Safe & secure IPOR wallet

Take control of your IPOR assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

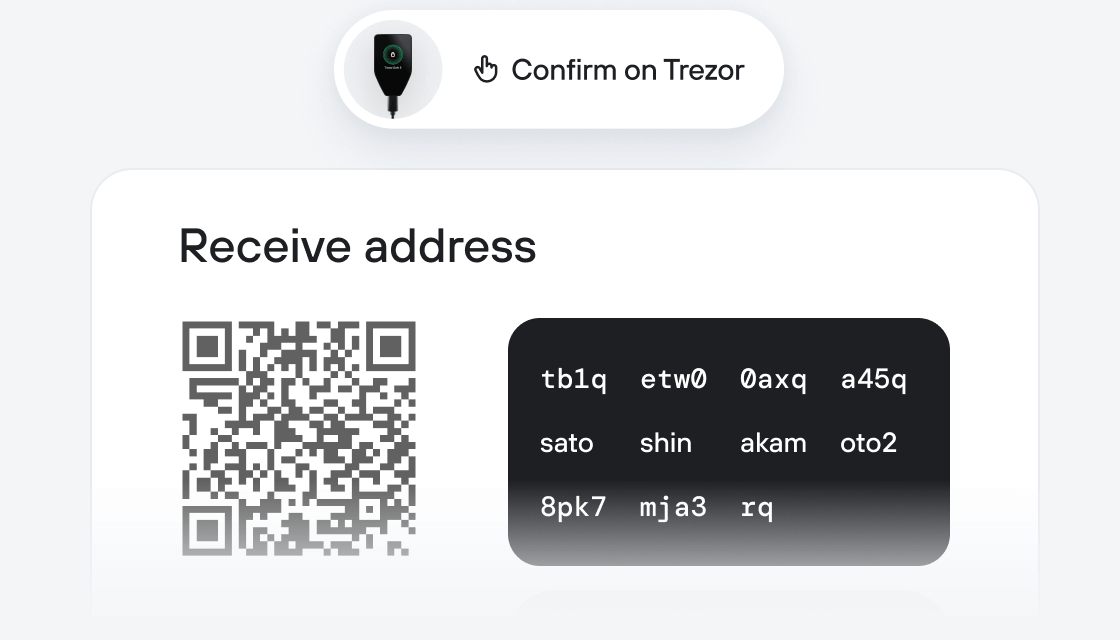

Send & receive your IPOR with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support IPOR

Sync your Trezor with wallet apps

Manage your IPOR with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported IPOR Networks

- Base

- Ethereum

- Arbitrum One

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

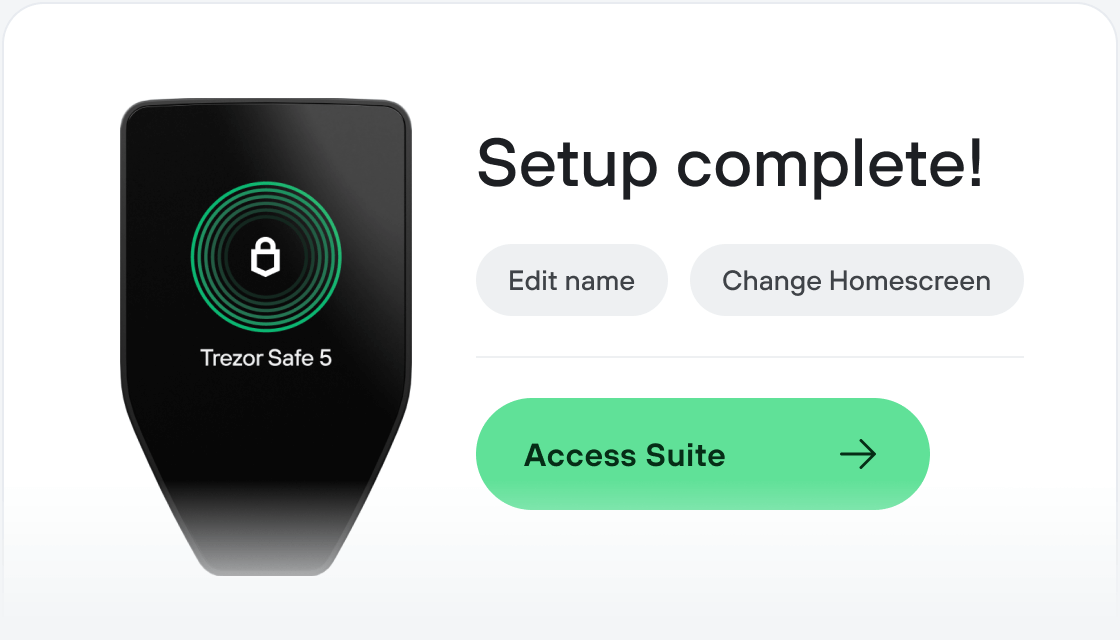

How to IPOR on Trezor

Connect your Trezor

Install Trezor Suite

Transfer your IPOR

Make the most of your IPOR

Trezor keeps your IPOR secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

IPOR, the Inter Protocol Over-block Rate, is the heartbeat of DeFi credit markets. It is the first attempt in DeFi to establish a yield curve representing the average cost of borrowing in DeFi with information published on-chain by the largest credit market protocols in DeFi - Aave and Compound.

The IPOR Protocol consists of two main parts:

- A benchmark interest rate for DeFi (“The Index”). Currently available for USDT, USDC, and DAI (ETH coming up). These are calculated and published on-chain are public goods in the Ethereum ecosystem.

- A suite of interest rate derivative DEXes (“The IRDs”) that quote rates for 28-day interest rate swaps for the above markets.

The IPOR Index Currently, there are three IPOR rates for USDC, USDT, and DAI which have essentially different rate behavior. An IPOR ETH rate is on the horizon. These are all currently spot rates, as there is really no yield curve in DeFi, and the lack of the yield curve presents the index with a huge market opportunity.

The IRDs The first instrument to reference the IPOR rates is a 4 week IRS. It takes the best of DeFi incorporating a liquidity pool and an AMM. The liquidity pool is a passive underwriter for like asset. The AMM prices the instruments based on a few different quant models broken down into something cheap enough to run on Ethereum. The taker is quoted a fixed rate, the floating rate is the IPOR (printed on chain via an oracle).

IPOR plans to mature into a fully community-driven DAO. IPOR Labs will transfer ownership into the IPOR DAO, and complete ownership and control of the IPOR Protocol will be in the IPOR token holders. IPOR labs will continue to participate and make proposals; however, the ultimate approval will be in a decentralized manner via the DAO.