Billetera Yieldflow segura y protegida

Toma el control de tus Yieldflow activos con total confianza en el ecosistema de Trezor.

- Protegido por tu billetera física

- Usa con billeteras digitales compatibles

- Con la confianza de más de 2 millones de clientes

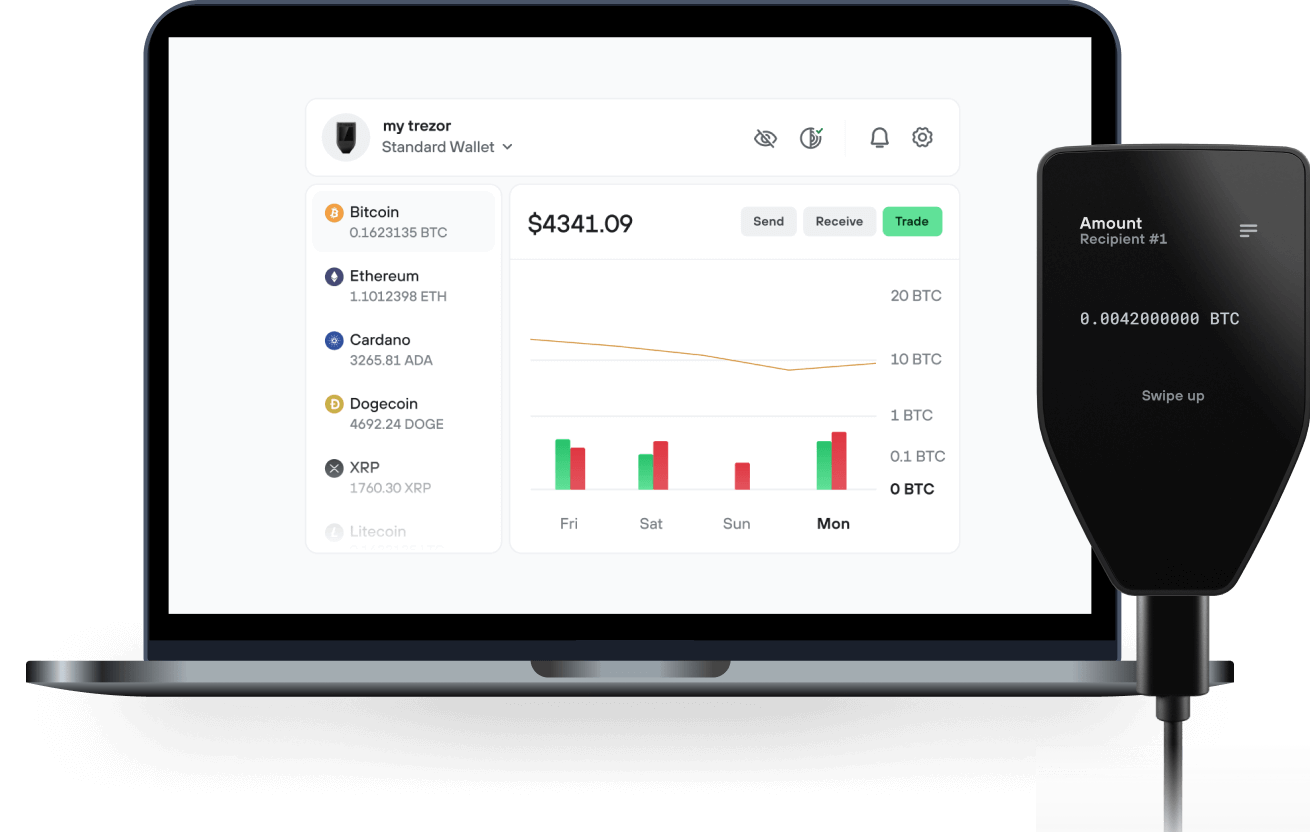

Envía y recibe tu Yieldflow con la app Trezor Suite

Enviar y recibir

Billeteras físicas Trezor compatibles con Yieldflow

Sincroniza tu Trezor con apps de billeteras

Gestiona tus Yieldflow con tu billetera física Trezor sincronizada con apps de billeteras.

