Billetera dFund segura y protegida

Toma el control de tus dFund activos con total confianza en el ecosistema de Trezor.

- Protegido por tu billetera física

- Usa con billeteras digitales compatibles

- Con la confianza de más de 2 millones de clientes

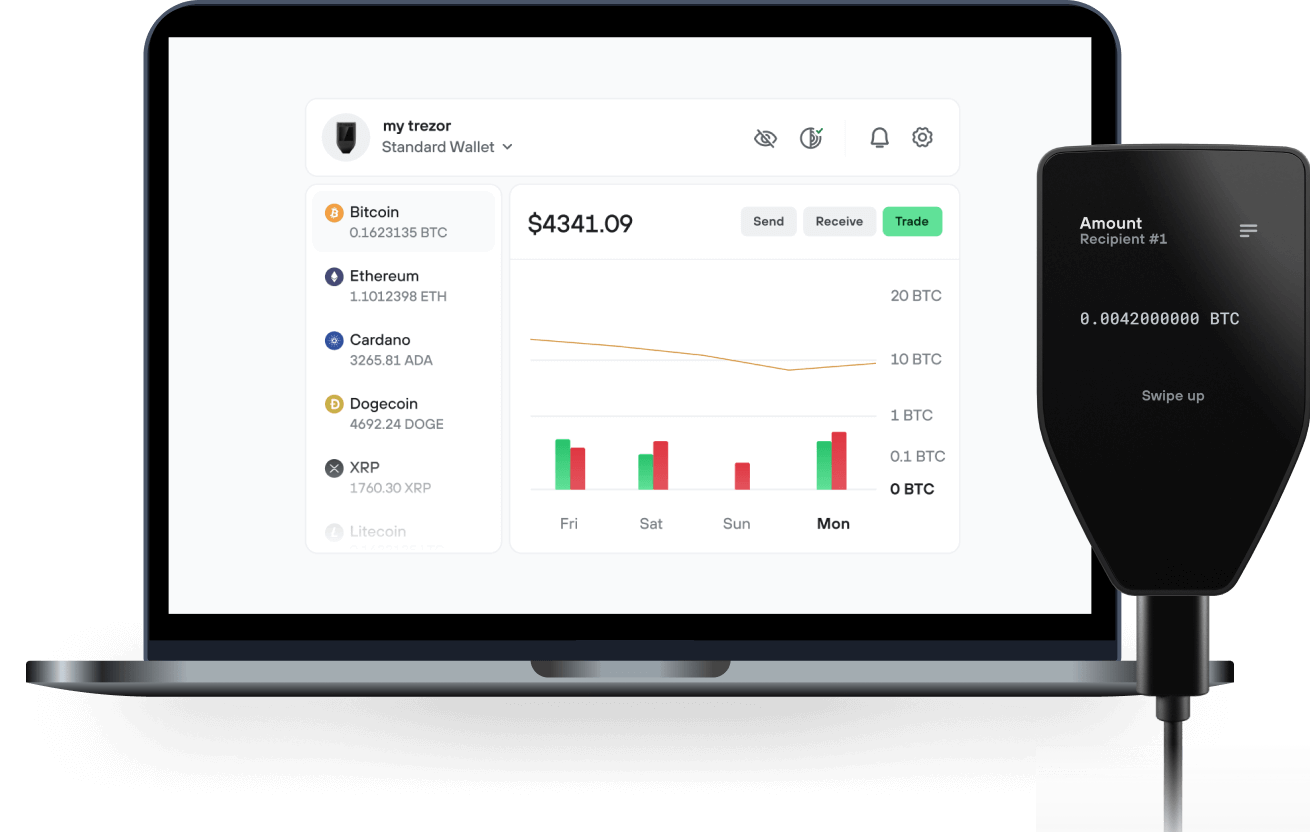

Envía y recibe tu dFund con la app Trezor Suite

Enviar y recibir

Billeteras físicas Trezor compatibles con dFund

Sincroniza tu Trezor con apps de billeteras

Gestiona tus dFund con tu billetera física Trezor sincronizada con apps de billeteras.

Trezor Suite

MetaMask

Rabby

Red dFund Compatible

- Ethereum

¿Por qué una billetera física?

Desconéctate con Trezor

- Tus monedas son 100% tuyas

- Tu billetera está 100% segura offline

- Tus datos son 100% anónimos

- Tus monedas no están atadas a una compañía

Exchanges en línea

- Si un exchange falla, pierdes tus monedas

- Los exchanges son blanco de los hackers

- Tu información personal puede ser expuesta

- Tus monedas no son realmente tuyas

¿Cómo usar DFND en Trezor?

Conecta tu Trezor

Abre una app de billetera de terceros

Gestiona tus activos

Aprovecha al máximo tus DFND

Trezor mantiene tus DFND seguros

Protegido por Elemento Seguro

Protegido por Elemento SeguroLa mejor defensa contra amenazas tanto online como offline

Tus tokens, bajo tu control

Tus tokens, bajo tu controlControl absoluto de cada transacción con confirmación directa en el dispositivo

La seguridad empieza por código abierto

La seguridad empieza por código abiertoUn diseño de billetera de forma transparente hace que tu Trezor sea más seguro y confiable

Copia de seguridad de billetera clara y sencilla

Copia de seguridad de billetera clara y sencillaRecupera el acceso a tus activos digitales con nuevo estándar de copia de seguridad

Confianza desde el primer día

Confianza desde el primer díaEl embalaje y los sellos de seguridad del dispositivo protegen la integridad de tu Trezor

dFund is a project that aims to build an all-encompassing platform combining advanced DeFi smart-contract-powered features including decentralized hedge funds, direct p2p lending, credit scores, DAO governance and a secondary marketplace for synthetic assets into one easy to use platform. Every user on the platform will be able to start their own decentralized hedge fund, or invest in one, and decentralized hedge funds on the platform will be ranked by their performance (roi), so people can make informed decisions. The founder of the decentralized hedge fund can only swap / trade with user funds, while withdrawals and payouts are automated by smart contracts, therefore eliminating the possibility of scam or pyramid schemes. The platform will also enable users to participate in direct p2p lending, where every user sets the loan amount, interest rate, loan duration, and collateral requirement, which can be even under or over 100% allowing for under and over collateralized loans. Every borrower on the platform will have a credit rating, and lenders can set the minimum credit rating required to take the loan, and even set different collateral requirements and interest rates for users with different credit ratings. If someone never got liquidated on their loan aka never defaulted and always paid back the loan amount + interest on time, they will have a very high credit rating, while users who get liquidated / default many times will see their credit rating slip down. Credit rating can be improved or worsened over time. The platform will also have a secondary marketplace for synthetic assets where users can buy and sell the loans, therefore allowing lenders to exit their positions and delegate the risk and waiting time to other users. So for example, if a user is lending a loan with a 10% interest rate, but they need money / liquidity urgently or they simply don’t want to wait until the end of the loan duration, they can instead decide to sell their loan, and maybe someone will buy it for 4% instantly, which would mean a 6% profit for them after they receive the original 10% interest at the end of the loan’s duration, which is beneficial for both a buyer and the seller. For the seller (the original lender), they don’t have to wait and they are getting a smaller profit with no risk, and for the buyer of the loan, they are receiving a higher profit for waiting until the end of the loan’s duration. This is in many ways similar to real life bond market.