Safe & secure Compound wallet

Take control of your Compound assets with complete confidence in the Trezor ecosystem.

- Secured by your hardware wallet

- Use with compatible hot wallets

- Trusted by over 2 million customers

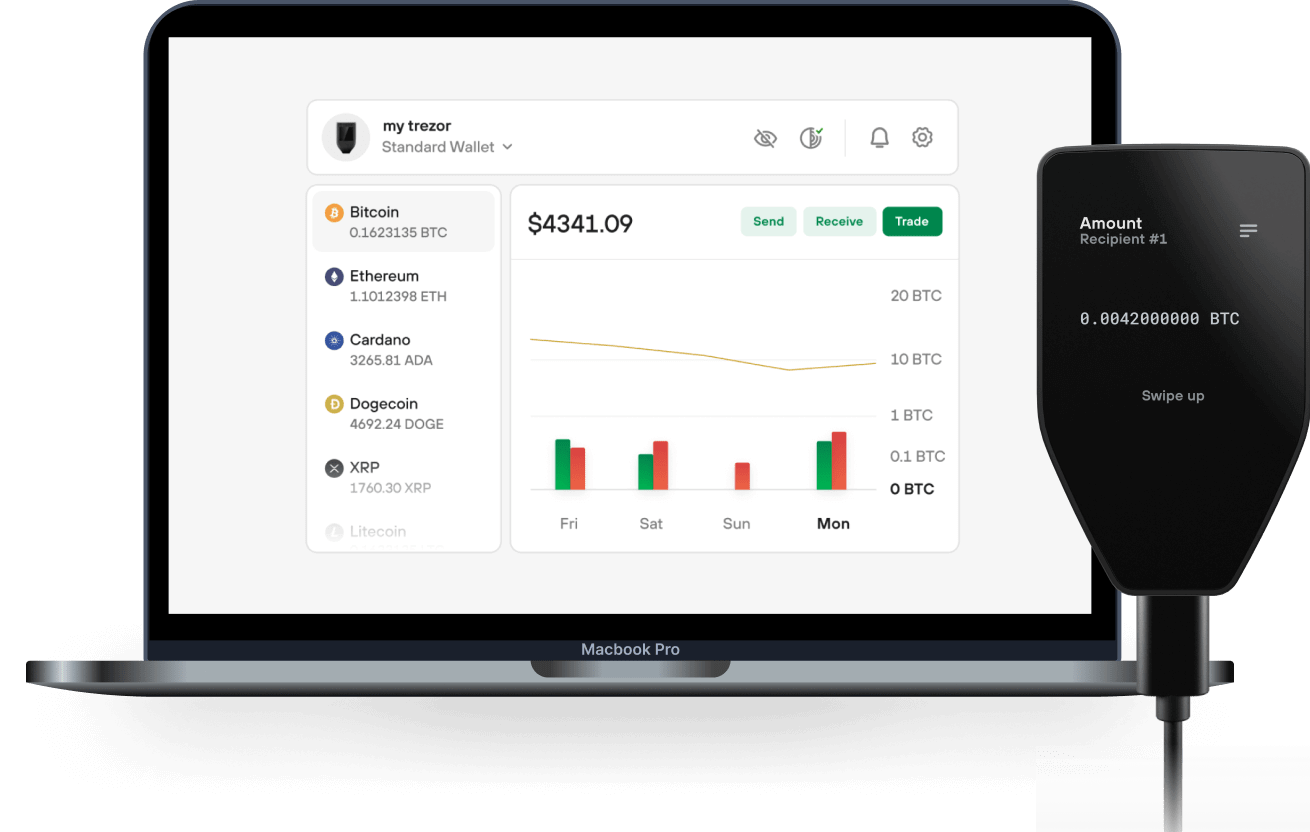

Buy, sell & manage your Compound with the Trezor Suite app

Send & receive

Buy, sell & swap

Trezor hardware wallets that support Compound

Sync your Trezor with wallet apps

Manage your Compound with your Trezor hardware wallet synced with several wallet apps.

Trezor Suite

MetaMask

Rabby

Supported Compound Networks

- Polygon POS

- Base

- Ethereum

- Harmony Shard 0

- Arbitrum One

- Avalanche

- Energi

- BNB Smart Chain

Why a hardware wallet?

Go offline with Trezor

- You own 100% of your coins

- Your wallet is 100% safe offline

- Your data is 100% anonymous

- Your coins aren’t tied to any company

Online exchanges

- If an exchange fails, you lose your coins

- Exchanges are targets for hackers

- Your personal data may be exposed

- You don’t truly own your coins

How to COMP on Trezor

Connect your Trezor

Install Trezor Suite

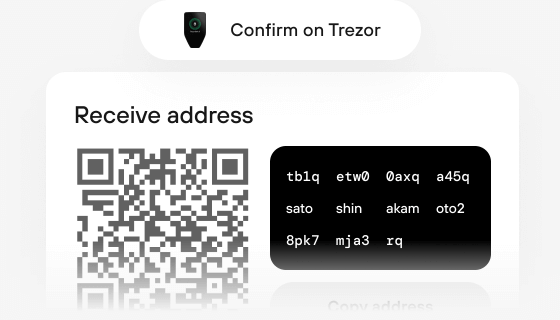

Transfer your COMP

Make the most of your COMP

Trezor keeps your COMP secure

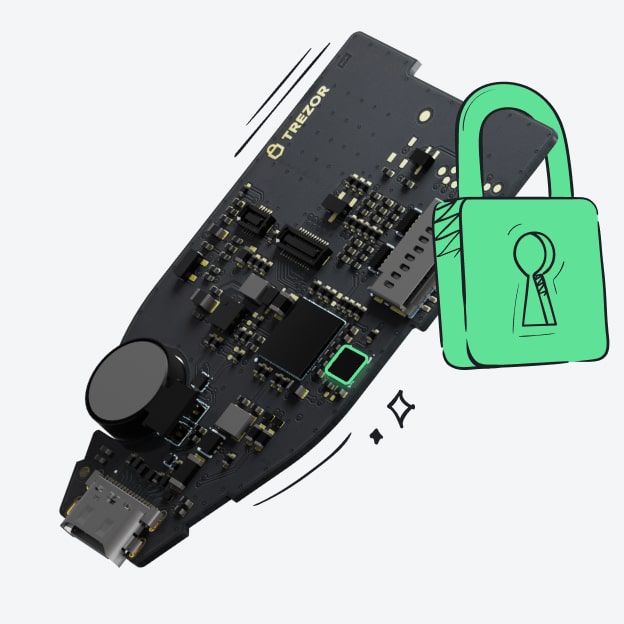

Protected by Secure Element

Protected by Secure ElementThe best defense against both online and offline threats

Your tokens, your control

Your tokens, your controlAbsolute control of every transaction with on-device confirmation

Security starts with open-source

Security starts with open-sourceTransparent wallet design makes your Trezor better and safer

Clear & simple wallet backup

Clear & simple wallet backupRecover access to your digital assets with a new backup standard

Confidence from day one

Confidence from day onePackaging & device security seals protect your Trezor’s integrity

The Compound Governance Token is a governance token on the Compound Finance lending protocol, COMP allows the owner to delegate voting rights to the address of their choice; the owner’s wallet, another user, an application, or a DeFi expert. Anybody can participate in Compound governance by receiving delegation, without needing to own COMP.

Anybody with 1% of COMP delegated to their address can propose a governance action; these are simple or complex sets of actions, such as adding support for a new asset, changing an asset’s collateral factor, changing a market’s interest rate model, or changing any other parameter or variable of the protocol that the current administrator can modify.