Portefeuille sûr et sécurisé Chainlink

Prenez le contrôle de vos Chainlink actifs en toute confiance dans l’écosystème Trezor.

- Sécurisé par votre portefeuille matériel

- Utiliser avec des hot wallets compatibles

- Adopté par plus de 2 millions de clients

Achetez, vendez et gérez vos Chainlink avec l'application Trezor Suite

Envoyer et recevoir

Achetez, vendez et échangez

Portefeuilles matériels Trezor qui supportent Chainlink

Synchronisez votre Trezor avec des applications de portefeuille

Gérez vos Chainlink avec votre portefeuille matériel Trezor synchronisé avec plusieurs applications de portefeuilles.

Trezor Suite

MetaMask

Backpack

Rabby

NuFi

Chainlink Réseaux supportés

- Polygon POS

- Base

- Cronos

- Ethereum

- Fantom

- Harmony Shard 0

- Arbitrum One

- Avalanche

- Metis Andromeda

- Optimism

- Gnosis Chain

- Energi

- BNB Smart Chain

- Huobi ECO Chain Mainnet

- Kaia

- Blast

- Polygon zkEVM

- Astar

- Moonbeam

- Merlin Chain

- ZkSync

- Scroll

- Moonriver

- Fraxtal

- Wemix Network

- Linea

- Mantle

- Mode

- Milkomeda (Cardano)

- OpBNB

- X Layer

- Rootstock RSK

- Core

- Sei Network

- XDC Network

- Solana

- Kroma

- Zircuit

- Etherlink

- Berachain

- Ronin

- Cronos zkEVM

- World Chain

- Monad

- ApeChain

- Sonic

- Ink

- Abstract

- Soneium

- Unichain

- HyperEVM

- Corn

- Superseed

- Lens

- Plume Network

- Hemi

- Katana

- Bitlayer

- Botanix

- TAC

- HashKey Chain

- Plasma

- Henesys

- Bittensor EVM

Pourquoi un portefeuille matériel ?

