Sichere & geschützte VanEck Treasury Fund Wallet

Übernimm die Kontrolle über deine VanEck Treasury Fund Assets mit vollem Vertrauen in das Trezor Ökosystem.

- Gesichert durch deine Hardware-Wallet

- Nutze ihn mit kompatiblen Hot-Wallets

- Über 2 Millionen Kunden vertrauen uns

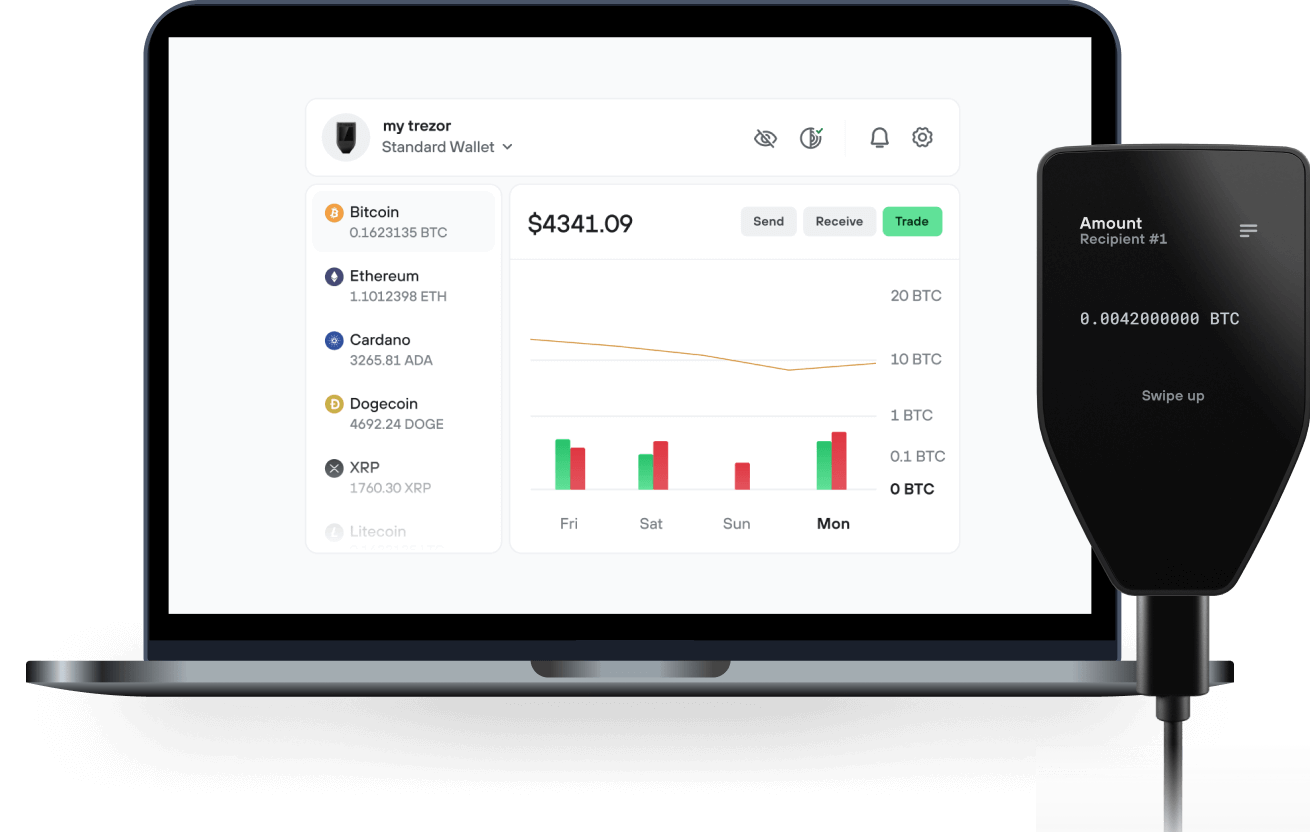

Sende & empfange deinen VanEck Treasury Fund mit der Trezor Suite App

Sende & empfange

Tauschen

Trezor Hardware-Wallet, die VanEck Treasury Fund unterstützen

Synchronisiere Trezor mit Wallet-Apps

Verwalte deine VanEck Treasury Fund mit deiner Trezor Hardware-Wallet, die mit mehreren Wallet-Apps synchronisiert ist.

Trezor Suite

MetaMask

Backpack

Rabby

NuFi

Unterstütztes VanEck Treasury Fund Netzwerk

- Ethereum

- Avalanche

- BNB Smart Chain

- Solana

Warum eine Hardware-Wallet?

