Carteira Spark segura & protegida

Assuma o controle dos seus Spark ativos com completa confiança no ecossistema Trezor.

- Protegido por sua carteira de hardware

- Use com carteiras quentes compatíveis

- Confiança de mais de 2 milhões de clientes

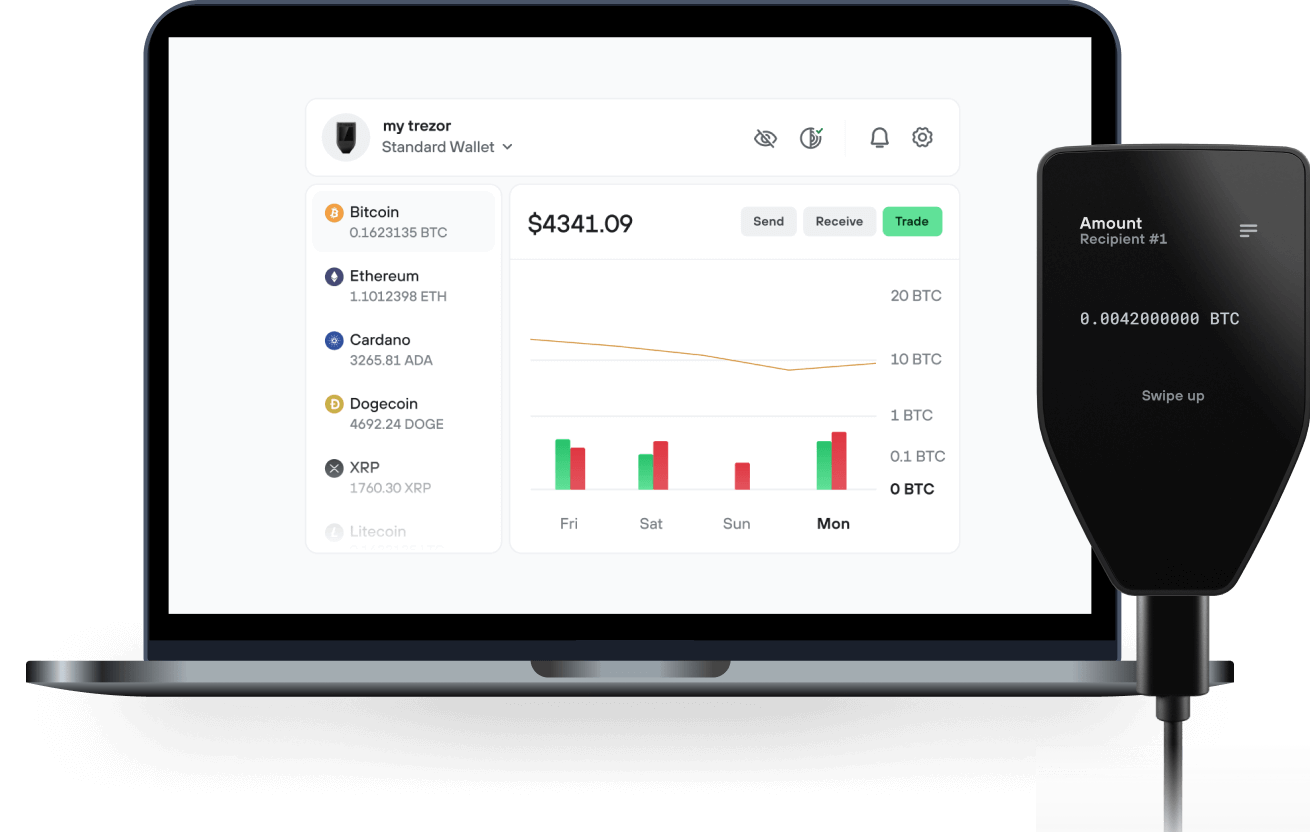

Envie & receba o seu Spark com o app Trezor Suite

Enviar & receber

Troque

As carteiras de hardware Trezor suportam Spark

Sincronize sua Trezor com apps de carteira

Gerencie a sua Spark com sua carteira física Trezor sincronizada com vários apps de carteira.