Allez hors ligne avec Trezor

- Vous possédez 100% de vos cryptos

- Votre portefeuille est 100% sécurisé hors ligne

- Vos données sont 100 % anonymes

- Vos cryptos ne dépendent d’aucune entreprise

Échanges en ligne

- Si un échange échoue, vous perdez vos cryptos

- Les échanges sont des cibles pour les pirates

- Vos données personnelles peuvent être exposées

- Vous ne possédez pas réellement vos cryptos

Comment utiliser LINK sur Trezor

Connectez votre Trezor

Installez l'application Trezor Suite

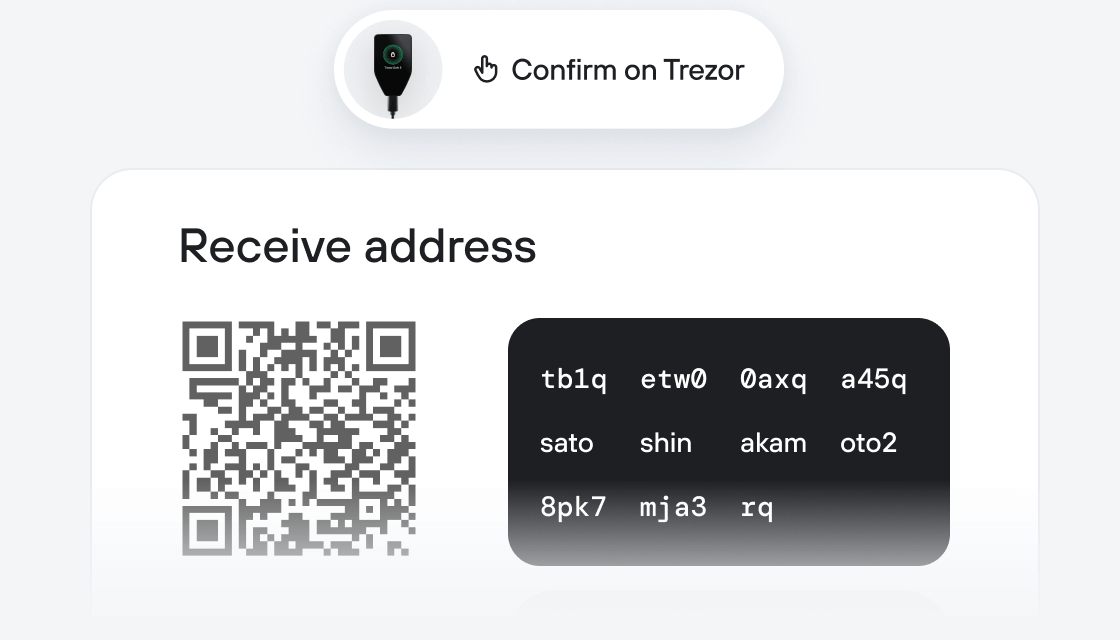

Transférez votre LINK

Profitez pleinement de votre LINK

Trezor garde vos LINK en sécurité

Protégé par Élément Sécurisé

Protégé par Élément SécuriséLa meilleure défense contre les menaces en ligne et hors ligne

Vos jetons, votre contrôle

Vos jetons, votre contrôleContrôle absolu de chaque transaction avec confirmation sur l'appareil

La sécurité commence par l'open source

La sécurité commence par l'open sourceLe design de portefeuille transparent rend votre Trezor meilleur et plus sûr

Sauvegarde de portefeuille claire et simple

Sauvegarde de portefeuille claire et simpleRécupérez l’accès à vos actifs digitaux avec un nouveau standard de sauvegarde

Confiance depuis le premier jour

Confiance depuis le premier jourLes sceaux de sécurité sur l’emballage et l’appareil protègent l’intégrité de votre Trezor

Chainlink est le réseau d’oracles décentralisé de référence de l’industrie, qui résout le « problème de l’oracle » en connectant les smart contracts aux données du monde réel. Les blockchains ne peuvent pas accéder seules aux informations externes ; Chainlink agit donc comme un pont sécurisé, permettant aux smart contracts de réagir à des événements réels à l’aide de données vérifiées et infalsifiables. Il est largement considéré comme l’un des premiers réseaux d’oracles décentralisés et comme le leader du marché pour l’intégration de données off-chain on-chain.

La plateforme fonctionne grâce à un réseau décentralisé de nodes qui collectent, valident et transmettent des données aux smart contracts. Lorsqu’un contrat demande une information, comme le prix d’une action, un comité de nodes indépendants récupère et agrège les données afin d’atteindre un consensus, puis fournit une réponse unique et fiable. Chainlink propose une suite de services comprenant notamment Data Feeds pour les prix des actifs, CCIP pour les transferts de jetons et la messagerie cross-chain, Automation pour déclencher des fonctions de smart contracts, et Proof of Reserve pour vérifier la collatéralisation des actifs.

Chainlink s’est imposé comme une infrastructure critique pour la DeFi comme pour l’adoption institutionnelle, avec des partenariats incluant Swift, Euroclear, Mastercard, UBS, ANZ, Fidelity International et J.P. Morgan. Ses produits institutionnels comprennent le Chainlink Runtime Environment pour les flux de travail d’actifs tokenisés, Confidential Compute pour le calcul préservant la confidentialité, et l’Automated Compliance Engine pour intégrer des règles réglementaires directement dans les smart contracts.

Le jeton LINK est l’actif natif utilisé pour rémunérer les opérateurs de nodes pour leurs services, alimenter les comptes d’abonnement et inciter à la sécurité du réseau via le staking. Les opérateurs de nodes mettent des LINK en staking comme collatéral, lesquels peuvent être slashed s’ils fournissent des données inexactes. Chainlink a été cofondé en 2017 par Sergey Nazarov et Steve Ellis, qui ont coécrit le livre blanc avec Ari Juels, et a levé 32 millions de dollars lors de son ICO en septembre 2017.