Gehe offline mit Trezor

- Du besitzt 100 % deiner Coins

- Deine Wallet ist offline zu 100 % sicher

- Deine Daten sind zu 100 % anonym

- Deine Coins sind an keine Firma gebunden

Online-Börsen

- Wenn ein Umtausch fehlschlägt, verlierst du deine Coins

- Börsen sind Ziele von Hackern

- Deine persönlichen Daten könnten offengelegt werden

- Du besitzt deine Coins nicht wirklich

Wie man VBILL auf Trezor

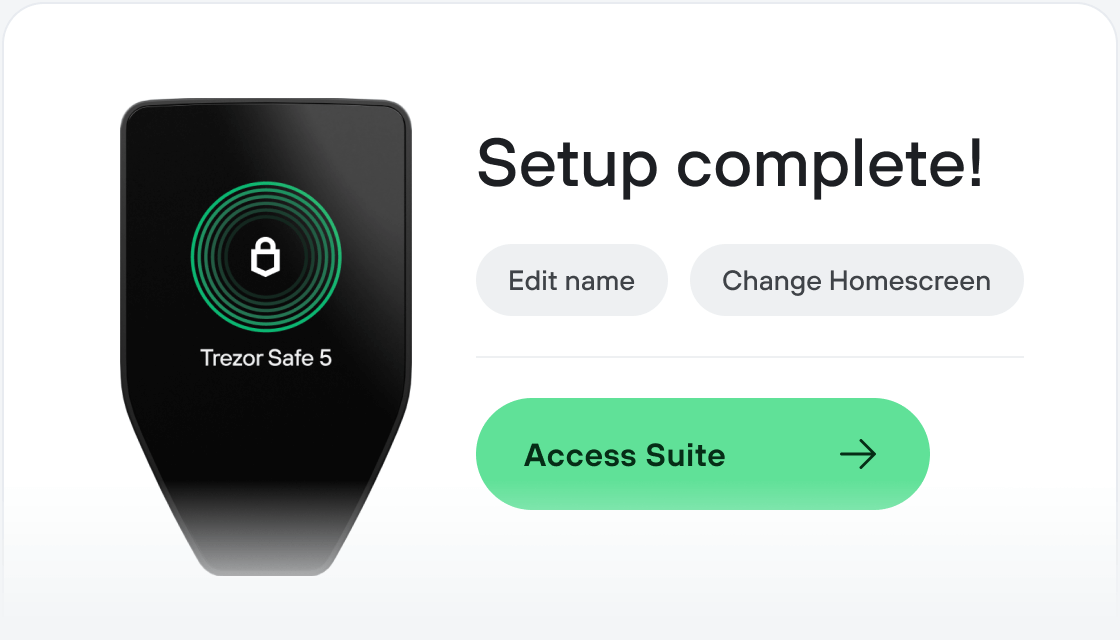

Verbinde deinen Trezor

Installiere Trezor Suite App

Übertrage deinen VBILL

Mache das Beste aus deinen VBILL

Trezor hält dein VBILL sicher

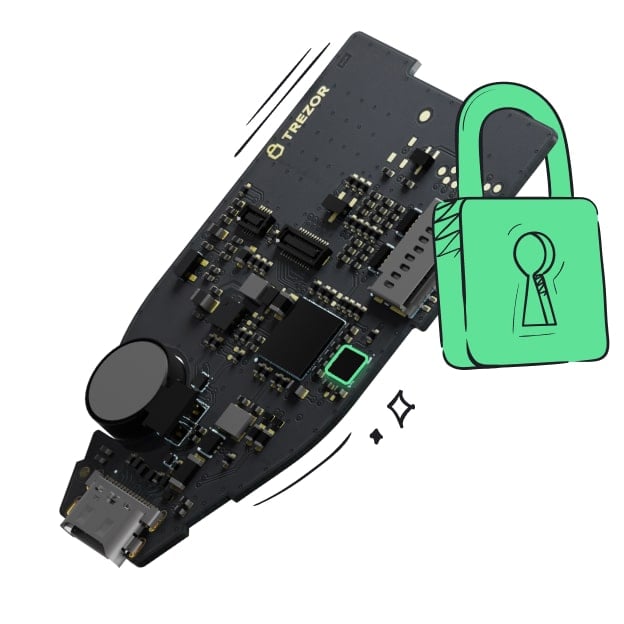

Geschützt durch Secure Element

Geschützt durch Secure ElementDie beste Verteidigung gegen beides, online und offline Bedrohungen

