Safe & secure Convex Finance wallet

Take control of your Convex Finance assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your Convex Finance with the Trezor Suite app

Send & receive

Buy & swap

Trezor hardware wallets that support Convex Finance

Sync your Trezor with wallet apps

Manage your Convex Finance with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Convex Finance Network

- Ethereum

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to CVX on Trezor

Connect your Trezor

Install Trezor Suite app

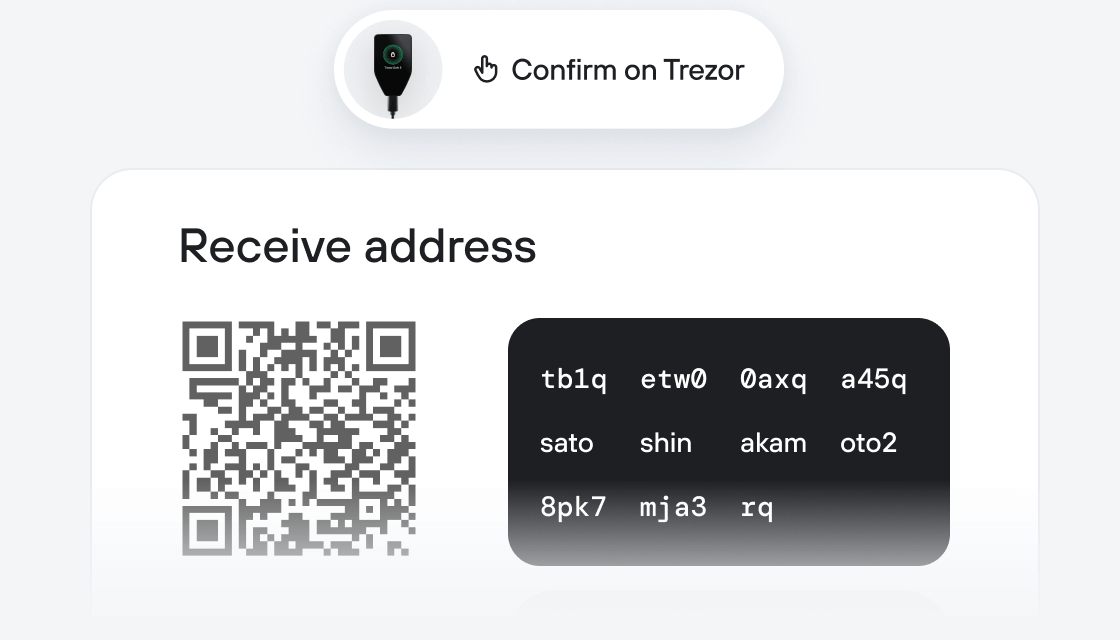

Transfer your CVX

Make the most of your CVX

Trezor keeps your CVX secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

Convex is a protocol that simplifies Curve boosting experience in order to maximize yields. Convex allows Curve liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort. If you would like to stake CRV, Convex lets users receive trading fees as well as a share of boosted CRV received by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers as well as better capital efficiency.

Curve liquidity providers can deposit their LP tokens into Convex to maximize their CRV earnings with a more efficient boost.

Curve DAO token stakers will be able to earn additional boosted CRV and CVX tokens through the protocol.