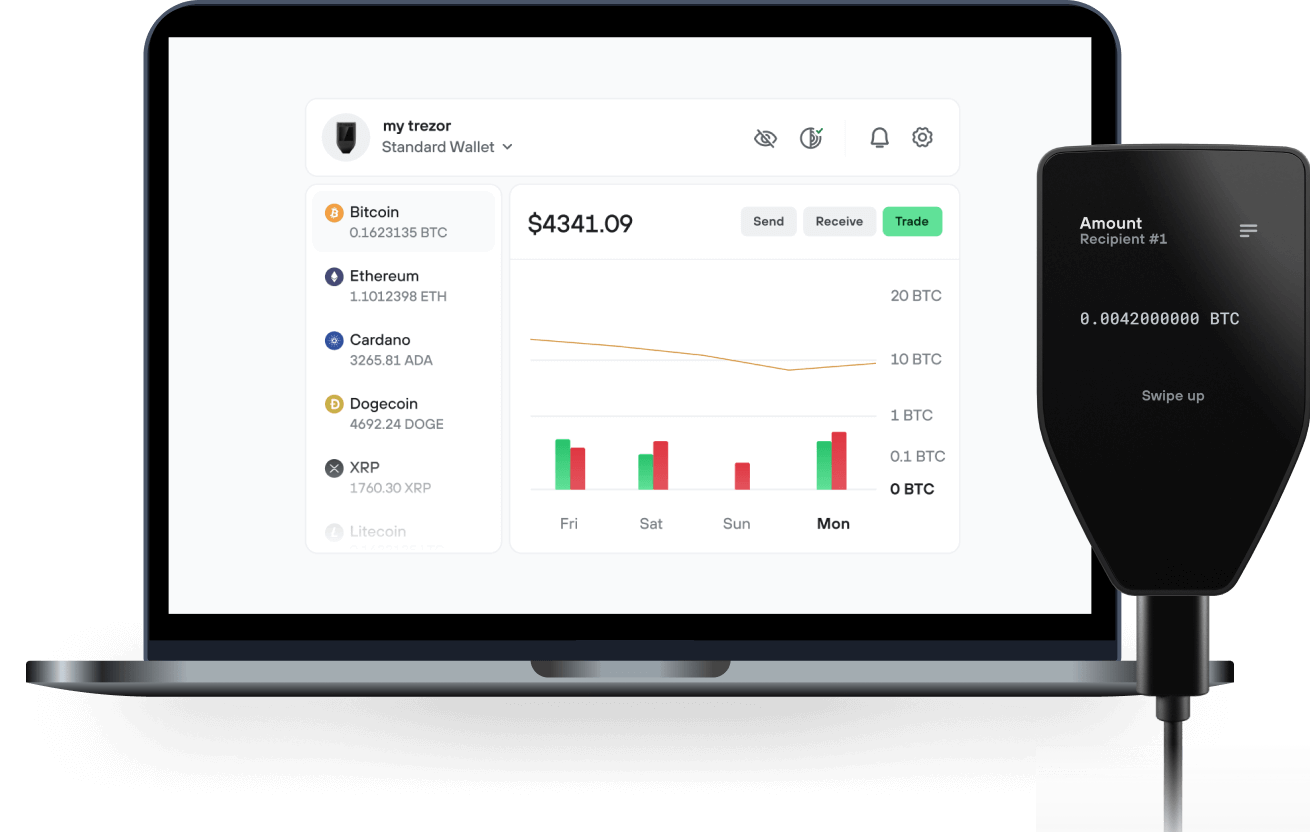

Send & receive your Re7 USDT Morpho Vault with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Re7 USDT Morpho Vault

Sync your Trezor with wallet apps

Manage your Re7 USDT Morpho Vault with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Re7 USDT Morpho Vault Network

