Billetera VanEck Treasury Fund segura y protegida

Toma el control de tus VanEck Treasury Fund activos con total confianza en el ecosistema de Trezor.

- Protegido por tu billetera física

- Usa con billeteras digitales compatibles

- Con la confianza de más de 2 millones de clientes

Envía y recibe tu VanEck Treasury Fund con la app Trezor Suite

Enviar y recibir

Intercambiar

Billeteras físicas Trezor compatibles con VanEck Treasury Fund

Sincroniza tu Trezor con apps de billeteras

Gestiona tus VanEck Treasury Fund con tu billetera física Trezor sincronizada con apps de billeteras.

Trezor Suite

MetaMask

Backpack

Rabby

NuFi

Redes VanEck Treasury Fund Compatibles

- Ethereum

- Avalanche

- BNB Smart Chain

- Solana

¿Por qué una billetera física?

Desconéctate con Trezor

- Tus monedas son 100% tuyas

- Tu billetera está 100% segura offline

- Tus datos son 100% anónimos

- Tus monedas no están atadas a una compañía

Exchanges en línea

- Si un exchange falla, pierdes tus monedas

- Los exchanges son blanco de los hackers

- Tu información personal puede ser expuesta

- Tus monedas no son realmente tuyas

¿Cómo usar VBILL en Trezor?

Conecta tu Trezor

Instala la app Trezor Suite

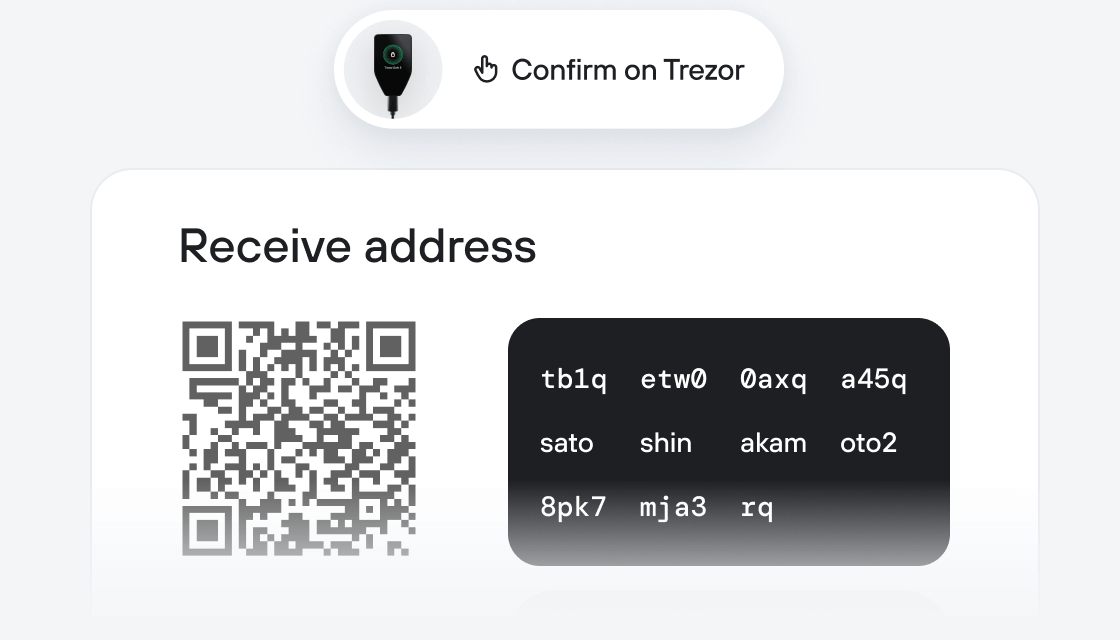

Transfiere tus VBILL

Aprovecha al máximo tus VBILL

Trezor mantiene tus VBILL seguros

Protegido por Elemento Seguro

Protegido por Elemento SeguroLa mejor defensa contra amenazas tanto online como offline

Tus tokens, bajo tu control

Tus tokens, bajo tu controlControl absoluto de cada transacción con confirmación directa en el dispositivo

La seguridad empieza por código abierto

La seguridad empieza por código abiertoUn diseño de billetera de forma transparente hace que tu Trezor sea más seguro y confiable

Copia de seguridad de billetera clara y sencilla

Copia de seguridad de billetera clara y sencillaRecupera el acceso a tus activos digitales con nuevo estándar de copia de seguridad

Confianza desde el primer día

Confianza desde el primer díaEl embalaje y los sellos de seguridad del dispositivo protegen la integridad de tu Trezor

This Fund seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each day. The Fund primarily invests its total assets in cash, U.S. Treasury bills, and repurchase agreements, allowing investors to earn yield while holding the token on the blockchain.

The Fund pursues its investment objective by investing only in cash, U.S. Treasury obligations, which include securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government (“U.S. Treasury Obligations”), and repurchase agreements collateralized by U.S. Treasury Obligations and cash. The Fund will invest in securities with maturities of (or deemed maturities of) 397 days or less and will maintain a dollar-weighted average portfolio maturity of 60 days or less and a dollar-weighted average portfolio life of 120 days or less.

The Fund may also invest in one or more other pooled investment vehicles managed by third-party investment managers or the Investment Manager or an affiliate thereof that invest in the same types of securities in which the Fund may invest directly (“Underlying Funds”). Underlying Funds may include investment companies registered under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”).

The Fund may also invest in or otherwise hold one or more stablecoins and similar yield-bearing digital asset instruments, including in connection with investors that subscribe for Shares (as defined below) in-kind with stablecoins and such instruments instead of U.S. dollars, including subscriptions executed through Atomic Swaps (as defined below), and in connection with processing redemption transactions.

For the purposes of satisfying the Fund’s investment strategy of investing only in cash, U.S. Treasury Obligations and repurchase agreements collateralized by U.S. Treasury Obligations and cash, investments in Underlying Funds, stablecoins and similar yieldbearing digital asset instruments will be considered as if they are invested in cash and such securities.

For the purposes of this Memorandum, the Fund’s investments are collectively referred to as “Investments”. While the Fund intends to invest in the manner described above, the Fund will also remain opportunistic and may pursue other investment opportunities.

There can be no assurance that the Fund will achieve its investment objective; you could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per Share, it cannot guarantee it will do so. An investment in the Fund is not a bank account or a deposit of a bank and is not insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency. You should not expect that the Investment Manager or its affiliates will provide financial support to the Fund at any time, including during periods of market stress.