Safe & secure Apollo Diversified Credit Securitize Fund wallet

Take control of your Apollo Diversified Credit Securitize Fund assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

Send & receive your Apollo Diversified Credit Securitize Fund with the Trezor Suite app

Send & receive

Swap

Trezor hardware wallets that support Apollo Diversified Credit Securitize Fund

Sync your Trezor with wallet apps

Manage your Apollo Diversified Credit Securitize Fund with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Backpack

Rabby

NuFi

Supported Apollo Diversified Credit Securitize Fund Networks

- Polygon POS

- Ethereum

- Avalanche

- Solana

- Ink

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to ACRED on Trezor

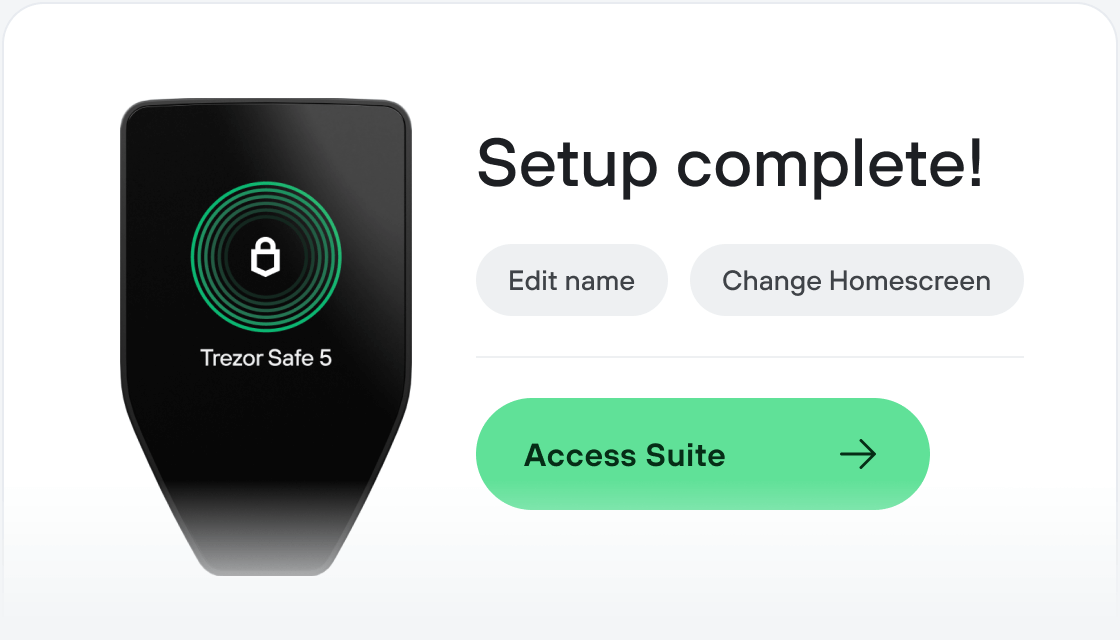

Connect your Trezor

Install Trezor Suite

Transfer your ACRED

Make the most of your ACRED

Trezor keeps your ACRED secure

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

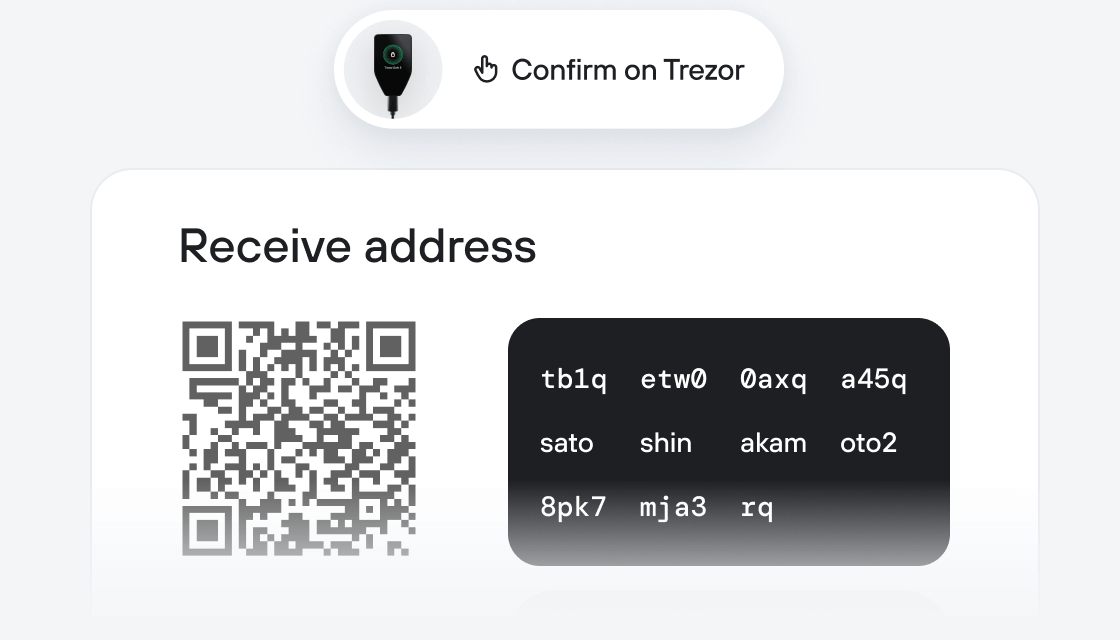

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

This feeder fund invests in the Apollo Diversified Credit Fund ("Underlying Fund") which seeks to generate a return comprised of both current income and capital appreciation, emphasizing current income with low volatility and low correlation to the broader markets.

✓ Seasoned Asset Manager: Apollo draws on 30+ years of experience, aiming to achieve attractive returns across the risk spectrum through proprietary origination, credit strategies, and a flexible approach to borrower needs.(1)

✓ Historical Track Record of Outperformance: A diversified, global credit strategy with potential for enhanced income and attractive risk-adjusted returns across various market cycles.

✓ 0% Performance Fee

✓ $0 Redemptions

✓ Pricing Transparency: Daily pricing transparency and daily liquidity.(2)

The Underlying Fund takes a multi-asset private and public credit approach centered around five key pillars:

✓ Corporate Direct Lending: Targets large scale corporate originations and sponsor-backed issuers of first lien, senior secured and unitranche loans, utilizing Apollo’s proprietary sourcing channel.

✓ Asset-Backed Lending: Focuses on agile deployment of capital into origination and proprietary sourcing channels across a broad mandate of asset-backed investments, with a focus on investments collateralized by tangible investments.

✓ Performing Credit: Primarily pursues liquid, performing senior secured corporate credits to generate total return.

✓ Dislocated Credit: Seeks to use contingent capital to tactically pursue “dislocated” credit opportunities such as stressed, performing assets that sell-off due to technical and/or non-fundamental reasons.

✓ Structured Credit: Focuses on structured credit opportunities across diverse asset types, vintages, maturities, jurisdictions, and capital structure priorities (for example, CLOs, residential, and commercial mortgage backed securities among others).9

(1) Diversification does not ensure profit or protect against loss. (2) Investment performance is not guaranteed and is subject to market risks.