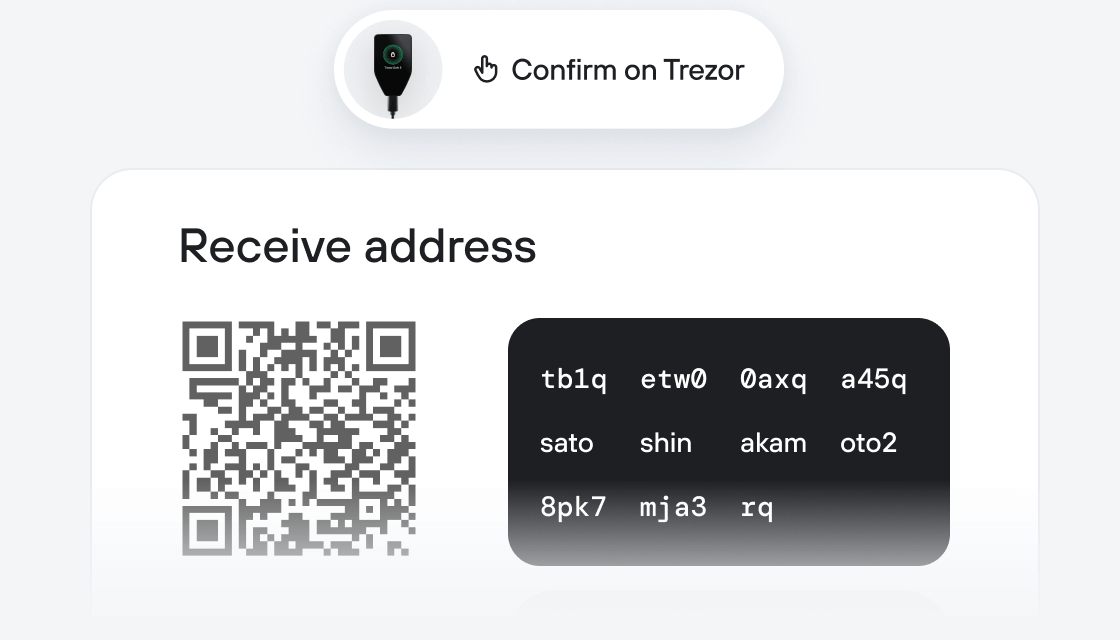

Deine Token, deine Kontrolle

Deine Token, deine KontrolleAbsolute Kontrolle über jede Transaktion mit Bestätigung auf dem Gerät

Sicherheit beginnt mit Open-Source

Sicherheit beginnt mit Open-SourceDas transparente Wallet-Design macht deinen Trezor besser und sicherer

Übersichtliches & einfaches Wallet-Backup

Übersichtliches & einfaches Wallet-BackupStelle deinen Zugriff auf deine digitalen Assets wieder her mit einem neuen Backup-Standard

Vertrauen vom ersten Tag an

Vertrauen vom ersten Tag anVerpackungs- & Gerätesicherheitssiegel schützen die Integrität deines Trezors

This Fund seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each day. The Fund primarily invests its total assets in cash, U.S. Treasury bills, and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain.

The Fund pursues its investment objective by investing only in cash, U.S. Treasury obligations, which include securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government (“U.S. Treasury Obligations”), and repurchase agreements collateralized by U.S. Treasury Obligations and cash. The Fund will invest in securities with maturities of (or deemed maturities of) 397 days or less and will maintain a dollar-weighted average portfolio maturity of 60 days or less and a dollar-weighted average portfolio life of 120 days or less.

The Fund may also invest in one or more other pooled investment vehicles managed by third-party investment managers or the Investment Manager or an affiliate thereof that invest in the same types of securities in which the Fund may invest directly (“Underlying Funds”). Underlying Funds may include investment companies registered under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”).

The Fund may also invest in or otherwise hold one or more stablecoins and similar yield-bearing digital asset instruments, including in connection with investors that subscribe for Shares (as defined below) in-kind with stablecoins and such instruments instead of U.S. dollars, including subscriptions executed through Atomic Swaps (as defined below), and in connection with processing redemption transactions.

For the purposes of satisfying the Fund’s investment strategy of investing only in cash, U.S. Treasury Obligations and repurchase agreements collateralized by U.S. Treasury Obligations and cash, investments in Underlying Funds, stablecoins and similar yieldbearing digital asset instruments will be considered as if they are invested in cash and such securities.

For the purposes of this Memorandum, the Fund’s investments are collectively referred to as “Investments”. While the Fund intends to invest in the manner described above, the Fund will also remain opportunistic and may pursue other investment opportunities.

There can be no assurance that the Fund will achieve its investment objective; you could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per Share, it cannot guarantee it will do so. An investment in the Fund is not a bank account or a deposit of a bank and is not insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency. You should not expect that the Investment Manager or its affiliates will provide financial support to the Fund at any time, including during periods of market stress.