Trezor Suite

MetaMask

Rabby

Red Yieldflow Compatible

- Arbitrum One

¿Por qué una billetera física?

Desconéctate con Trezor

- Tus monedas son 100% tuyas

- Tu billetera está 100% segura offline

- Tus datos son 100% anónimos

- Tus monedas no están atadas a una compañía

Exchanges en línea

- Si un exchange falla, pierdes tus monedas

- Los exchanges son blanco de los hackers

- Tu información personal puede ser expuesta

- Tus monedas no son realmente tuyas

¿Cómo usar YFLOW en Trezor?

Conecta tu Trezor

Abre una app de billetera de terceros

Gestiona tus activos

Aprovecha al máximo tus YFLOW

Trezor mantiene tus YFLOW seguros

Protegido por Elemento Seguro

Protegido por Elemento SeguroLa mejor defensa contra amenazas tanto online como offline

Tus tokens, bajo tu control

Tus tokens, bajo tu controlControl absoluto de cada transacción con confirmación directa en el dispositivo

La seguridad empieza por código abierto

La seguridad empieza por código abiertoUn diseño de billetera de forma transparente hace que tu Trezor sea más seguro y confiable

Copia de seguridad de billetera clara y sencilla

Copia de seguridad de billetera clara y sencillaRecupera el acceso a tus activos digitales con nuevo estándar de copia de seguridad

Confianza desde el primer día

Confianza desde el primer díaEl embalaje y los sellos de seguridad del dispositivo protegen la integridad de tu Trezor

YieldFlow is a decentralized finance (DeFi) protocol that enables users to earn yields on their digital assets through multiple yield-generating strategies including staking, lending, and liquidity provision. The platform operates as a multi-chain ecosystem, primarily on Ethereum mainnet and Arbitrum One while supporting additional networks such as Fantom, Polygon, and Avalanche.

The protocol offers several core products designed to maximize returns on digital assets. The staking functionality allows users to lock various cryptocurrencies including Polygon (MATIC), Fantom (FTM), Aave (AAVE), The Sandbox (SAND), and the platform's native YFlow token to earn rewards while contributing to network security. The lending module facilitates cryptocurrency lending through integration with established protocols like Aave, specifically offering USDT and SNX lending products that generate interest for lenders. YieldFlow's liquidity pool infrastructure enables users to provide liquidity to decentralized exchanges and earn trading fees. The platform supports both traditional liquidity pools and advanced Uniswap V3 positions, with automated management features that optimize yield generation. LP token staking extends earning opportunities by allowing users to stake their liquidity provider tokens for additional YFlow token rewards across various lockup periods.

The platform introduces an innovative on-chain GridBot trading system that automates trading strategies for users, combining DeFi yield farming with algorithmic trading capabilities. Additionally, YieldFlow operates two NFT collections - YArt and YTrade - that integrate with the broader ecosystem to provide utility and additional earning mechanisms.

Central to the protocol's governance structure is the YFlow utility token, which serves multiple functions within the ecosystem. Token holders participate in decentralized governance through a battle-tested system forked from the Compound Protocol, utilizing Governor Alpha and TimeLock smart contracts to ensure community-driven decision making. YFlow staking offers three distinct lockup periods (6, 12, and 36 months) with varying reward rates, incentivizing long-term participation and platform stability.

The protocol emphasizes security through its decentralized architecture, ensuring users maintain custody of their assets at all times. Smart contracts handle all automated processes without third-party intervention, and the platform undergoes regular security audits by industry experts. The governance system removes traditional "admin keys" by transferring ownership to community-controlled timelock contracts, enhancing decentralization and security.

YieldFlow's fee structure benefits stakeholders through a tiered system where YFlow token holders receive fee reductions and additional yield benefits. An affiliate program incentivizes ecosystem growth while maintaining the platform's decentralized ethos. The protocol currently manages over $3 million in total value locked (TVL) across more than 20 supported assets.

Through its comprehensive suite of yield-generating products, robust governance framework, and commitment to decentralization, YieldFlow positions itself as a complete DeFi solution for users seeking to optimize returns on their digital asset holdings while maintaining security and anonymity in the decentralized financial ecosystem.