Billetera Spark segura y protegida

Toma el control de tus Spark activos con total confianza en el ecosistema de Trezor.

- Protegido por tu billetera física

- Usa con billeteras digitales compatibles

- Con la confianza de más de 2 millones de clientes

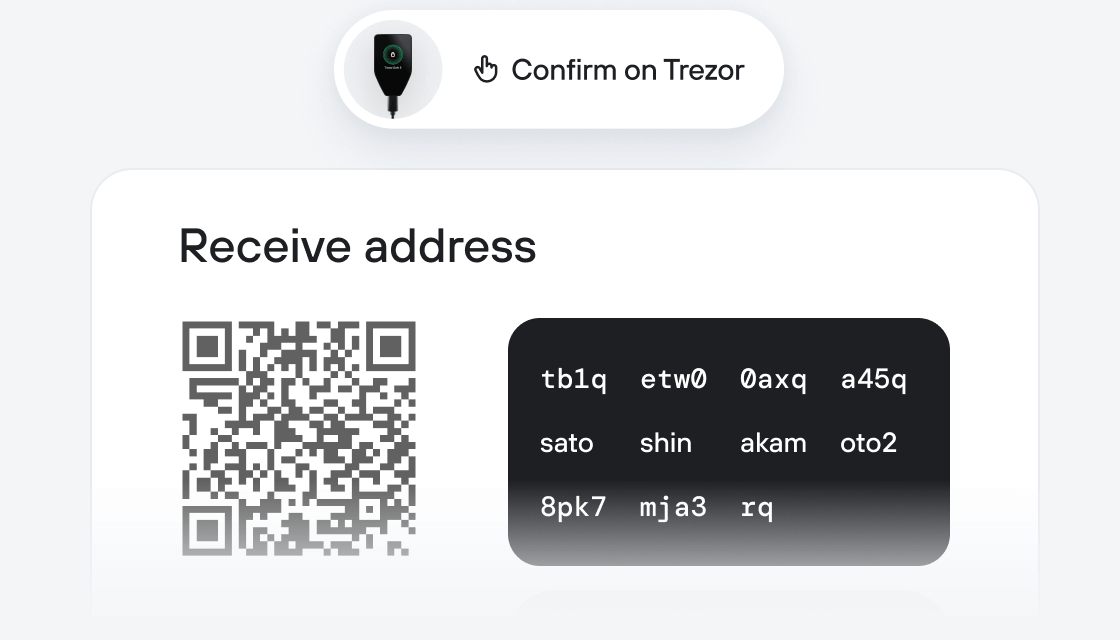

Envía y recibe tu Spark con la app Trezor Suite

Enviar y recibir

Intercambiar

Billeteras físicas Trezor compatibles con Spark

Sincroniza tu Trezor con apps de billeteras

Gestiona tus Spark con tu billetera física Trezor sincronizada con apps de billeteras.

Trezor Suite

MetaMask

Rabby

Red Spark Compatible

- Ethereum

¿Por qué una billetera física?

