Safe & secure Flux DAI wallet

Take control of your Flux DAI assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

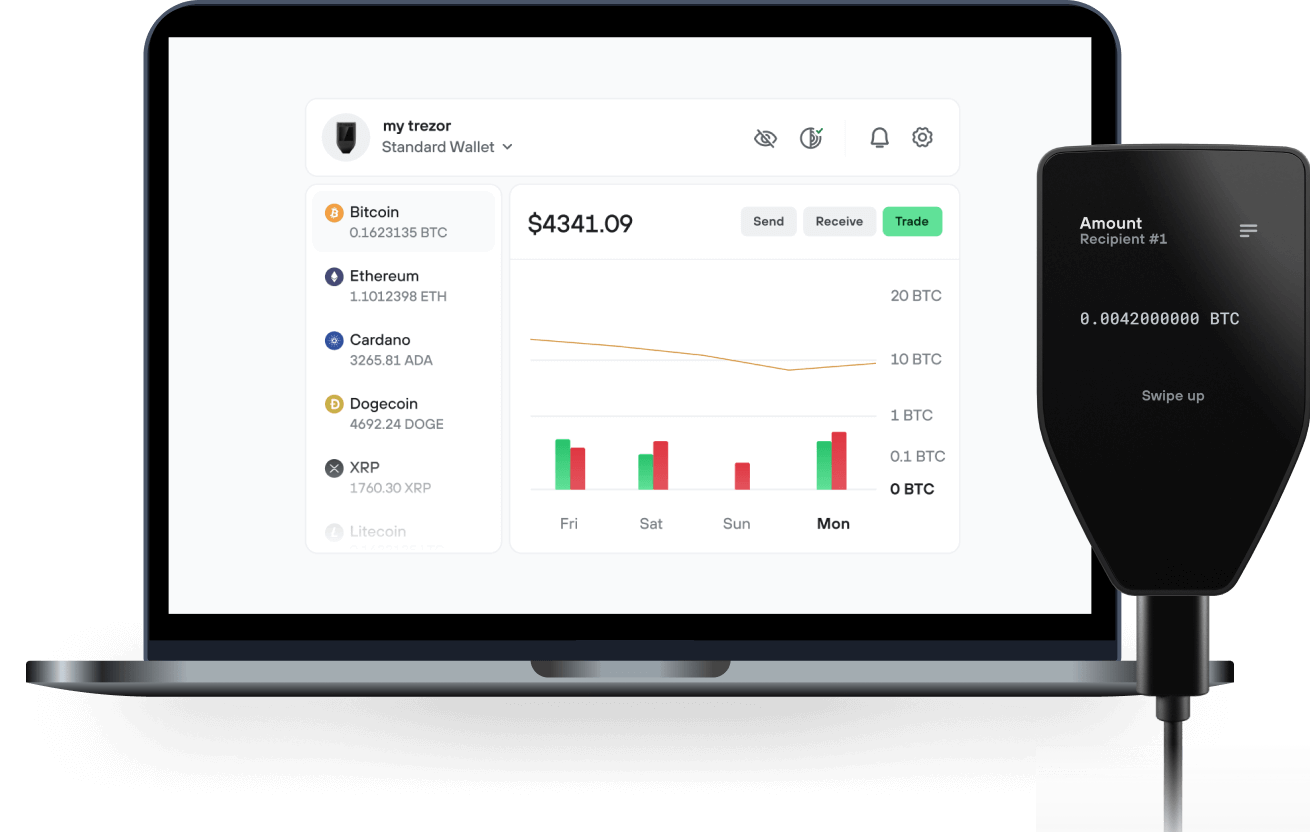

Send & receive your Flux DAI with the Trezor Suite app

Send & receive

Trezor hardware wallets that support Flux DAI

Sync your Trezor with wallet apps

Manage your Flux DAI with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Flux DAI Network

- Ethereum

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to FDAI on Trezor

Connect your Trezor

Open a third-party wallet app

Manage your assets

Make the most of your FDAI

Trezor keeps your FDAI secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

What is fDAI? Each asset supported by the Flux Finance Protocol is integrated through a fToken contract, which is a representation of balances supplied to the protocol. fTokens, such as fDAI, are a fork of Compound V2's cTokens, with additional functionality to support permissioned assets.

What Makes fDAI Unique? fDAI is minted when users deposit DAI on Flux Finance. By doing so, the user's DAI will become available to borrowers, and the user will earn the DAI supply rate. fDAI increases in value relative to the underlying DAI, meaning users can redeem more assets over time as interest is earned. The interest rate earned by lenders fluctuates and depends on the market's utilization (i.e. the percentage of deposited assets that have been borrowed).

History of fDAI In January 2023, Flux was announced as a decentralized lending protocol that can support permissionless cryptoassets alongside permissioned tokens. The protocol was initially developed by Ondo Finance, a software development firm in DeFi, before being sold to Flux Finance.

Flux is governed by the Ondo DAO, in which ONDO holders vote to upgrade its code and alter its risk parameters. In February 2023, the protocol was initialized and its supported assets and parameters were selected in a genesis vote. fDAI was among the first assets to be selected, alongside fUSDC and fOUSG. Markets for these assets opened shortly after.

What can fDAI be Used For? By minting fDAI, users earn interest and gain the ability to use fDAI as collateral. fDAI can be transferred to effect change in ownership. Transferring fDAI means transferring your balance of the underlying DAI inside the Flux Finance protocol. Transfers that would result in negative account liquidity for borrowers on Flux Finance will fail.

What’s Next for fDAI? As a permissionless yielding asset, fDAI can in turn be used as collateral at other lending protocols, and offers an alternative settlement option between parties.