Safe & secure Radiant Capital wallet

Take control of your Radiant Capital assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

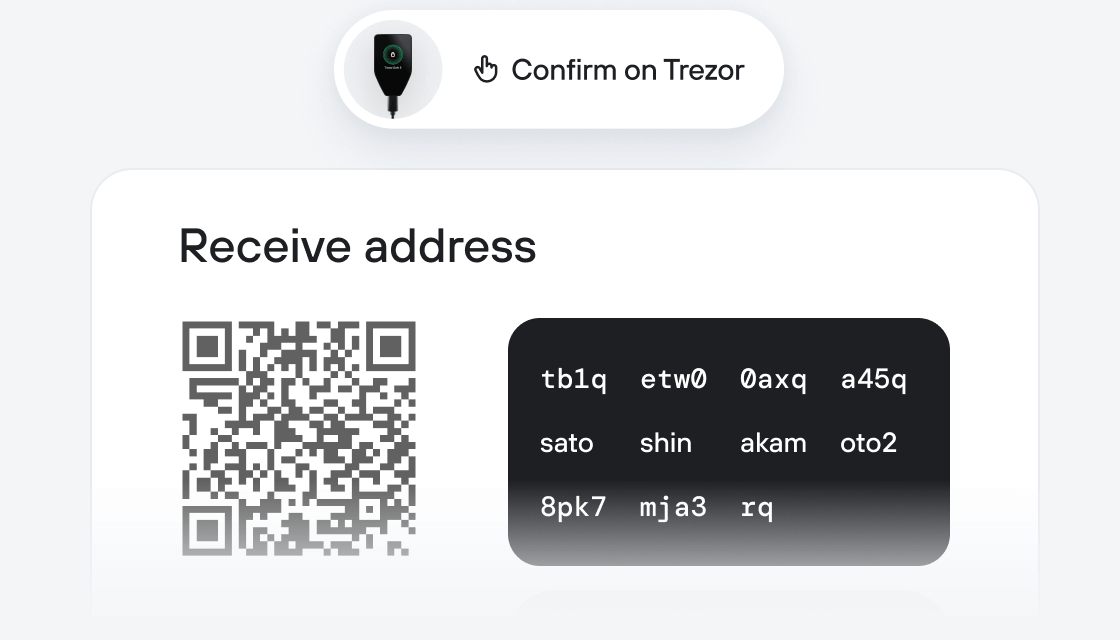

Send & receive your Radiant Capital with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Radiant Capital

Sync your Trezor with wallet apps

Manage your Radiant Capital with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Radiant Capital Networks

- Base

- Ethereum

- Arbitrum One

- BNB Smart Chain

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to RDNT on Trezor

Connect your Trezor

Install Trezor Suite app

Transfer your RDNT

Make the most of your RDNT

Trezor keeps your RDNT secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

What is Radiant Capital?

Project Overview

Capital in DeFi is extremely fragmented across chains, evidenced by the dozens of different money markets, all with their own liquidity.

Radiant aims to be an omnichain money market where users can deposit any major asset on any major chain and borrow various supported assets across multiple chains, eliminating the need for silos of liquidity.

Radiant’s cross-chain interoperability functions using LayerZero messaging and Stargate's stable router interface. For example, lenders may reclaim their collateral and can direct which chain to withdraw funds from and what percentage they’d like sent to each chain.

Radiant aims to solve DeFi 1.0 issues of unpredictable and transient liquidity through its innovative Dynamic Liquidity Providers (dLP) and gated emissions.

Value Proposition

Consolidation of Fragmented Liquidity: The primary goal of the Radiant DAO is to consolidate billions in fragmented liquidity across multiple lending protocols and chains under one safe, user-friendly, and capital-efficient cross-chain protocol. This consolidation of fragmented liquidity is intended to enhance the overall DeFi ecosystem and create a more seamless experience for users.

Gated Emissions: Sustainability is an important Key Performance Indicator to the Radiant DAO and thus the protocol implemented a Dynamic Liquidity (dLP) mechanism which only enables incentivized RDNT emissions to dLP providers. Dynamic Liquidity Provisioners also share in the utility of platform fees captured in blue-chip assets such as Bitcoin, Ethereum, BNB, and stablecoins through borrowing interest, flash loans, and liquidations.

Project Key Highlights

Omnichain Money Market: Users can deposit and borrow assets across chains seamlessly within minutes via Radiant’s integrations with LayerZero and the Stargate stable router interface, which solves many DeFi pain points related to requiring multiple transactions to lend, borrow, bridge, and swap.

DeFi 3.0: Early iterations of DeFi featured many copycat protocols with zero utility and high-emission governance tokens. In the Radiant DAO’s V2 launch, Radiant will continue to allow all users to borrow and lend cross-chain, seamlessly. However, emissions are gated to only users which provide utility to the protocol in the form of Dynamic Liquidity Provisioning

Support for 20+ Collateral Options: As the Radiant DAO expands its cross-chain functionality to additional chains, new collateral options will emerge with DAO-voted Loan-To-Value parameters and oracle usage.