Trezor Suite

MetaMask

Rabby

Rede Spark Suportada

- Ethereum

Por que uma carteira de hardware?

Fique offline com a Trezor

- Você controla 100% das suas moedas

- Sua carteira está 100% segura offline

- Seus dados são 100% anônimos

- Suas moedas não estão vinculadas a nenhuma empresa

Corretoras online

- Se uma corretora falir, você perde suas moedas

- Corretoras são alvos de hackers

- Seus dados pessoais podem ter sido expostos

- Você não tem total controle das suas moedas

Como SPK na Trezor

Conecte seu Trezor

Instale o aplicativo Trezor Suite

Transfira seu SPK

Aproveite o máximo do seu SPK

Trezor mantém o seu SPK seguro

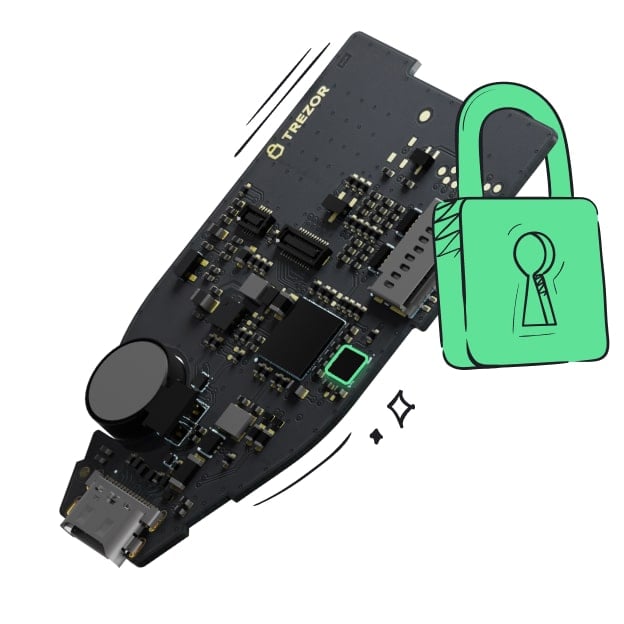

Protegido por Elemento Seguro

Protegido por Elemento SeguroA melhor defesa contra ameaças online e offline

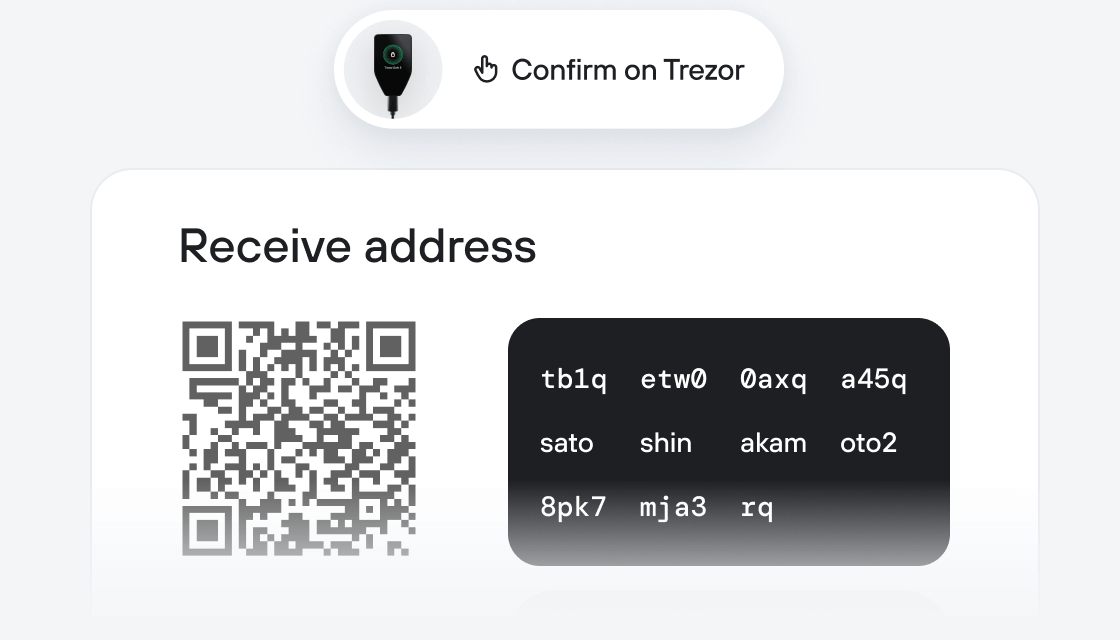

Seus tokens, seu controle

Seus tokens, seu controleControle absoluto de cada transação com confirmação no dispositivo

A segurança começa no código aberto

A segurança começa no código abertoO design transparente da carteira torna sua Trezor melhor e mais segura

Backup de carteira claro & simples

Backup de carteira claro & simplesRecupere o acesso a seus ativos digitais com um novo padrão de backup

Confiança desde o primeiro dia

Confiança desde o primeiro diaA embalagem & os selos de segurança protegem a integridade da sua Trezor

Spark is an onchain capital allocator, with $3.86B deployed across DeFi, CeFi, and RWA. It unlocks capital efficiency at scale, auto-balancing allocations based on market conditions while maintaining a conservative risk profile. Spark was created to solve DeFi’s core inefficiencies: fragmented liquidity, unstable yields, and idle stablecoin capital. It acts as a two-sided capital allocator—borrowing from Sky’s $6.5B+ reserves and deploying across DeFi, CeFi, and RWAs to provide deep, consistent liquidity. This yield is packaged into products like sUSDS and sUSDC, offering users programmable, fee-free income. Rather than competing with protocols, Spark powers them as the liquidity and yield infrastructure for onchain finance.