Desconéctate con Trezor

- Tus monedas son 100% tuyas

- Tu billetera está 100% segura offline

- Tus datos son 100% anónimos

- Tus monedas no están atadas a una compañía

Exchanges en línea

- Si un exchange falla, pierdes tus monedas

- Los exchanges son blanco de los hackers

- Tu información personal puede ser expuesta

- Tus monedas no son realmente tuyas

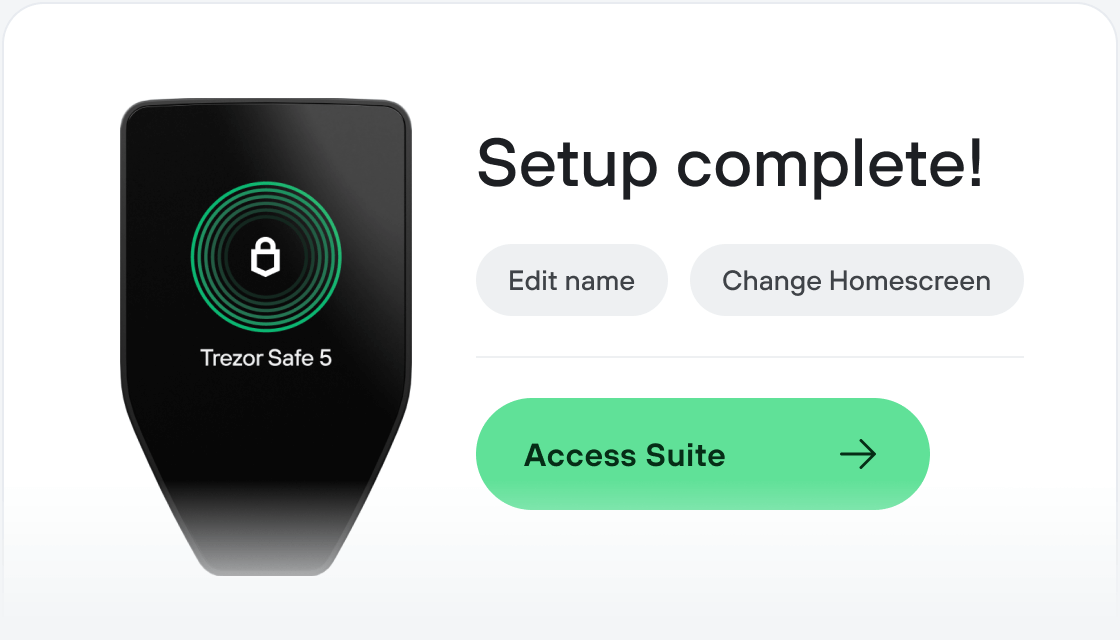

¿Cómo usar SPK en Trezor?

Conecta tu Trezor

Instala la app Trezor Suite

Transfiere tus SPK

Aprovecha al máximo tus SPK

Trezor mantiene tus SPK seguros

Protegido por Elemento Seguro

Protegido por Elemento SeguroLa mejor defensa contra amenazas tanto online como offline

Tus tokens, bajo tu control

Tus tokens, bajo tu controlControl absoluto de cada transacción con confirmación directa en el dispositivo

La seguridad empieza por código abierto

La seguridad empieza por código abiertoUn diseño de billetera de forma transparente hace que tu Trezor sea más seguro y confiable

Copia de seguridad de billetera clara y sencilla

Copia de seguridad de billetera clara y sencillaRecupera el acceso a tus activos digitales con nuevo estándar de copia de seguridad

Confianza desde el primer día

Confianza desde el primer díaEl embalaje y los sellos de seguridad del dispositivo protegen la integridad de tu Trezor

Spark is an onchain capital allocator, with $3.86B deployed across DeFi, CeFi, and RWA. It unlocks capital efficiency at scale, auto-balancing allocations based on market conditions while maintaining a conservative risk profile. Spark was created to solve DeFi’s core inefficiencies: fragmented liquidity, unstable yields, and idle stablecoin capital. It acts as a two-sided capital allocator—borrowing from Sky’s $6.5B+ reserves and deploying across DeFi, CeFi, and RWAs to provide deep, consistent liquidity. This yield is packaged into products like sUSDS and sUSDC, offering users programmable, fee-free income. Rather than competing with protocols, Spark powers them as the liquidity and yield infrastructure for onchain finance.

Access to Deep, Scalable Liquidity: Spark taps into Sky’s $6.5B+ stablecoin reserves, enabling large-scale capital deployment across DeFi, CeFi, and RWAs. User-Friendly Yield Products: Yield is delivered through stablecoins like sUSDS and sUSDC—fully composable, fee-free, and available across chains.

SparkLend: A stablecoin lending market. Unlike other lending protocols where rates fluctuate based on utilization or loan size, SparkLend offers governance-defined rates that do not vary based on those factors. This is made possible by Spark’s Liquidity Layer (SLL), which supplies consistent stablecoin liquidity to the protocol.

Spark Savings: A product for earning yield on stablecoins like USDC, and USDS (and soon, USDT) by converting them into yield-bearing sUSDS or sUSDC. These yield tokens are composable with other DeFi protocols, making it easy to put capital to work while maintaining exposure to onchain yield at a competitive risk-adjusted rate.

Spark Liquidity Layer (SLL): A backend capital allocator that routes liquidity to other protocols like Aave, Morpho, and even RWAs (e.g., BlackRock’s BUIDL). One of the most important SLL deployments on Base is the Spark USDC Morpho Vault, which currently supplies $95M USDC, making it the largest liquidity provider to the Coinbase app integration on Base. This vault plays a key role in mitigating rate volatility for borrowers and demonstrates how SLL enhances liquidity conditions across DeFi.

Existing Products: Spark's total TVL is currently $7.9B, split between SparkLend and the Spark Liquidity Layer (SLL). You can find real-time details and breakdowns here: https://defillama.com/protocol/spark#information

Spark in DeFiLlama, https://defillama.com/protocol/spark#information

SparkLend is one of the largest lending protocols in DeFi. It offers deep liquidity and governance-defined rates, providing borrowers with transparent conditions.

Spark Savings is live on Ethereum mainnet, Base, Optimism, Arbitrum, Unichain, and Gnosis, offering vaults for both USDS and USDC.

The Spark Liquidity Layer actively deploys capital across protocols on multiple chains, including Ethereum mainnet, Base, and Arbitrum.

SLL allocations in real-time, https://data.spark.fi/spark-liquidity-layer