Portefeuille sûr et sécurisé dFund

Prenez le contrôle de vos dFund actifs en toute confiance dans l’écosystème Trezor.

- Sécurisé par votre portefeuille matériel

- Utiliser avec des hot wallets compatibles

- Adopté par plus de 2 millions de clients

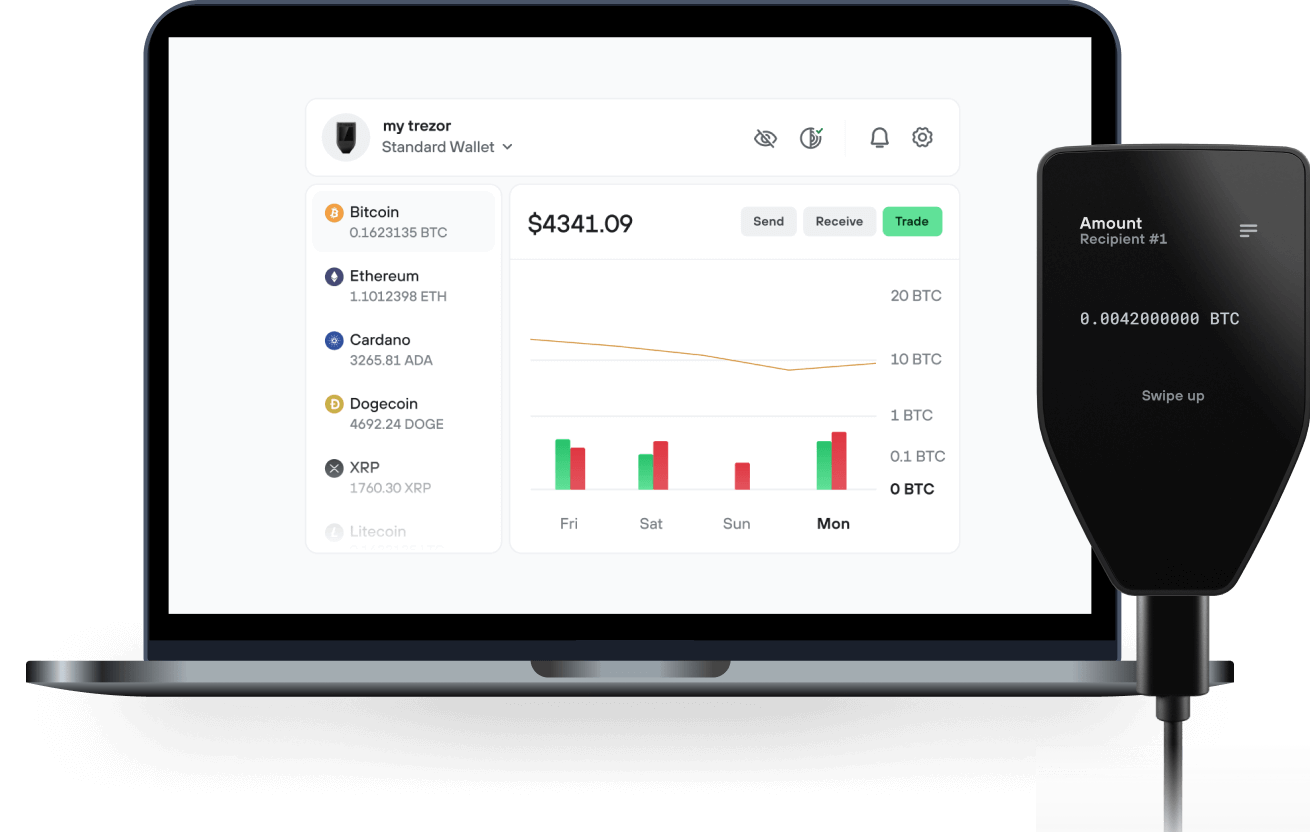

Envoyez et recevez vos dFund avec l'application Trezor Suite

Envoyer et recevoir

Portefeuilles matériels Trezor qui supportent dFund

Synchronisez votre Trezor avec des applications de portefeuille

Gérez vos dFund avec votre portefeuille matériel Trezor synchronisé avec plusieurs applications de portefeuilles.

Trezor Suite

MetaMask

Rabby

dFund Réseau supporté

- Ethereum

Pourquoi un portefeuille matériel ?

Allez hors ligne avec Trezor

- Vous possédez 100% de vos crypto

- Votre portefeuille est 100% sécurisé hors ligne

- Vos données sont 100 % anonymes

- Vos cryptos ne dépendent d’aucune entreprise

Échanges en ligne

- Si un échange échoue, vous perdez vos crypto

- Les échanges sont des cibles pour les pirates

- Vos données personnelles peuvent être exposées

- Vous ne possédez pas réellement vos crypto

Comment utiliser DFND sur Trezor

Connectez votre Trezor

Ouvrez une application de portefeuille tierce

Gérez vos actifs

Profitez pleinement de votre DFND

Trezor garde vos DFND en sécurité

Protégé par Élément Sécurisé

Protégé par Élément SécuriséLa meilleure défense contre les menaces en ligne et hors ligne

Vos jetons, votre contrôle

Vos jetons, votre contrôleContrôle absolu de chaque transaction avec confirmation sur l'appareil

La sécurité commence par le code ouvert

La sécurité commence par le code ouvertLe design de portefeuille transparent rend votre Trezor meilleur et plus sûr

Sauvegarde de portefeuille claire et simple

Sauvegarde de portefeuille claire et simpleRécupérez l’accès à vos actifs digitaux avec un nouveau standard de sauvegarde

Confiance depuis le premier jour

Confiance depuis le premier jourLes sceaux de sécurité sur l’emballage et l’appareil protègent l’intégrité de votre Trezor

dFund is a project that aims to build an all-encompassing platform combining advanced DeFi smart-contract-powered features including decentralized hedge funds, direct p2p lending, credit scores, DAO governance and a secondary marketplace for synthetic assets into one easy to use platform. Every user on the platform will be able to start their own decentralized hedge fund, or invest in one, and decentralized hedge funds on the platform will be ranked by their performance (roi), so people can make informed decisions. The founder of the decentralized hedge fund can only swap / trade with user funds, while withdrawals and payouts are automated by smart contracts, therefore eliminating the possibility of scam or pyramid schemes. The platform will also enable users to participate in direct p2p lending, where every user sets the loan amount, interest rate, loan duration, and collateral requirement, which can be even under or over 100% allowing for under and over collateralized loans. Every borrower on the platform will have a credit rating, and lenders can set the minimum credit rating required to take the loan, and even set different collateral requirements and interest rates for users with different credit ratings. If someone never got liquidated on their loan aka never defaulted and always paid back the loan amount + interest on time, they will have a very high credit rating, while users who get liquidated / default many times will see their credit rating slip down. Credit rating can be improved or worsened over time. The platform will also have a secondary marketplace for synthetic assets where users can buy and sell the loans, therefore allowing lenders to exit their positions and delegate the risk and waiting time to other users. So for example, if a user is lending a loan with a 10% interest rate, but they need money / liquidity urgently or they simply don’t want to wait until the end of the loan duration, they can instead decide to sell their loan, and maybe someone will buy it for 4% instantly, which would mean a 6% profit for them after they receive the original 10% interest at the end of the loan’s duration, which is beneficial for both a buyer and the seller. For the seller (the original lender), they don’t have to wait and they are getting a smaller profit with no risk, and for the buyer of the loan, they are receiving a higher profit for waiting until the end of the loan’s duration. This is in many ways similar to real life bond market.