Access to Deep, Scalable Liquidity: Spark taps into Sky’s $6.5B+ stablecoin reserves, enabling large-scale capital deployment across DeFi, CeFi, and RWAs. User-Friendly Yield Products: Yield is delivered through stablecoins like sUSDS and sUSDC—fully composable, fee-free, and available across chains.

SparkLend: A stablecoin lending market. Unlike other lending protocols where rates fluctuate based on utilization or loan size, SparkLend offers governance-defined rates that do not vary based on those factors. This is made possible by Spark’s Liquidity Layer (SLL), which supplies consistent stablecoin liquidity to the protocol.

Spark Savings: A product for earning yield on stablecoins like USDC, and USDS (and soon, USDT) by converting them into yield-bearing sUSDS or sUSDC. These yield tokens are composable with other DeFi protocols, making it easy to put capital to work while maintaining exposure to onchain yield at a competitive risk-adjusted rate.

Spark Liquidity Layer (SLL): A backend capital allocator that routes liquidity to other protocols like Aave, Morpho, and even RWAs (e.g., BlackRock’s BUIDL). One of the most important SLL deployments on Base is the Spark USDC Morpho Vault, which currently supplies $95M USDC, making it the largest liquidity provider to the Coinbase app integration on Base. This vault plays a key role in mitigating rate volatility for borrowers and demonstrates how SLL enhances liquidity conditions across DeFi.

Existing Products: Spark's total TVL is currently $7.9B, split between SparkLend and the Spark Liquidity Layer (SLL). You can find real-time details and breakdowns here: https://defillama.com/protocol/spark#information

Spark in DeFiLlama, https://defillama.com/protocol/spark#information

SparkLend is one of the largest lending protocols in DeFi. It offers deep liquidity and governance-defined rates, providing borrowers with transparent conditions.

Spark Savings is live on Ethereum mainnet, Base, Optimism, Arbitrum, Unichain, and Gnosis, offering vaults for both USDS and USDC.

The Spark Liquidity Layer actively deploys capital across protocols on multiple chains, including Ethereum mainnet, Base, and Arbitrum.

SLL allocations in real-time, https://data.spark.fi/spark-liquidity-layer