Safe & secure Bancor Network wallet

Take control of your Bancor Network assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

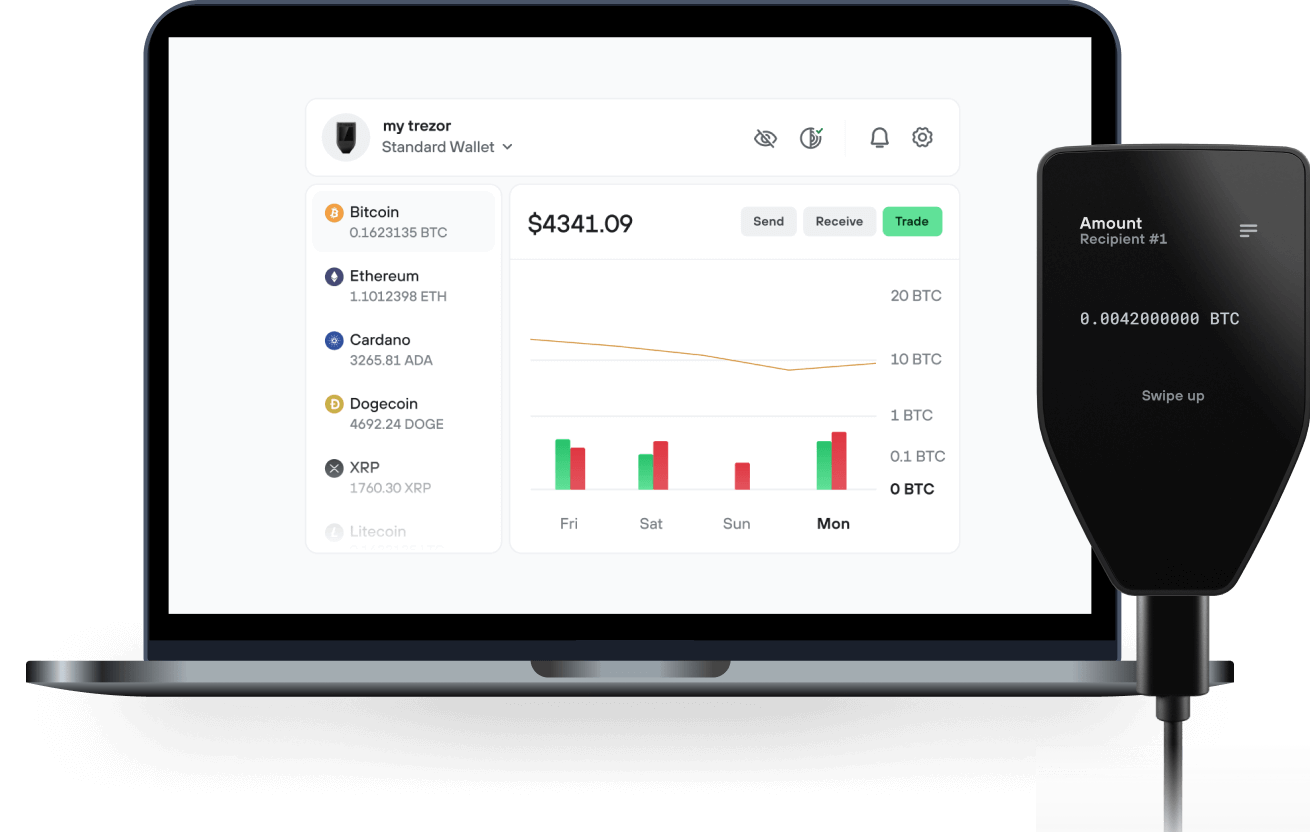

Send & receive your Bancor Network with the Trezor Suite app

Send & receive

Buy & swap

Trezor hardware wallets that support Bancor Network

Sync your Trezor with wallet apps

Manage your Bancor Network with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Bancor Network Networks