- Ethereum

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to RE7USDT on Trezor

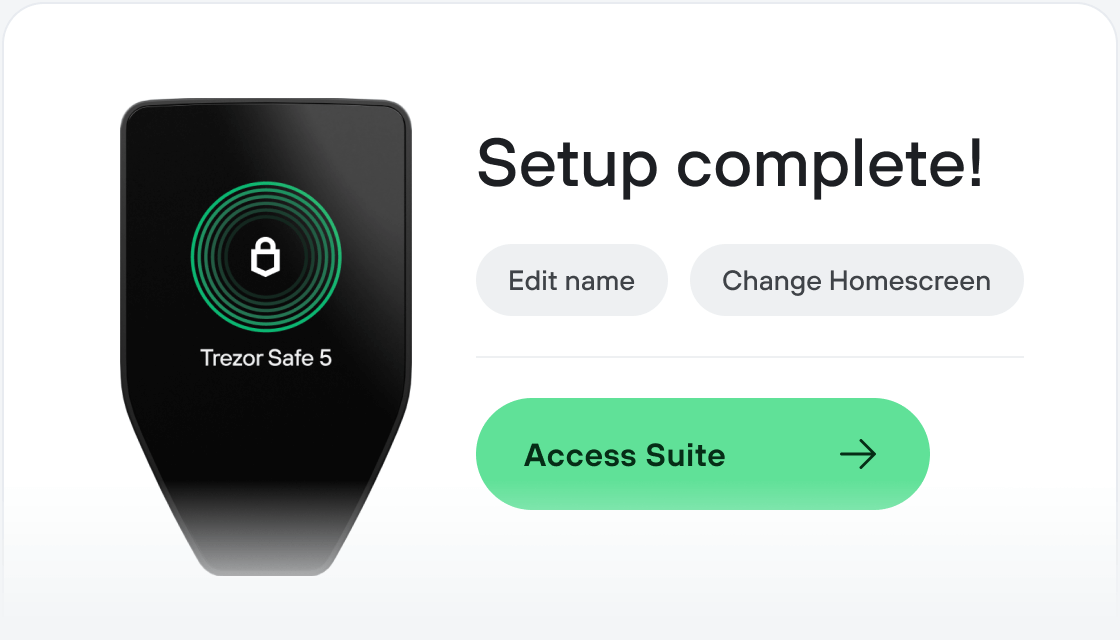

Connect your Trezor

Install Trezor Suite app

Transfer your RE7USDT

Make the most of your RE7USDT

Trezor keeps your RE7USDT secure

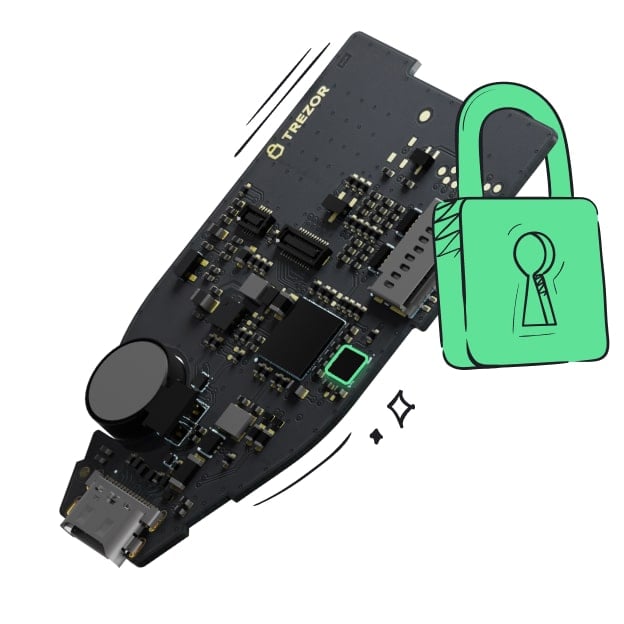

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

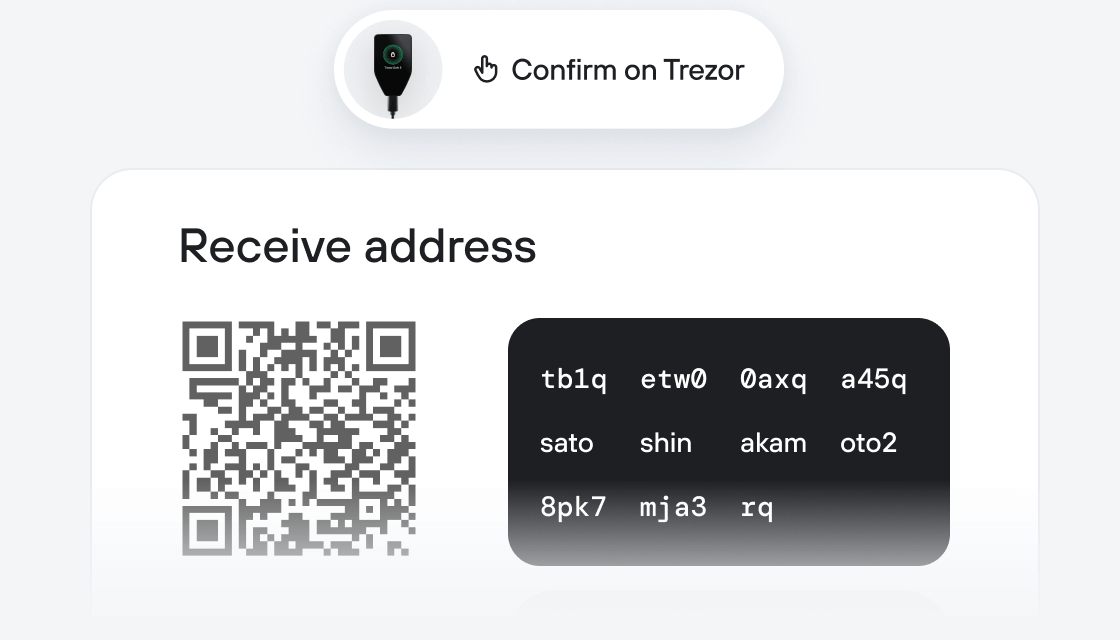

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

The Re7 USDT Morpho vault curated by Re7 Labs aims to provide an above-market USDT yield by enabling leveraged-yield strategies and supporting high-yield USDT markets. Learn more about RE7 Labs curations in the forum.

Re7 has been providing liquidity in DeFi since 2019 having deployed over $100m of assets. We bring practical experience to risk management from years of managing stablecoin and ETH yield strategies as well as further strategies like our Liquid Token fund. As DeFi-native managers, we have focused on enabling yield strategies, providing early liquidity to various DeFi protocols, and have worked with teams throughout the space on a close basis to grow DeFi liquidity while managing risk.