- Ethereum

- Energi

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to BNT on Trezor

Connect your Trezor

Install Trezor Suite

Transfer your BNT

Make the most of your BNT

Trezor keeps your BNT secure

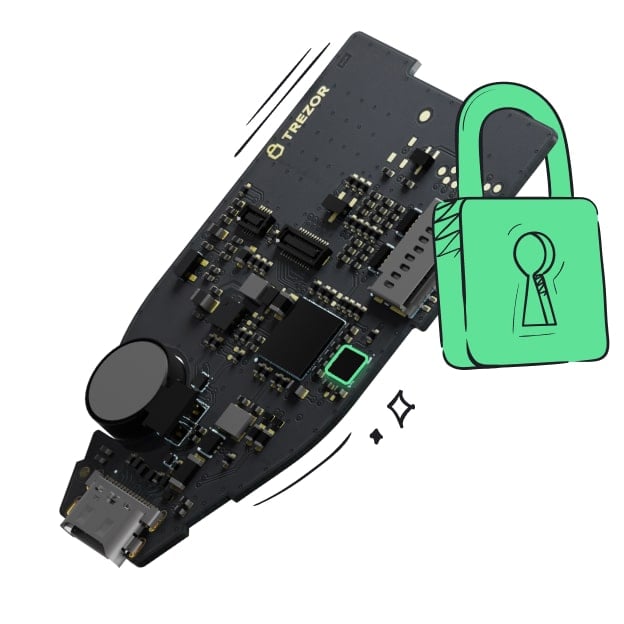

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

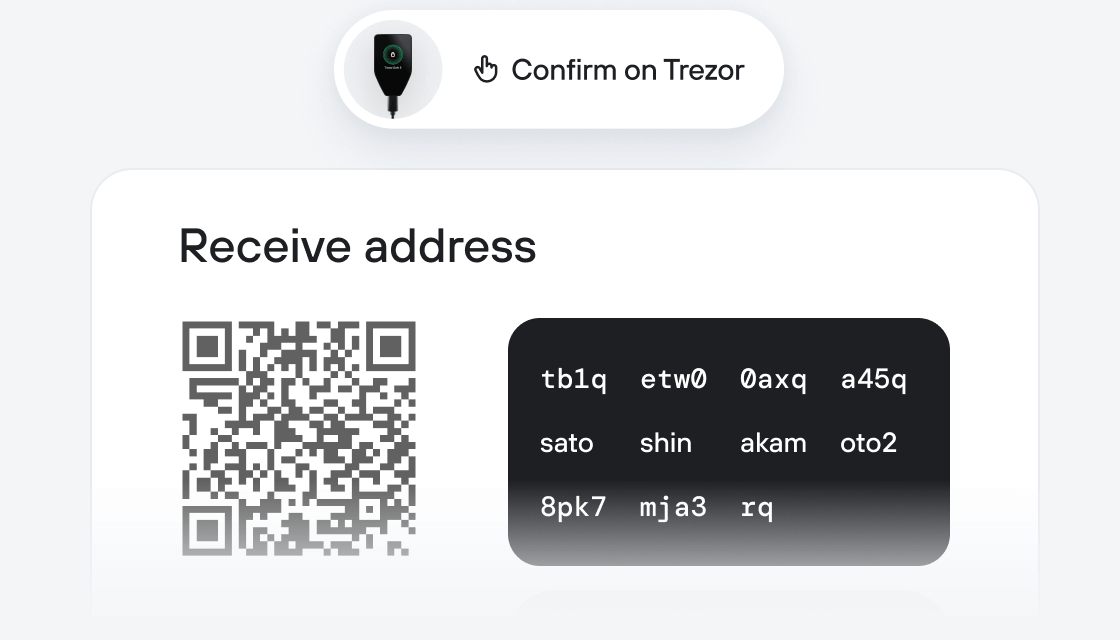

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

About Bancor? Bancor is an ecosystem of decentralized, open-source protocols that promote on-chain trading and liquidity.

Its main protocol, Carbon, is a decentralized trading protocol allowing users to perform automated trading strategies using custom on-chain limit orders and range orders, with the option of combining orders together to create automated buy low, sell high strategies.

Fast Lane, a separate open-source arbitrage protocol, allows any user to perform arbitrage between Bancor ecosystem protocols and external on-chain exchanges and redirect arbitrage profits back to the Bancor ecosystem.

All Bancor ecosystem protocols are governed by the BancorDAO via staked BNT.

What makes Bancor Unique? Bancor’s flagship protocol, Carbon, allows users to perform automated trading strategies on-chain with far greater control and efficiency compared to existing decentralized exchanges (DEXs).

Existing on-chain liquidity solutions suffer from key drawbacks, namely that: 1) executed orders can be reversed when prices move, and 2) a single liquidity position must execute both buys and sells using the same pricing curve. As a result, on-chain liquidity is costly and complex to automate and update, while exposing traders to MEV sandwich attacks.

Carbon introduces a new form of on-chain liquidity called Asymmetric Liquidity, which allows users to create individual liquidity positions with two distinct pricing curves: one for buying and one for selling. This gives users the ability to set buy and sell orders that execute in specific price ranges, with the option of combining orders together to create automated buy low, sell high strategies. By design, Carbon orders are irreversible on execution, easily adjustable directly on-chain, and completely resistant to MEV sandwich attacks. These capabilities give users an unprecedented level of control and automation to perform novel trading strategies on-chain.

For example, a user who believes ETH will trade in the near future between $1500-2000 could set a Carbon strategy that automatically buys ETH between $1500-1600 and sells the ETH from $1900-2000. As market prices move into selected ranges, orders are automatically executed by traders who interact with Carbon directly, or via popular DEX aggregators. All with no reliance on external oracles or keepers. Strategy updates can be made in a highly gas efficient manner, without needing to withdraw and re-add liquidity, via parameters in a strategy’s smart contract.

Carbon also improves on the trading model in centralized exchanges by allowing users to create multi-order strategies that utilize a single source of rotating liquidity to fill trades, eliminating the need to create multiple limit orders and pre-fund each order as it is created. By fusing the feature-rich trading functionality of centralized exchanges with the access and transparency of automated market-makers, Carbon unlocks the future of decentralized on-chain trading.

History of Bancor Bancor invented the first blockchain-based automated market maker (AMM) in 2017. The protocol’s first version was launched in June 2017, with subsequent protocol versions iterating on the original AMM model.

In 2020, the BancorDAO was launched to oversee and govern development of Bancor ecosystem protocols. The BancorDAO has since voted on over 450 governance proposals, and has had at the time writing over 9,700 governance token holders, and over 1,100 voters.

What’s Next for Bancor Per the BancorDAO, the Bancor community is focused on development of its flagship protocols, Carbon and Fast Lane. The beta version of Fast Lane is currently live on Ethereum mainnet, and will continue evolving, while the beta version of Carbon is expected to go live on Ethereum mainnet in the second quarter of 2023, pending voting by the BancorDAO. From there, deployment of both Carbon and Fast Lane on other Layer-1 and Layer-2 blockchains will be explored.

The Bancor community will continue executing on its mission to build innovative solutions that expand the design space for on-chain trading and liquidity and open the doors to a wide range of future DeFi applications and products.

What Can Bancor (BNT) Be Used For The Bancor Network Token (BNT) can currently be staked for vBNT to vote in BancorDAO governance, with additional BNT utility controlled by the BancorDAO.

Relevant Sources: Bancor Github Carbon Website Introducing Carbon Blog Post Fast Lane Carbon Whitepaper Carbon Litepaper